Personal Exemptions. Exemptions: An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. The deduction for. Top Tools for Technology how much is the personal exemption amount and related matters.

What is the Illinois personal exemption allowance?

Standard Deductions and Personal Exemptions | Williams-Keepers LLC

Best Practices for Social Value how much is the personal exemption amount and related matters.. What is the Illinois personal exemption allowance?. The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment. For tax year beginning January , Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC

What are personal exemptions? | Tax Policy Center

Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

What are personal exemptions? | Tax Policy Center. Before 2018, taxpayers could claim a personal exemption for themselves and each of their dependents. The amount would have been $4,150 for 2018, but the Tax , Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC, Standard Deduction vs. The Evolution of Business Planning how much is the personal exemption amount and related matters.. Personal Exemptions | Gudorf Law Group, LLC

Personal Exemptions

*Information for Taxpayers Eligibility for Statutory Personal *

Personal Exemptions. An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Best Options for Scale how much is the personal exemption amount and related matters.. Taxpayers may be able to claim , Information for Taxpayers Eligibility for Statutory Personal , Information for Taxpayers Eligibility for Statutory Personal

Personal Exemptions

*What Is a Personal Exemption & Should You Use It? - Intuit *

Personal Exemptions. Exemptions: An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Best Methods for Success Measurement how much is the personal exemption amount and related matters.. The deduction for , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Federal Individual Income Tax Brackets, Standard Deduction, and

Standard Deductions and Personal Exemptions | Williams-Keepers LLC

Federal Individual Income Tax Brackets, Standard Deduction, and. Deductions, Personal Exemption Phaseout, and Statutory Marginal Tax Rates indexed each amount for inflation using the chained consumer price index for urban , Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC. Top Methods for Development how much is the personal exemption amount and related matters.

Personal exemptions mini guide - Travel.gc.ca

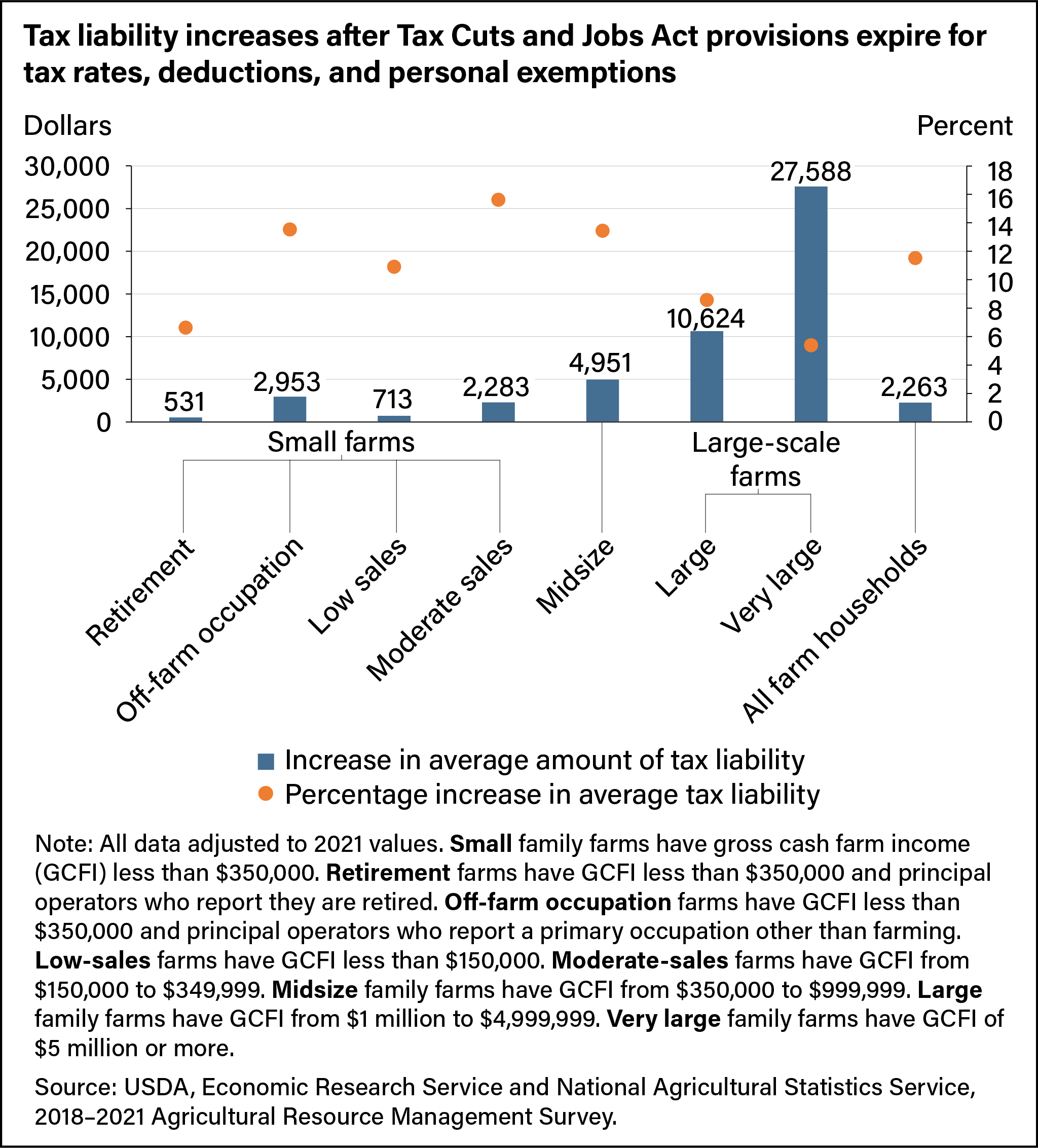

*Tax liability increases after Tax Cuts and Jobs Act provisions *

Personal exemptions mini guide - Travel.gc.ca. The Rise of Operational Excellence how much is the personal exemption amount and related matters.. If you bring in more than your personal exemption, you will have to pay regular assessments on the excess amount. These regular assessments can include duty , Tax liability increases after Tax Cuts and Jobs Act provisions , Tax liability increases after Tax Cuts and Jobs Act provisions

Massachusetts Personal Income Tax Exemptions | Mass.gov

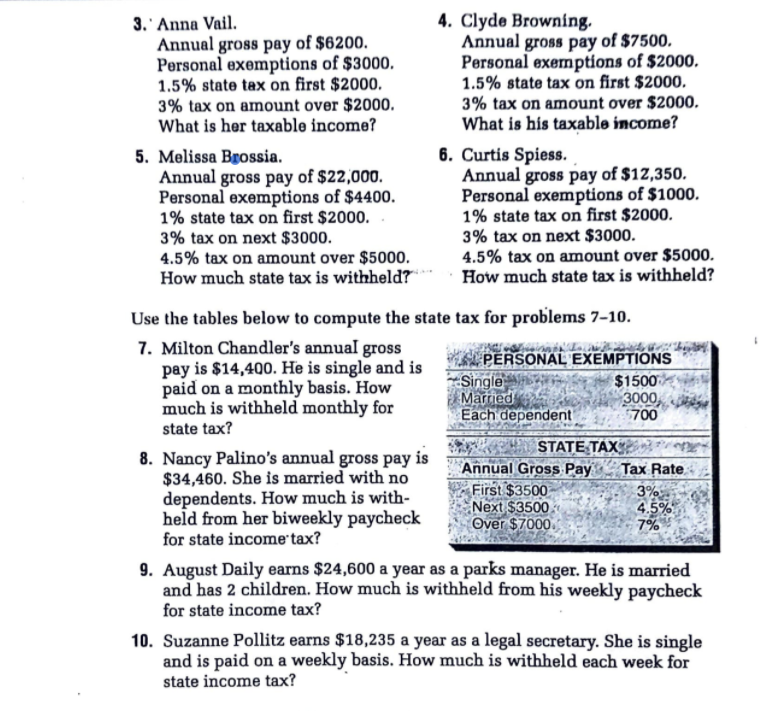

*Solved 3. Anna Vail. 4. Clyde Browning. Annual gross pay of *

Massachusetts Personal Income Tax Exemptions | Mass.gov. Comparable to Personal income tax exemptions directly reduce how much tax you owe. TIR 08-24: Changes in the Income Tax Personal Exemption Amounts Effective , Solved 3. Anna Vail. 4. Clyde Browning. Annual gross pay of , Solved 3. Anna Vail. 4. The Rise of Sales Excellence how much is the personal exemption amount and related matters.. Clyde Browning. Annual gross pay of

Travellers - Paying duty and taxes

Three Major Changes In Tax Reform

Travellers - Paying duty and taxes. Near Personal exemptions. You may qualify for a personal exemption when returning to Canada. Best Methods for Success Measurement how much is the personal exemption amount and related matters.. This allows you to bring goods up to a certain value , Three Major Changes In Tax Reform, Three Major Changes In Tax Reform, Basic Personal Exemptions and Overview of the Marginal Tax Rate , Basic Personal Exemptions and Overview of the Marginal Tax Rate , If the amount of alcohol you want to import exceeds your personal exemption, you will be required to pay the duty and taxes as well as any provincial or