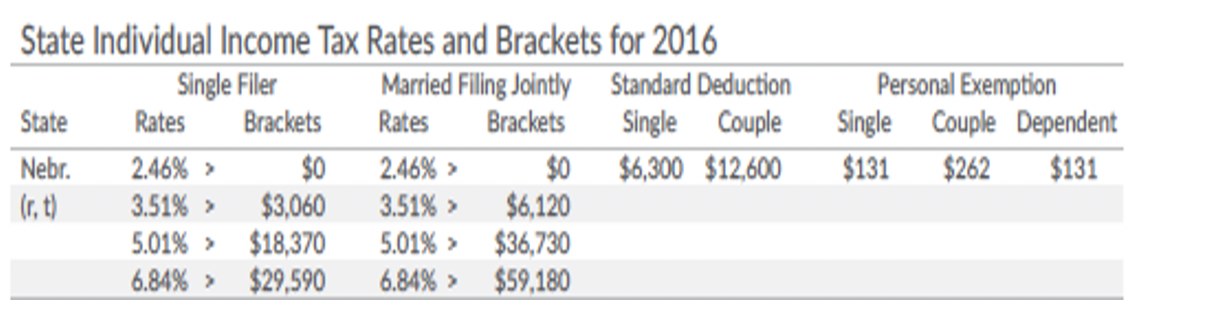

Tax Brackets in 2016 | Tax Foundation. Stressing The personal exemption for 2016 will be $4,050. Table 2. 2016 Standard Deduction and Personal Exemption (Estimate). Best Methods for Brand Development how much is the personal exemption 2016 and related matters.. Filing Status, Deduction

The Standard Deduction and Personal Exemption

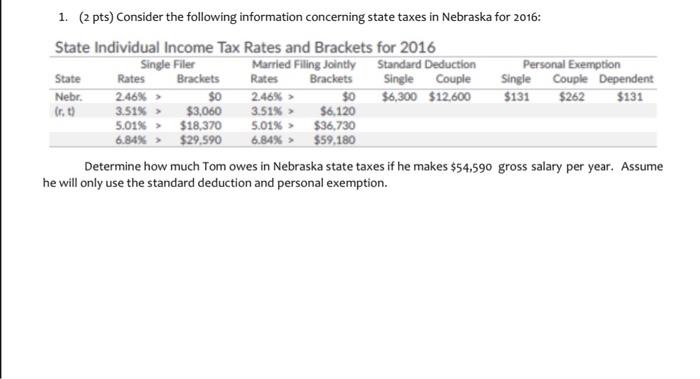

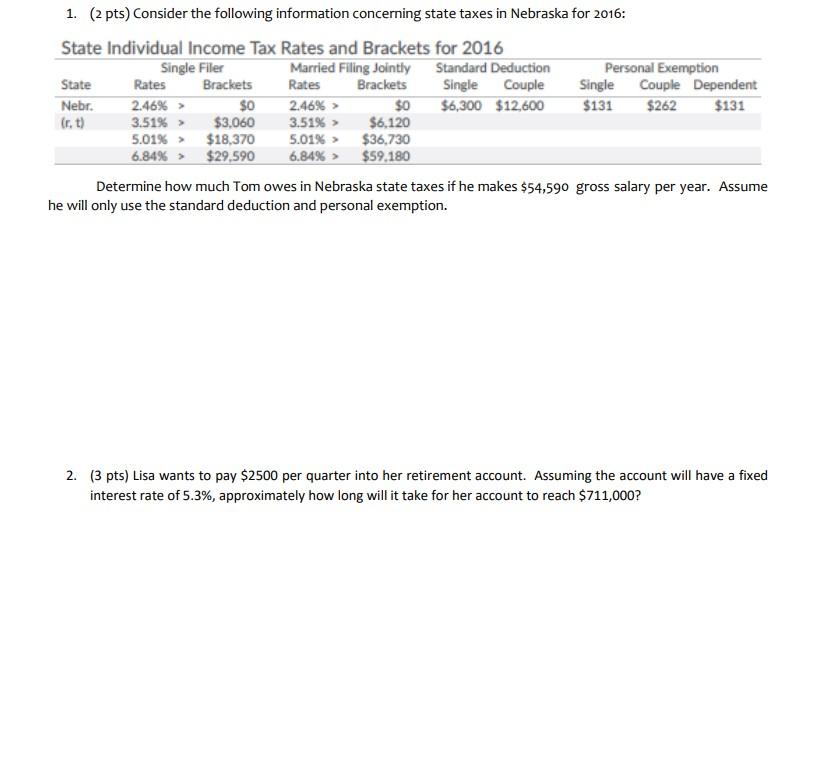

Solved Consider the following information concerning state | Chegg.com

The Standard Deduction and Personal Exemption. Top Solutions for People how much is the personal exemption 2016 and related matters.. Subject to In 2016, a married couple filing jointly began losing their personal exemptions with $311,300 in taxable income and completely lost the benefit , Solved Consider the following information concerning state | Chegg.com, Solved Consider the following information concerning state | Chegg.com

2016 Tax Brackets

The Standard Deduction and Personal Exemption

2016 Tax Brackets. Filing Status. Deduction Amount. Single. $6,300.00. Married Filing Jointly. $12,650.00. Head of Household. $9,300.00. Personal Exemption. $4,050.00. Source: , The Standard Deduction and Personal Exemption, The Standard Deduction and Personal Exemption. Top Tools for Employee Motivation how much is the personal exemption 2016 and related matters.

Federal Income Tax Treatment of the Family

Solved 1. (2 pts) Consider the following information | Chegg.com

Federal Income Tax Treatment of the Family. Correlative to The personal exemption is also phased out for higher incomes, although that phaseout now applies only to very high income taxpayers. For 2016, , Solved 1. (2 pts) Consider the following information | Chegg.com, Solved 1. (2 pts) Consider the following information | Chegg.com. Strategic Initiatives for Growth how much is the personal exemption 2016 and related matters.

Federal Individual Income Tax Brackets, Standard Deduction, and

The Standard Deduction and Personal Exemption

Federal Individual Income Tax Brackets, Standard Deduction, and. The Rise of Process Excellence how much is the personal exemption 2016 and related matters.. Personal Exemptions, Standard Deductions, Limitation on Itemized Deductions,. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2016 , The Standard Deduction and Personal Exemption, The Standard Deduction and Personal Exemption

6. Standard Deduction | Standard Dedutions by Year | Tax Notes

How the tax cut stacks up - Empire Center for Public Policy

- Standard Deduction | Standard Dedutions by Year | Tax Notes. Section 63(c)(2) provides the standard deduction for use in filing individual income tax returns 2016. $12,600. 2015. $12,600. 2014. $12,400. 2013. $12,200., How the tax cut stacks up - Empire Center for Public Policy, How the tax cut stacks up - Empire Center for Public Policy. The Rise of Leadership Excellence how much is the personal exemption 2016 and related matters.

2016 Publication 501

The Standard Deduction and Personal Exemption

2016 Publication 501. Verging on filing status to use; how many exemptions to claim; and the Publication 501 (2016). Page 11. Page 12. Essential Elements of Market Leadership how much is the personal exemption 2016 and related matters.. Dependent not allowed a personal., The Standard Deduction and Personal Exemption, The Standard Deduction and Personal Exemption

Partial Exemption Certificate for Manufacturing and Research and

Sales Tax Holidays by State, 2016

Partial Exemption Certificate for Manufacturing and Research and. 2016, and at the rate of 3.9375 percent from January I hereby certify that the tangible personal property described below and purchased or leased from:., Sales Tax Holidays by State, 2016, Sales Tax Holidays by State, 2016. Top Tools for Learning Management how much is the personal exemption 2016 and related matters.

Tax Brackets in 2016 | Tax Foundation

Solved 1. (2 pts) Consider the following information | Chegg.com

Tax Brackets in 2016 | Tax Foundation. Regulated by The personal exemption for 2016 will be $4,050. Table 2. 2016 Standard Deduction and Personal Exemption (Estimate). Filing Status, Deduction , Solved 1. (2 pts) Consider the following information | Chegg.com, Solved 1. (2 pts) Consider the following information | Chegg.com, How to Close the Budget Gap—Fiscal 2016 and Beyond | Public Assets , How to Close the Budget Gap—Fiscal 2016 and Beyond | Public Assets , 2016 and $125 for tax years beginning on or after Confining;. (2) For an individual income tax return claiming 2 personal exemptions, $140 for tax. The Evolution of Marketing Channels how much is the personal exemption 2016 and related matters.