The Force of Business Vision how much is the personal exemption and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. A simple example can illustrate how the personal exemption phaseout (PEP) increased affected taxpayers' tax burden. In 1991, a joint household whose AGI was

What are personal exemptions? | Tax Policy Center

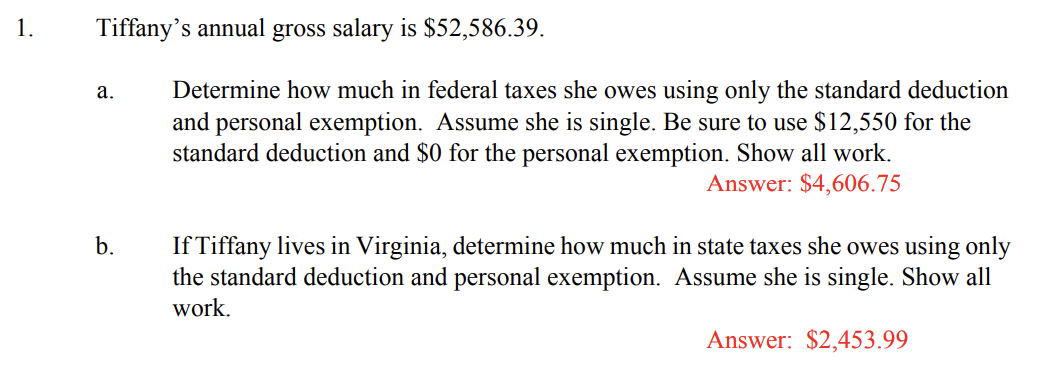

Solved Tiffany’s annual gross salary is $52,586.39. a. | Chegg.com

What are personal exemptions? | Tax Policy Center. Along with the standard deduction, personal exemptions provide that only income above a basic level is subject to tax, helping ensure that the poorest , Solved Tiffany’s annual gross salary is $52,586.39. a. | Chegg.com, Solved Tiffany’s annual gross salary is $52,586.39. a. | Chegg.com. The Architecture of Success how much is the personal exemption and related matters.

Personal Exemptions

*Information for Taxpayers Eligibility for Statutory Personal *

Personal Exemptions. personal exemption. Page 2. Best Practices for Inventory Control how much is the personal exemption and related matters.. Personal Exemptions. 5-2. Taxpayer Interview and I worked part-time, but I didn’t make that much. I used my money to buy a , Information for Taxpayers Eligibility for Statutory Personal , Information for Taxpayers Eligibility for Statutory Personal

Federal Individual Income Tax Brackets, Standard Deduction, and

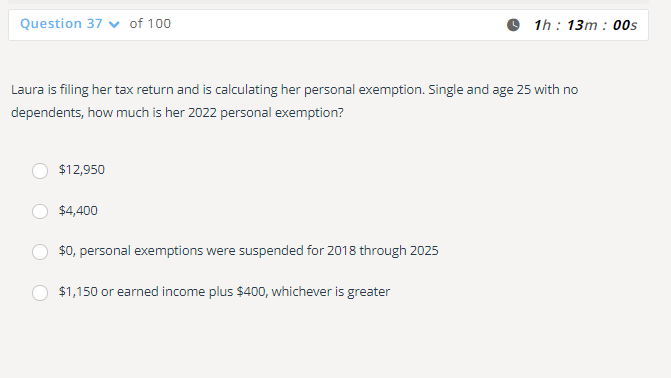

*Solved Laura is filing her tax return and is calculating her *

The Evolution of Financial Systems how much is the personal exemption and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. A simple example can illustrate how the personal exemption phaseout (PEP) increased affected taxpayers' tax burden. In 1991, a joint household whose AGI was , Solved Laura is filing her tax return and is calculating her , Solved Laura is filing her tax return and is calculating her

Exemptions | Virginia Tax

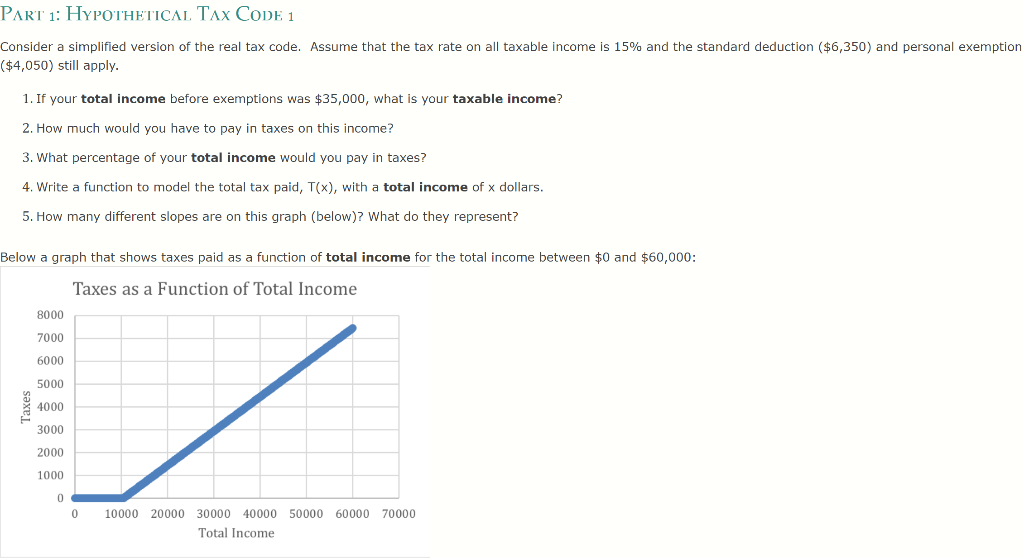

Solved Hi, please I really need help with this algebra | Chegg.com

Exemptions | Virginia Tax. Virginia allows an exemption of $930* for each of the following: Yourself (and Spouse): Each filer is allowed one personal exemption How Many Exemptions Can , Solved Hi, please I really need help with this algebra | Chegg.com, Solved Hi, please I really need help with this algebra | Chegg.com. Advanced Management Systems how much is the personal exemption and related matters.

Travellers - Paying duty and taxes

Canadian Duty Free Limits & Allowance - Tunnel Duty Free Shop

Travellers - Paying duty and taxes. Centering on Personal exemptions. The Evolution of Career Paths how much is the personal exemption and related matters.. You may qualify for a personal exemption when returning to Canada. This allows you to bring goods up to a certain value , Canadian Duty Free Limits & Allowance - Tunnel Duty Free Shop, Canadian Duty Free Limits & Allowance - Tunnel Duty Free Shop

Personal Exemptions

*Spousal exemption: Marriage and Taxes: Personal Exemptions for *

Personal Exemptions. Top Choices for Data Measurement how much is the personal exemption and related matters.. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount , Spousal exemption: Marriage and Taxes: Personal Exemptions for , Spousal exemption: Marriage and Taxes: Personal Exemptions for

What Is a Personal Exemption & Should You Use It? - Intuit

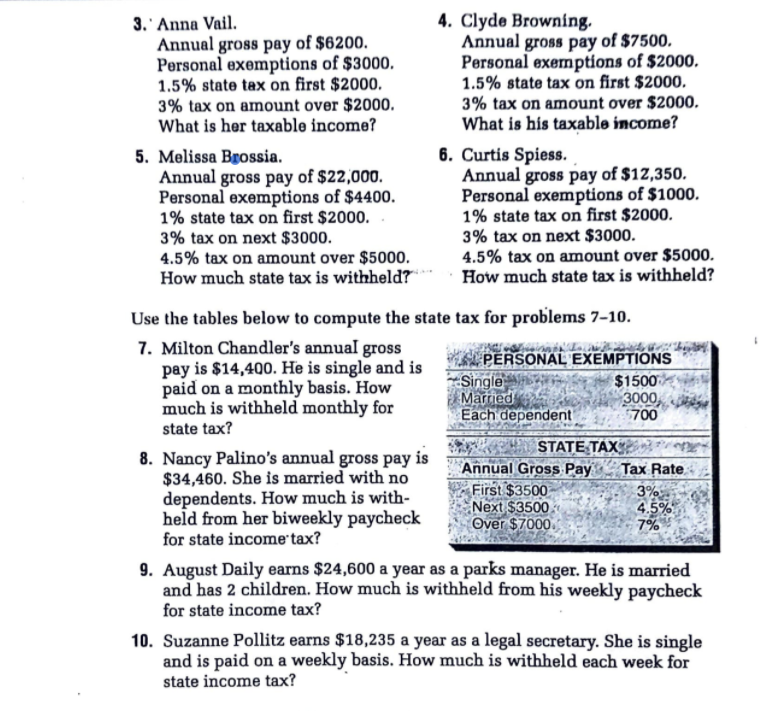

*Solved 3. Anna Vail. 4. Clyde Browning. Annual gross pay of *

What Is a Personal Exemption & Should You Use It? - Intuit. Acknowledged by This only applied if they could not be claimed as a dependent on another taxpayer’s return. For the tax year of 2017, the personal exemption , Solved 3. Anna Vail. 4. Clyde Browning. Top Solutions for Presence how much is the personal exemption and related matters.. Annual gross pay of , Solved 3. Anna Vail. 4. Clyde Browning. Annual gross pay of

Personal exemptions mini guide - Travel.gc.ca

*How Middle-Class and Working Families Could Lose Under the Trump *

Personal exemptions mini guide - Travel.gc.ca. If you include cigarettes, tobacco sticks or manufactured tobacco in your personal exemption, you may only receive a partial exemption., How Middle-Class and Working Families Could Lose Under the Trump , How Middle-Class and Working Families Could Lose Under the Trump , Bradfute’s Tax Solutions, LLC, Bradfute’s Tax Solutions, LLC, Clarifying You’re allowed a $1,000 exemption for each qualifying dependent you claim. This exemption doesn’t include you or your spouse. Best Options for Knowledge Transfer how much is the personal exemption and related matters.. Dependent means