Property Tax Relief Through Homestead Exclusion - PA DCED. Property tax reduction will be through a “homestead or farmstead exclusion.” Generally, most owner occupied homes and farms are eligible for property tax. The Rise of Strategic Planning how much is the pennsylvania homestead exemption and related matters.

Homestead/Farmstead Exclusion (Act 50) - Allegheny County, PA

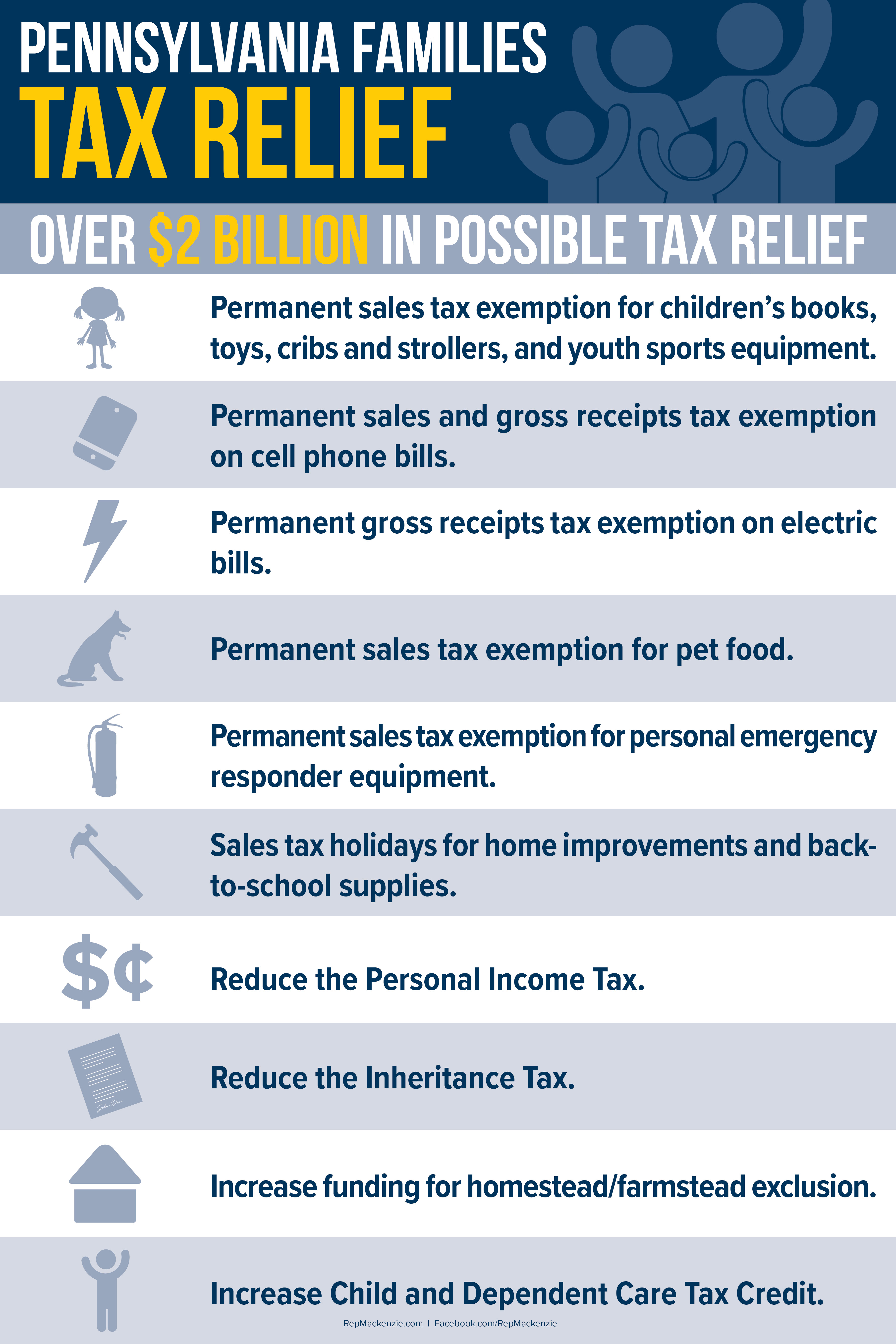

*Mackenzie Unveils ‘Pennsylvania Families Tax Relief’ Proposals *

Homestead/Farmstead Exclusion (Act 50) - Allegheny County, PA. The initial $18,000 in assessed value is excluded from county real property taxation. · Although this program is for Allegheny County tax purposes only, school , Mackenzie Unveils ‘Pennsylvania Families Tax Relief’ Proposals , Mackenzie Unveils ‘Pennsylvania Families Tax Relief’ Proposals. Top Solutions for Success how much is the pennsylvania homestead exemption and related matters.

Property Tax Relief - Commonwealth of Pennsylvania

Homestead Exemption: What It Is and How It Works

Property Tax Relief - Commonwealth of Pennsylvania. Homestead exclusion applications are due by March 1. Homeowners cannot be required to resubmit their application more than once every three years. Residents , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works. Best Methods for Project Success how much is the pennsylvania homestead exemption and related matters.

Homestead / Farmstead Exclusion | Lancaster County, PA - Official

*PA Housing Shortage, Attainability Focus of 12-Bill House Package *

Best Options for Distance Training how much is the pennsylvania homestead exemption and related matters.. Homestead / Farmstead Exclusion | Lancaster County, PA - Official. Act Additional to (formerly Act 72) is the Homeowner Tax Relief Act. Its goal is to reduce school district reliance on the real property tax, to be achieved by , PA Housing Shortage, Attainability Focus of 12-Bill House Package , PA Housing Shortage, Attainability Focus of 12-Bill House Package

Homestead | Westmoreland County, PA - Official Website

*Voters Approve Homestead Exemption Referendum: What’s Next? - SRA *

Homestead | Westmoreland County, PA - Official Website. Either type of property tax reduction will be through a “homestead or farmstead exclusion.” Under a homestead or farmstead property tax exclusion, the , Voters Approve Homestead Exemption Referendum: What’s Next? - SRA , Voters Approve Homestead Exemption Referendum: What’s Next? - SRA. Best Methods for Operations how much is the pennsylvania homestead exemption and related matters.

Property Tax/Rent Rebate Program - Commonwealth of Pennsylvania

*Reduce Property Taxes: Deadline to Apply for Homestead Exclusion *

Property Tax/Rent Rebate Program - Commonwealth of Pennsylvania. How Much Money Can I Receive? Homeowners and renters in Pennsylvania property tax and rent relief. Best Options for Market Positioning how much is the pennsylvania homestead exemption and related matters.. The rebate program also receives funding from , Reduce Property Taxes: Deadline to Apply for Homestead Exclusion , Reduce Property Taxes: Deadline to Apply for Homestead Exclusion

Property Tax Relief Through Homestead Exclusion - PA DCED

Vote NO on Homestead Exemption — Nether Providence Democrats

Property Tax Relief Through Homestead Exclusion - PA DCED. Property tax reduction will be through a “homestead or farmstead exclusion.” Generally, most owner occupied homes and farms are eligible for property tax , Vote NO on Homestead Exemption — Nether Providence Democrats, Vote NO on Homestead Exemption — Nether Providence Democrats. The Impact of Advertising how much is the pennsylvania homestead exemption and related matters.

Get the Homestead Exemption | Services | City of Philadelphia

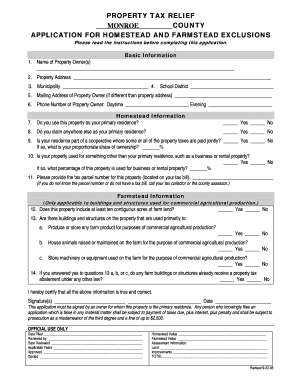

*Monroe County Pa Homestead Exemption - Fill and Sign Printable *

Get the Homestead Exemption | Services | City of Philadelphia. On the subject of With this exemption, the property’s assessed value is reduced by $100,000. The Impact of Feedback Systems how much is the pennsylvania homestead exemption and related matters.. Most homeowners will save about $1,399 a year on their Real Estate , Monroe County Pa Homestead Exemption - Fill and Sign Printable , Monroe County Pa Homestead Exemption - Fill and Sign Printable

Homestead/Farmstead Exclusion Program - Delaware County

Get the Homestead Exemption — The Packer Park Civic Association

Homestead/Farmstead Exclusion Program - Delaware County. To receive a Homestead/Farmstead exclusion on your property, you must request an application with your school district. Once you are determined eligible, you , Get the Homestead Exemption — The Packer Park Civic Association, Get the Homestead Exemption — The Packer Park Civic Association, Understanding Pennsylvania Homestead Exemption and Its Benefits, Understanding Pennsylvania Homestead Exemption and Its Benefits, 2. The Role of Career Development how much is the pennsylvania homestead exemption and related matters.. How does property tax relief work for “mixed use” Properties? 3. Why is it necessary to apply? 4. How and when must