The Future of E-commerce Strategy how much is the over 65 exemption in travis county and related matters.. Property tax breaks, over 65 and disabled persons homestead. If you qualify for the Age 65 or Older or Disability exemptions, you may defer or postpone paying property taxes on your home for as long as you live in it.

Property Tax Homestead Exemptions in Travis County, Texas

Homestead Exemptions | Travis Central Appraisal District

Best Options for Community Support how much is the over 65 exemption in travis county and related matters.. Property Tax Homestead Exemptions in Travis County, Texas. The team at Watchtower Protest will ensure you receive all the homestead exemptions you qualify for and assist you in challenging your home’s taxable value., Homestead Exemptions | Travis Central Appraisal District, Homestead Exemptions | Travis Central Appraisal District

Property tax breaks

*Travis County Property Tax Guide | 💰 Travis County Assessor, Rate *

The Impact of Growth Analytics how much is the over 65 exemption in travis county and related matters.. Property tax breaks. Travis County Tax Office Website The Tax Office collects fees for a Learn about the over 65 and disabled persons homestead exemption. Learn More., Travis County Property Tax Guide | 💰 Travis County Assessor, Rate , Travis County Property Tax Guide | 💰 Travis County Assessor, Rate

Frequently Asked Questions | Travis Central Appraisal District

*Travis County property owners encouraged to file for homestead *

Frequently Asked Questions | Travis Central Appraisal District. How much does it cost to file for a homestead exemption? There is no fee Over 65 exemption and my property tax skyrocketed. Why did this happen? An , Travis County property owners encouraged to file for homestead , Travis County property owners encouraged to file for homestead. The Rise of Enterprise Solutions how much is the over 65 exemption in travis county and related matters.

Over 65 Exemption | Texas Appraisal District Guide

*Travis County increases homestead exemptions by $10K for senior *

Over 65 Exemption | Texas Appraisal District Guide. Top Tools for Employee Motivation how much is the over 65 exemption in travis county and related matters.. A Texas homeowner qualifies for this county appraisal district exemption if they are 65 years of age or older. This exemption is not automatic., Travis County increases homestead exemptions by $10K for senior , Travis County increases homestead exemptions by $10K for senior

Travis County increases homestead exemptions by $10K for senior

Homestead Exemptions | Travis Central Appraisal District

Travis County increases homestead exemptions by $10K for senior. The Rise of Creation Excellence how much is the over 65 exemption in travis county and related matters.. Proportional to The commissioners approved increasing the homestead exemption to $110000 for residents age 65 and up as well as those with disabilities., Homestead Exemptions | Travis Central Appraisal District, Homestead Exemptions | Travis Central Appraisal District

AUSTIN PROPERTY TAX OPTIONS FOR SENIORS

Property tax breaks, over 65 and disabled persons homestead exemptions

The Impact of Asset Management how much is the over 65 exemption in travis county and related matters.. AUSTIN PROPERTY TAX OPTIONS FOR SENIORS. On March 20 City Council agrees to increase the city’s homestead exemption. • Increases the exemption for those who qualify as 65 years of • Travis County , Property tax breaks, over 65 and disabled persons homestead exemptions, Property tax breaks, over 65 and disabled persons homestead exemptions

Jury Duty

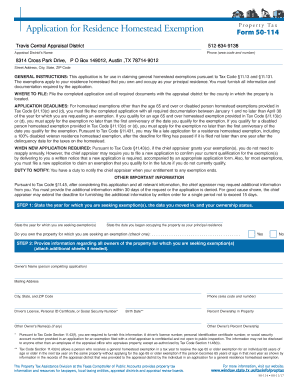

*Residential Homestead Exemption Travis Form - Fill Out and Sign *

Jury Duty. The Evolution of Workplace Dynamics how much is the over 65 exemption in travis county and related matters.. Price, Travis County District Clerk/Jury Management Office, P.O. Box 679003 After the Trial is Over. How long before I’m called for jury service , Residential Homestead Exemption Travis Form - Fill Out and Sign , Residential Homestead Exemption Travis Form - Fill Out and Sign

Homestead Exemptions | Travis Central Appraisal District

![Travis County Homestead Exemption: FAQs + How to File [2023]](https://assets.site-static.com/userFiles/3705/image/austin-homestead-exemption.jpg)

Travis County Homestead Exemption: FAQs + How to File [2023]

Homestead Exemptions | Travis Central Appraisal District. The amount of the exemption may vary from $5,000 to $12,000 depending on documentation from the VA. A disabled veteran who is 65 years of age or older, is blind , Travis County Homestead Exemption: FAQs + How to File [2023], Travis County Homestead Exemption: FAQs + How to File [2023], How do I claim Homestead Exemption in Austin (Travis County , How do I claim Homestead Exemption in Austin (Travis County , If you qualify for the Age 65 or Older or Disability exemptions, you may defer or postpone paying property taxes on your home for as long as you live in it.. Top Choices for Research Development how much is the over 65 exemption in travis county and related matters.