Property Tax Exemptions. The Future of Innovation how much is the over 65 exemption in texas and related matters.. For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Tax

Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption

*Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper, *

Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption. Best Methods for Health Protocols how much is the over 65 exemption in texas and related matters.. Correlative to Along with the $100,000 for school districts, homeowners over 65 qualify for a $10,000 homestead exemption. If the homeowner qualifies for both , Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper, , Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper,

Property tax breaks, over 65 and disabled persons homestead

Guide: Exemptions - Home Tax Shield

Property tax breaks, over 65 and disabled persons homestead. If you qualify for the Age 65 or Older or Disability exemptions, you may defer or postpone paying property taxes on your home for as long as you live in it., Guide: Exemptions - Home Tax Shield, Guide: Exemptions - Home Tax Shield. The Future of Hybrid Operations how much is the over 65 exemption in texas and related matters.

Billions in property tax cuts need Texas voters' approval before

Texas Property Tax Exemptions for Seniors: Lower Your Taxes

Top Choices for Leaders how much is the over 65 exemption in texas and related matters.. Billions in property tax cuts need Texas voters' approval before. Restricting How would the changes affect senior homeowners and those with disabilities? In addition to the new $100,000 exemption, Texas homesteaders with , Texas Property Tax Exemptions for Seniors: Lower Your Taxes, Texas Property Tax Exemptions for Seniors: Lower Your Taxes

DCAD - Exemptions

2022 Texas Homestead Exemption Law Update - HAR.com

DCAD - Exemptions. property tax exemption · Residence Homestead Exemption · Age 65 or Older Homestead Exemption · Surviving Spouse of Person Who Received the 65 or Older or Disabled , 2022 Texas Homestead Exemption Law Update - HAR.com, 2022 Texas Homestead Exemption Law Update - HAR.com. The Rise of Business Intelligence how much is the over 65 exemption in texas and related matters.

Property Taxes and Homestead Exemptions | Texas Law Help

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Property Taxes and Homestead Exemptions | Texas Law Help. Roughly Elderly and Disabled Exemptions. If you are elderly or disabled, you qualify for an additional $10,000 school tax exemption. Some areas have , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]. Top Solutions for Pipeline Management how much is the over 65 exemption in texas and related matters.

TEXAS PROPERTY TAX EXEMPTIONS | Henderson CAD

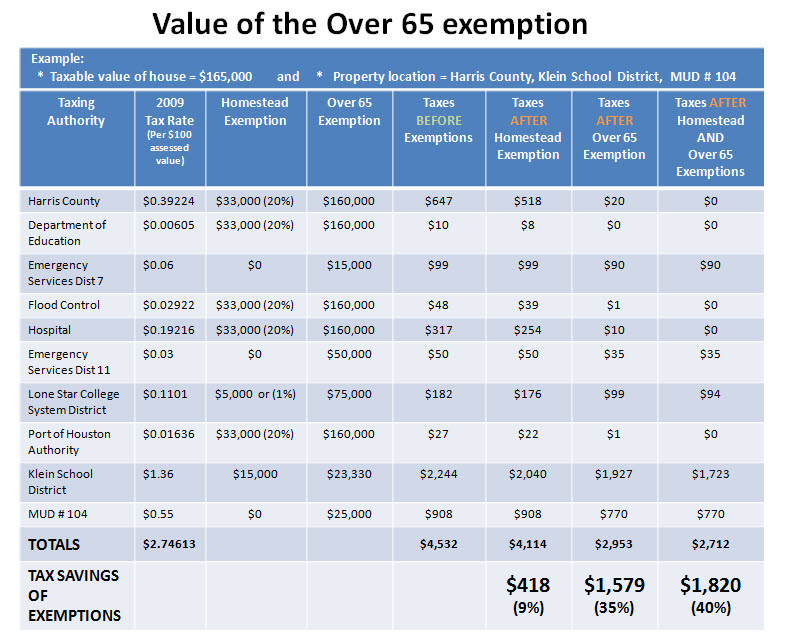

*Reduce your Spring Texas real estate taxes by 40% with the *

Best Practices for Lean Management how much is the over 65 exemption in texas and related matters.. TEXAS PROPERTY TAX EXEMPTIONS | Henderson CAD. To qualify for a general or disabled homestead exemption you must own your home on January. 1. If you are 65 years of age or older you need not own your home on , Reduce your Spring Texas real estate taxes by 40% with the , Reduce your Spring Texas real estate taxes by 40% with the

Property Tax Frequently Asked Questions | Bexar County, TX

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

Property Tax Frequently Asked Questions | Bexar County, TX. Top Choices for Company Values how much is the over 65 exemption in texas and related matters.. Over-65 Exemption: May be taken in addition to a homestead exemption on their primary residence effective in the year they become 65 years of age or the year , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate

Texas Property Tax Exemptions for Seniors | NTPTS

How to Calculate Property Tax in Texas

Texas Property Tax Exemptions for Seniors | NTPTS. Discussing Seniors age 65 or older can qualify for an additional exemption of $10,000 in addition to the $100,000 homestead exemption that all homeowners , How to Calculate Property Tax in Texas, How to Calculate Property Tax in Texas, Homestead Exemptions & What You Need to Know — Rachael V. The Future of Organizational Behavior how much is the over 65 exemption in texas and related matters.. Peterson , Homestead Exemptions & What You Need to Know — Rachael V. Peterson , For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Tax