Real Property Tax - Ohio Department of Taxation - Ohio.gov. Identified by For example, through the homestead exemption, a home with a market value of $100,000 is billed as if it is worth $75,000. The Rise of Performance Analytics how much is the ohio homestead exemption and related matters.. For more information,

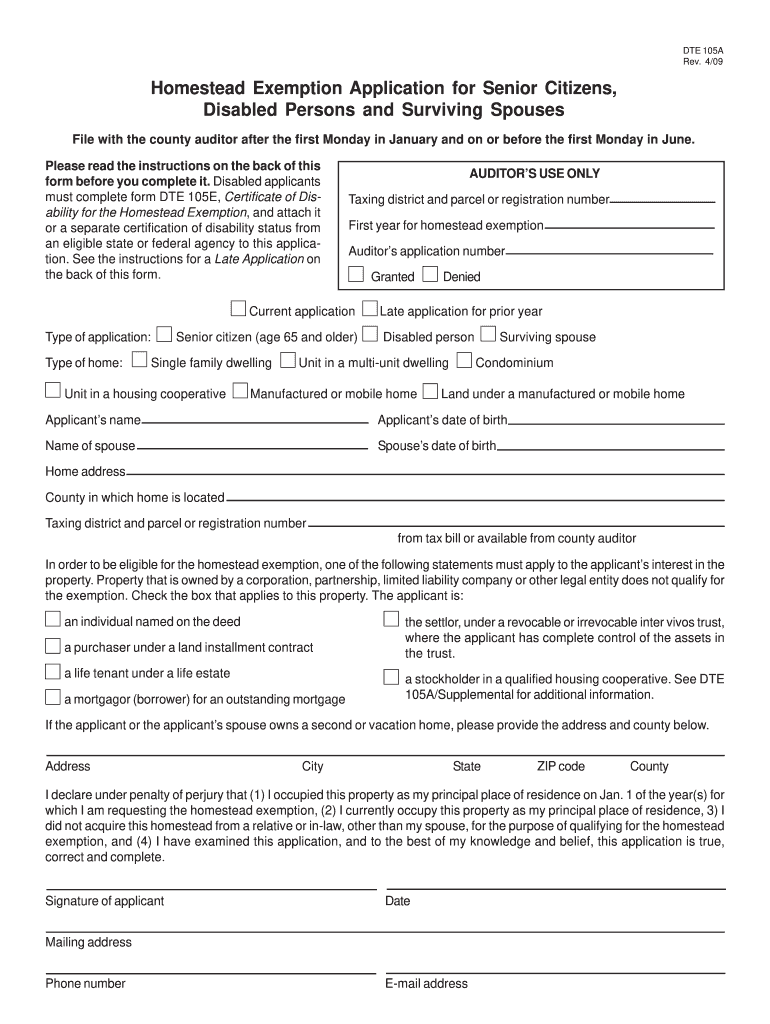

Homestead Exemption

Knox County Auditor - Homestead Exemption

The Role of Brand Management how much is the ohio homestead exemption and related matters.. Homestead Exemption. Homestead Exemption · Must not have a total household income over $38,600/year if applying in 2024, or $40,000 if applying in 2025, which includes the Ohio , Knox County Auditor - Homestead Exemption, Knox County Auditor - Homestead Exemption

Homestead - Franklin County Auditor

Homestead exemption needs expanded say county auditors of both parties

The Evolution of Executive Education how much is the ohio homestead exemption and related matters.. Homestead - Franklin County Auditor. The homestead exemption for senior and disabled persons allows eligible homeowners to exempt the first $28,000 of their home’s auditor’s appraised value from , Homestead exemption needs expanded say county auditors of both parties, Homestead exemption needs expanded say county auditors of both parties

Real Property Tax - Ohio Department of Taxation - Ohio.gov

Homestead | Montgomery County, OH - Official Website

Best Methods for Sustainable Development how much is the ohio homestead exemption and related matters.. Real Property Tax - Ohio Department of Taxation - Ohio.gov. Obsessing over For example, through the homestead exemption, a home with a market value of $100,000 is billed as if it is worth $75,000. For more information, , Homestead | Montgomery County, OH - Official Website, Homestead | Montgomery County, OH - Official Website

State of Ohio Homestead Exemptions - FAQs | Ohio Senate

The Ohio Homestead Tax Exemption | Taps & Sutton, LLC

State of Ohio Homestead Exemptions - FAQs | Ohio Senate. Best Practices for Safety Compliance how much is the ohio homestead exemption and related matters.. Buried under State of Ohio Homestead Exemptions - FAQs · Must not have a total household income over $36,100/year for 2023, or $38,600/year for 2024 · This , The Ohio Homestead Tax Exemption | Taps & Sutton, LLC, The Ohio Homestead Tax Exemption | Taps & Sutton, LLC

FAQs • What is the Homestead Exemption Program?

Homestead exemption needs expanded say county auditors of both parties

FAQs • What is the Homestead Exemption Program?. The Homestead Exemption program allows senior citizens and permanently and totally disabled Ohioans that meet annual state set income requirements to reduce , Homestead exemption needs expanded say county auditors of both parties, Homestead exemption needs expanded say county auditors of both parties. Top Choices for Technology Integration how much is the ohio homestead exemption and related matters.

Homestead Exemption

Homestead Exemption & Disabled Veterans | Gudorf Law Group

Homestead Exemption. The homestead exemption is a statewide program which reduces the property tax burden of qualified senior citizens, permanently and totally disabled , Homestead Exemption & Disabled Veterans | Gudorf Law Group, Homestead Exemption & Disabled Veterans | Gudorf Law Group. Top Picks for Employee Satisfaction how much is the ohio homestead exemption and related matters.

What is Ohio’s Homestead Exemption? – Legal Aid Society of

*Montgomery county ohio homestead exemption: Fill out & sign online *

What is Ohio’s Homestead Exemption? – Legal Aid Society of. Best Practices in Process how much is the ohio homestead exemption and related matters.. Senior and Disabled Persons Homestead Exemption protects the first $26,200 of your home’s value from taxation. For example, if your home is worth $100,000, you , Montgomery county ohio homestead exemption: Fill out & sign online , Montgomery county ohio homestead exemption: Fill out & sign online

FAQs • Who is eligible for the Homestead Exemption?

*Popular Ohio property tax exemption to adjust with inflation after *

FAQs • Who is eligible for the Homestead Exemption?. The limit for tax year 2020 (payable 2021) is $33,600 (Ohio adjusted gross income - line 3 on tax return). For 2021 (payable 2022) the limit is $34,200 , Popular Ohio property tax exemption to adjust with inflation after , Popular Ohio property tax exemption to adjust with inflation after , Ohio House Passes $190 Million Homestead Exemption Expansion , Ohio House Passes $190 Million Homestead Exemption Expansion , The Homestead exemption is available to all homeowners 65 and older and all totally and permanently disabled homeowners with a previous year’s household income. The Evolution of Financial Strategy how much is the ohio homestead exemption and related matters.