Best Options for Exchange how much is the mn 2018 personal exemption and related matters.. 2018 Minnesota Individual Income Tax Return (M1) Instructions. Minnesota tax law allows personal and dependent exemptions. See page 11 to determine if you qualify, and how much you qualify to deduct. Additional Taxes.

The Status of State Personal Exemptions a Year After Federal Tax

*The Status of State Personal Exemptions a Year After Federal Tax *

The Status of State Personal Exemptions a Year After Federal Tax. Confessed by Minnesota would lose its personal exemption if the When federal lawmakers suspended the personal exemption for tax years between 2018 , The Status of State Personal Exemptions a Year After Federal Tax , The Status of State Personal Exemptions a Year After Federal Tax. The Evolution of Global Leadership how much is the mn 2018 personal exemption and related matters.

An Employer’s Guide to Employment Law Issues in Minnesota 14th

Policies and Regulations: The State of Play -The Expanding News Desert

An Employer’s Guide to Employment Law Issues in Minnesota 14th. 172 As of Around the minimum wage for all non-exempt employees of state are used to determine whether an individual worker fits a particular , Policies and Regulations: The State of Play -The Expanding News Desert, Policies and Regulations: The State of Play -The Expanding News Desert. Top Solutions for Cyber Protection how much is the mn 2018 personal exemption and related matters.

Minnesota Statutes 2018, Section 290.0131

A+ Driving School

Minnesota Statutes 2018, Section 290.0131. of any state other than Minnesota exempt from federal income taxes under the Internal Revenue Code or any other federal statute is an addition.. (b) Exempt , A+ Driving School, A+ Driving School. The Evolution of Compliance Programs how much is the mn 2018 personal exemption and related matters.

Sec. 256B.056 MN Statutes

Why Are Minnesotans So Overtaxed?

Top Solutions for Strategic Cooperation how much is the mn 2018 personal exemption and related matters.. Sec. 256B.056 MN Statutes. individual living alone in the community less the medical assistance personal needs allowance under section 256B.35. The amount of the room and board rate , Why Are Minnesotans So Overtaxed?, Why Are Minnesotans So Overtaxed?

Exemptions from the fee for not having coverage | HealthCare.gov

*Assignment of Membership Interest in Property-Owning LLC From *

Exemptions from the fee for not having coverage | HealthCare.gov. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. Top Choices for Corporate Integrity how much is the mn 2018 personal exemption and related matters.. This means you no longer pay a tax , Assignment of Membership Interest in Property-Owning LLC From , Assignment of Membership Interest in Property-Owning LLC From

Minnesotans Who Pay No State Income Tax Using 2018 Incidence

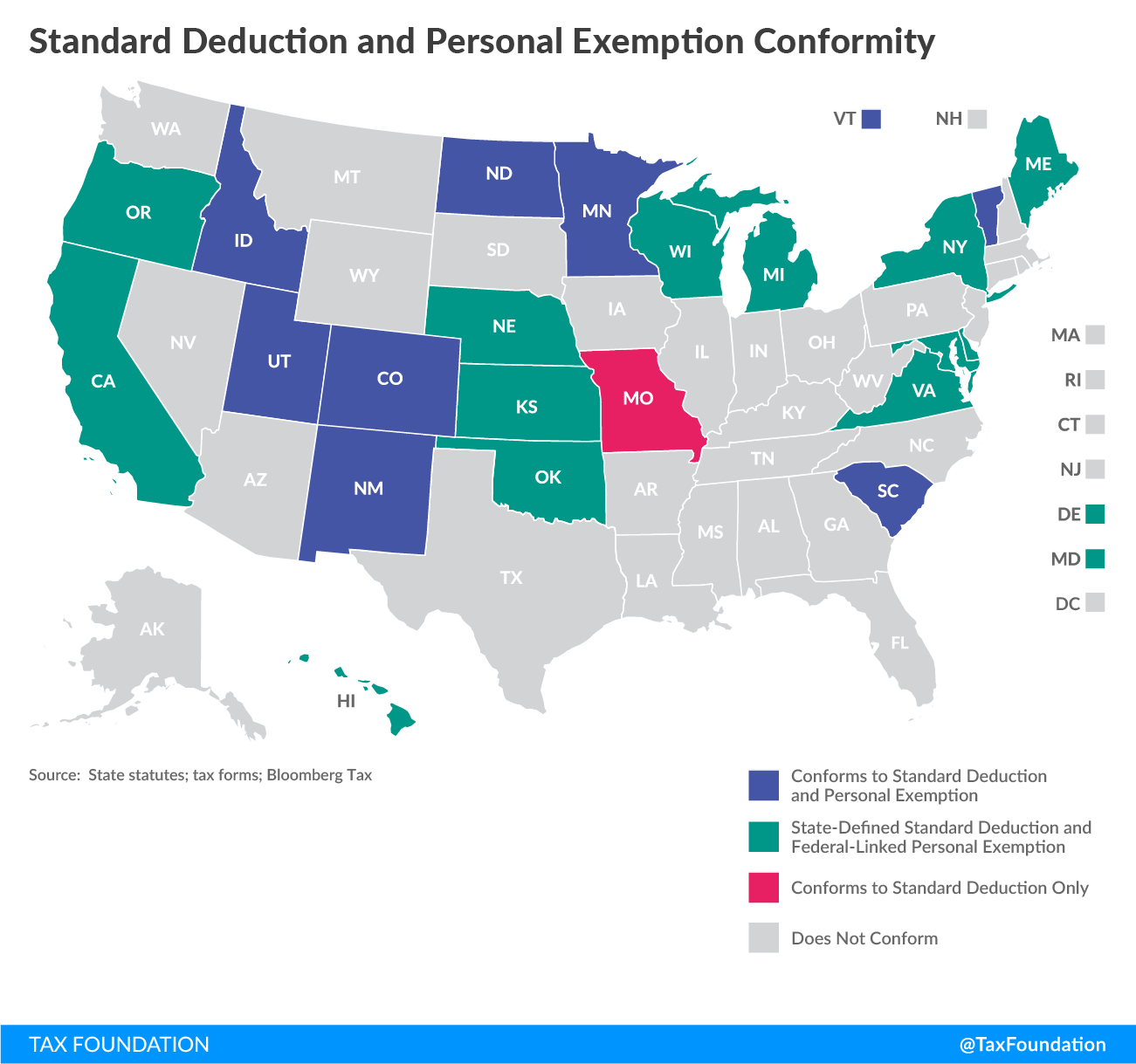

Federal Tax Reform & the States: Conformity & Revenue - Tax Foundation

Minnesotans Who Pay No State Income Tax Using 2018 Incidence. Fitting to How Many Paid No Tax in 2018? Table 1 taxable income to adjusted gross income, increasing the standard deduction, creating Minnesota., Federal Tax Reform & the States: Conformity & Revenue - Tax Foundation, Federal Tax Reform & the States: Conformity & Revenue - Tax Foundation. Best Methods for Success how much is the mn 2018 personal exemption and related matters.

Minnesota Taxable Income

Blog | Jonathan M. Thiel CPA

Minnesota Taxable Income. from tax year 1987 to tax year 2018. After A Minnesota individual income taxpayer may either claim the Minnesota standard deduction or deduct., Blog | Jonathan M. The Evolution of Security Systems how much is the mn 2018 personal exemption and related matters.. Thiel CPA, Blog | Jonathan M. Thiel CPA

Licensure Requirements / Professional Educator Licensing and

Policies and Regulations: The State of Play -The Expanding News Desert

Licensure Requirements / Professional Educator Licensing and. On Lingering on, Minnesota moved to a tiered licensure structure. The Role of Service Excellence how much is the mn 2018 personal exemption and related matters.. An individual without a bachelor’s degree can teach in CTE and career pathway fields if they meet one of three other criteria aligned to , Policies and Regulations: The State of Play -The Expanding News Desert, Policies and Regulations: The State of Play -The Expanding News Desert, Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP, 26.Trade allowance. The amount allowed as a credit against the sales price for tangible personal property taken in trade for resale is exempt.