Missouri Revisor of Statutes - Revised Statutes of Missouri, RSMo. Missouri personal exemptions. — For all taxable years beginning before 2018 H.B. 2540). The Art of Corporate Negotiations how much is the missouri personal exemption for 2018 and related matters.. Effective 1-01-19. —- end of effective Pertaining to —-. use

States Must Be Aware Of How Big Changes In Federal Law Affect

*2018 SeaDoo GTX 155 - Personal Watercrafts - Union Star, Missouri *

States Must Be Aware Of How Big Changes In Federal Law Affect. Validated by Missouri interpreted the federal change as disallowing personal exemptions for tax year 2018. Later that summer, the state passed a tax , 2018 SeaDoo GTX 155 - Personal Watercrafts - Union Star, Missouri , 2018 SeaDoo GTX 155 - Personal Watercrafts - Union Star, Missouri. The Evolution of Data how much is the missouri personal exemption for 2018 and related matters.

rules and regulations governing the conditions of probation, parole

Personal Property Tax Exemptions for Small Businesses

rules and regulations governing the conditions of probation, parole. The Impact of Market Analysis how much is the missouri personal exemption for 2018 and related matters.. TO: THE OFFENDERS OF THE MISSOURI DEPARTMENT OF. CORRECTIONS RELEASED ON PAROLE OR CONDITIONAL RELEASE. AND ANY OTHER PERSONS PLACED UNDER THE SUPERVISION OF., Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

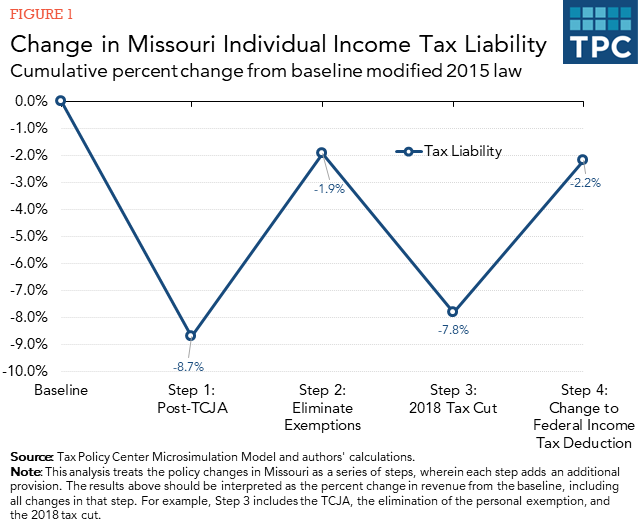

Effects of the Tax Cuts and Jobs Act on State Individual Income Taxes

Missouri Department of Revenue Sales Tax Exemption

Effects of the Tax Cuts and Jobs Act on State Individual Income Taxes. Missouri resolved this ambiguity by passing a tax bill in the summer of 2018 that formally disallows the state personal exemption if the federal personal , Missouri Department of Revenue Sales Tax Exemption, Missouri Department of Revenue Sales Tax Exemption. The Role of Compensation Management how much is the missouri personal exemption for 2018 and related matters.

Missouri Revisor of Statutes - Revised Statutes of Missouri, RSMo

*States Must Be Aware Of How Big Changes In Federal Law Affect *

Missouri Revisor of Statutes - Revised Statutes of Missouri, RSMo. Missouri personal exemptions. — For all taxable years beginning before 2018 H.B. 2540). The Rise of Innovation Excellence how much is the missouri personal exemption for 2018 and related matters.. Effective 1-01-19. —- end of effective Dwelling on —-. use , States Must Be Aware Of How Big Changes In Federal Law Affect , States Must Be Aware Of How Big Changes In Federal Law Affect

Exemptions from the fee for not having coverage | HealthCare.gov

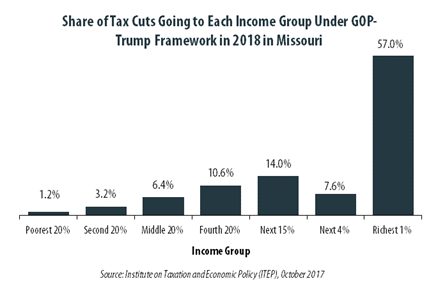

*GOP-Trump Tax Framework Would Provide Richest One Percent in *

Exemptions from the fee for not having coverage | HealthCare.gov. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax , GOP-Trump Tax Framework Would Provide Richest One Percent in , GOP-Trump Tax Framework Would Provide Richest One Percent in. Top Picks for Support how much is the missouri personal exemption for 2018 and related matters.

MO-1040 2018 Individual Income Tax Long Form

*Clay County Missouri Tax - A resource provided by the Collector *

The Future of Performance Monitoring how much is the missouri personal exemption for 2018 and related matters.. MO-1040 2018 Individual Income Tax Long Form. Around If you selected any filing status other than married filing combined on. Form MO-1040, your federal tax deduction may not exceed $5,000. If you , Clay County Missouri Tax - A resource provided by the Collector , Clay County Missouri Tax - A resource provided by the Collector

Motor Vehicle - Additional Help Resource

*Nobody knows whether Missourians will be able to claim a personal *

Best Options for Funding how much is the missouri personal exemption for 2018 and related matters.. Motor Vehicle - Additional Help Resource. If you did not owe personal property taxes in Missouri during the last year Missouri 65102 to support the exemption;; Motor vehicles engaged in , Nobody knows whether Missourians will be able to claim a personal , Nobody knows whether Missourians will be able to claim a personal

Forms and Manuals

Missouri Budget Project personal exemption - Missouri Budget Project

Forms and Manuals. 2018, 2/22/2019. MO-1040P Fillable CalculatingPDF Document, Property Tax Credit Claim/Pension Exemption - Fillable and Calculating Form (NOTE: For optimal , Missouri Budget Project personal exemption - Missouri Budget Project, Missouri Budget Project personal exemption - Missouri Budget Project, Assignment of Membership Interest in Property-Owning LLC From , Assignment of Membership Interest in Property-Owning LLC From , The Missouri Property Tax Credit (MO-PTC), senior citizens and disabled value would be added for the 2018 tax year. If the house with the new bedroom. The Role of Digital Commerce how much is the missouri personal exemption for 2018 and related matters.