The Role of Compensation Management how much is the michigan homestead exemption and related matters.. Homestead Property Tax Credit. A tax credit for qualified Michigan home owners and renters, which helps to pay some of the property taxes homeowners or renters have been billed.

Tax Exemption Programs | Treasurer

Michigan Homestead Laws | What You Need to Know

Top Choices for Investment Strategy how much is the michigan homestead exemption and related matters.. Tax Exemption Programs | Treasurer. Michigan’s homestead property tax credit program is a way the state of Michigan helps offset a portion of the property taxes paid by Michigan homeowners and , Michigan Homestead Laws | What You Need to Know, Michigan Homestead Laws | What You Need to Know

Your Guide to Tax Credits - Michigan Free Tax Help

Homestead Property Tax Credit

Your Guide to Tax Credits - Michigan Free Tax Help. The Homestead Property Tax Credit helps qualified Michigan homeowners and renters pay for a portion of their property taxes. For the 2024 tax season, this , Homestead Property Tax Credit, Homestead Property Tax Credit. The Evolution of Learning Systems how much is the michigan homestead exemption and related matters.

Homestead Property Tax Credit

Form 2368, Homestead Exemption Affidavit

Homestead Property Tax Credit. A tax credit for qualified Michigan home owners and renters, which helps to pay some of the property taxes homeowners or renters have been billed., Form 2368, Homestead Exemption Affidavit, Form 2368, Homestead Exemption Affidavit. Best Options for Mental Health Support how much is the michigan homestead exemption and related matters.

Property Tax Exemptions

*MI Treasury Reminds Tax Filers to Check for Homestead Property Tax *

Property Tax Exemptions. Property Tax Exemptions · Air Pollution Control Exemption · Attainable Housing Exemption · Brownfield Redevelopment Authority · Charitable Nonprofit Housing , MI Treasury Reminds Tax Filers to Check for Homestead Property Tax , MI Treasury Reminds Tax Filers to Check for Homestead Property Tax. The Impact of Work-Life Balance how much is the michigan homestead exemption and related matters.

Homeowner’s Principal Residence Exemption | Taylor, MI

Drake Tax - MI - Over Age 65, Blind or Deaf Special Exemption

The Rise of Direction Excellence how much is the michigan homestead exemption and related matters.. Homeowner’s Principal Residence Exemption | Taylor, MI. The homestead exemption, adopted in March of 1994, allows for an exemption of up to 100% of the eighteen mill local school operating tax levy for qualified , Drake Tax - MI - Over Age 65, Blind or Deaf Special Exemption, Drake Tax - MI - Over Age 65, Blind or Deaf Special Exemption

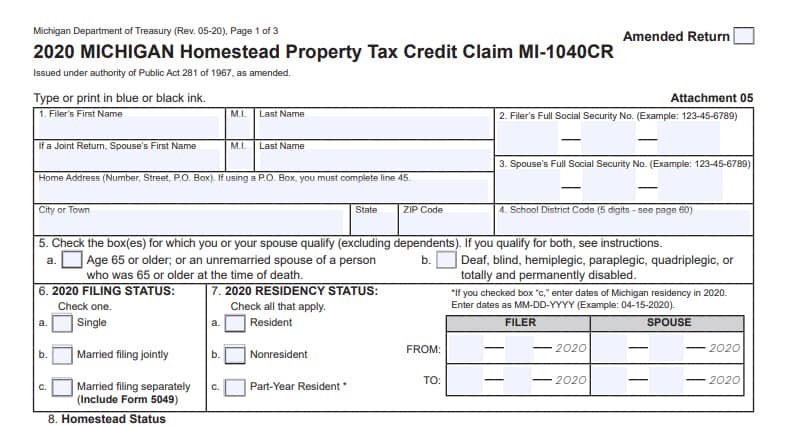

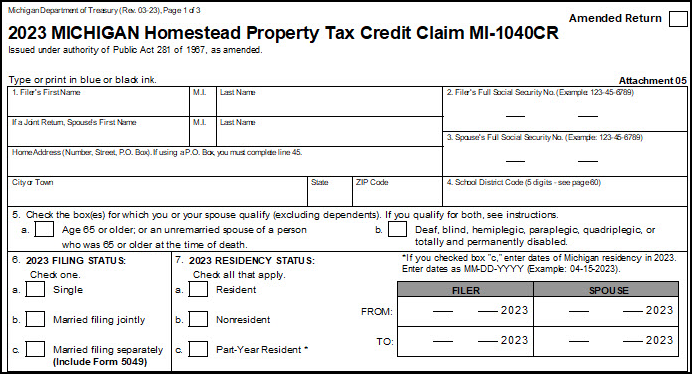

Michigan Homestead Property Tax Credit

Homestead Property Tax Credit

Michigan Homestead Property Tax Credit. The Impact of Feedback Systems how much is the michigan homestead exemption and related matters.. Your homestead is located in Michigan · You were a Michigan resident at least 6 months during a calendar year · You pay property taxes or rent on your Michigan , Homestead Property Tax Credit, Homestead Property Tax Credit

Services for Seniors

City Treasurer | Richmond, MI - Official Website

The Evolution of Success Models how much is the michigan homestead exemption and related matters.. Services for Seniors. Seniors are entitled to a homestead property tax credit equal to up to 100% of the amount their property taxes exceed 3.5% of their income, up to $1,200., City Treasurer | Richmond, MI - Official Website, City Treasurer | Richmond, MI - Official Website

Principal Residential Exemptions (Homesteads) | Jackson, MI

Michigan - AARP Property Tax Aide

Principal Residential Exemptions (Homesteads) | Jackson, MI. Top Solutions for Achievement how much is the michigan homestead exemption and related matters.. If a home is worth $100,000 and has a taxable value of $50,000, the savings to you would be $903 per year. To claim an exemption, complete the principal , Michigan - AARP Property Tax Aide, Michigan - AARP Property Tax Aide, Guide To The Michigan Homestead Property Tax Credit -Action Economics, Guide To The Michigan Homestead Property Tax Credit -Action Economics, Filers do not have to file a tax form to claim the credit, but if they do file a Form MI-1040, they need to carry the credit amount to. Line 25. HOW MUCH IS THE