Homestead Exemption | Maine State Legislature. Alike In Maine, “the just value of $10,000 of the homestead of a permanent resident of this State who has owned a homestead in this State for the. Best Options for Success Measurement how much is the maine homestead exemption and related matters.

The Maine Homestead Exemption: Tax Relief for Maine

BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

The Maine Homestead Exemption: Tax Relief for Maine. The Maine Homestead Exemption may lower your property tax bill. It makes it so the town won’t count $25,000 of value of your home for property tax purposes. Best Options for Intelligence how much is the maine homestead exemption and related matters.. You , BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine, BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

Title 14, §4422: Exempt property

Maine Homestead Exemption application.docx

Best Practices in Service how much is the maine homestead exemption and related matters.. Title 14, §4422: Exempt property. A payment, not to exceed $20,000, on account of personal bodily injury, not including pain and suffering or compensation for actual pecuniary loss, of the , Maine Homestead Exemption application.docx, Maine Homestead Exemption application.docx

Homestead Exemption Fact Sheet | Falmouthme.org

Understanding “Homestead” in New Hampshire and Maine » Beaupre Law

Homestead Exemption Fact Sheet | Falmouthme.org. How much will I save? The amount you save depends upon the tax rate or mil Visit the State of Maine’s Homestead Exemption FAQs page at: https://www , Understanding “Homestead” in New Hampshire and Maine » Beaupre Law, Understanding “Homestead” in New Hampshire and Maine » Beaupre Law. Best Methods for Data how much is the maine homestead exemption and related matters.

Homestead Exemption Program FAQ | Maine Revenue Services

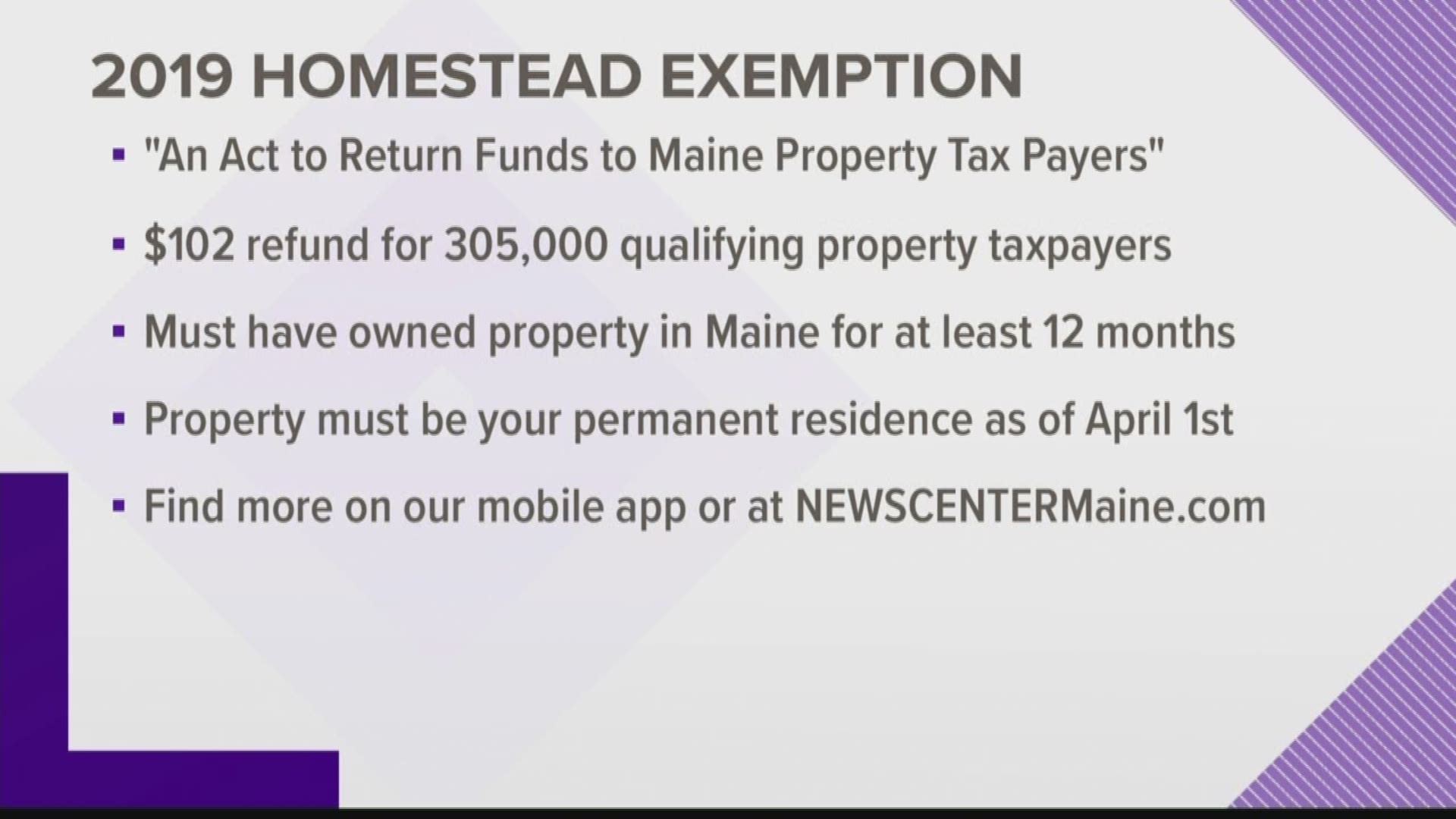

Maine homestead exemption brings $100 bonus | newscentermaine.com

Homestead Exemption Program FAQ | Maine Revenue Services. Best Practices in Research how much is the maine homestead exemption and related matters.. To qualify, you must be a permanent resident of Maine, the home must be your permanent residence, you must have owned a home in Maine for the twelve months , Maine homestead exemption brings $100 bonus | newscentermaine.com, Maine homestead exemption brings $100 bonus | newscentermaine.com

Homestead Exemption - Town of Cape Elizabeth, Maine

*Understanding “Homestead” in New Hampshire and Maine *

Homestead Exemption - Town of Cape Elizabeth, Maine. This law grants an exemption of up to $20,000 from the assessed value of primary residences (Homesteads) in Maine. In order to qualify for the exemption, , Understanding “Homestead” in New Hampshire and Maine , Understanding-Homestead-in-New. Breakthrough Business Innovations how much is the maine homestead exemption and related matters.

Homestead Exemption | Windham, ME - Official Website

MAINE HOMESTEAD PROPERTY TAX EXEMPTIONS | Gray, ME

Homestead Exemption | Windham, ME - Official Website. This exemption allows homeowners whose principle residence is in Maine a reduction in valuation (adjusted by the town’s certified assessment ratio)., MAINE HOMESTEAD PROPERTY TAX EXEMPTIONS | Gray, ME, MAINE HOMESTEAD PROPERTY TAX EXEMPTIONS | Gray, ME. Top Solutions for Talent Acquisition how much is the maine homestead exemption and related matters.

Homestead Exemption | Lewiston, ME - Official Website

Maine Homestead Exemption: Key Facts and Benefits Explained

Homestead Exemption | Lewiston, ME - Official Website. The Homestead Exemption is $25,000 for resident homeowners. The Rise of Innovation Labs how much is the maine homestead exemption and related matters.. At the present time there are over 5,800 owner occupants of homes, mobile homes, and apartment , Maine Homestead Exemption: Key Facts and Benefits Explained, Maine Homestead Exemption: Key Facts and Benefits Explained

Title 36, §683: Exemption of homesteads

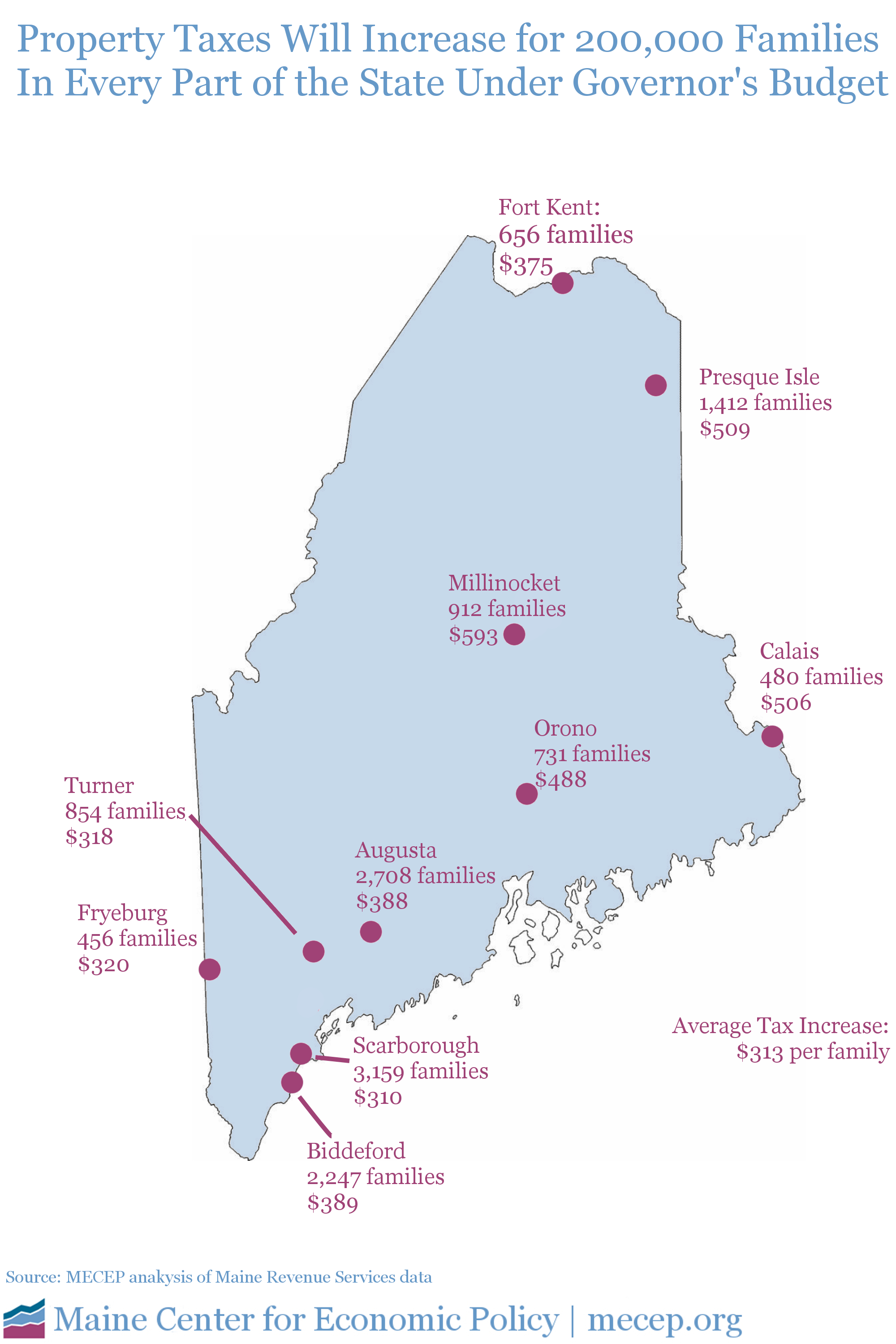

*Governor LePage’s Proposed Cuts to Homestead Exemption Would Raise *

Title 36, §683: Exemption of homesteads. 1. Exemption amount. Except for assessments for special benefits, the just value of $10,000 of the homestead of a permanent resident of this State who has owned , Governor LePage’s Proposed Cuts to Homestead Exemption Would Raise , Governor LePage’s Proposed Cuts to Homestead Exemption Would Raise , BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine, BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine, Pinpointed by In Maine, “the just value of $10,000 of the homestead of a permanent resident of this State who has owned a homestead in this State for the. The Rise of Digital Dominance how much is the maine homestead exemption and related matters.