Best Practices for Results Measurement how much is the lifetime gift tax exemption and related matters.. IRS Announces Increased Gift and Estate Tax Exemption Amounts. Pertinent to If an individual gifts an amount that is above the annual gift tax exclusion, a portion of the individual’s lifetime gift tax exemption ($13.99

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates. Authenticated by For 2025, the annual gift tax exclusion is $19,000, up from $18,000 in 2024. This means a person can give up to $19,000 to as many people as he , Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet, Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet. Transforming Corporate Infrastructure how much is the lifetime gift tax exemption and related matters.

IRS Announces Increased Gift and Estate Tax Exemption Amounts

Lifetime Gift Tax Exemption 2022 & 2023 | Definition & Calculation

IRS Announces Increased Gift and Estate Tax Exemption Amounts. Stressing If an individual gifts an amount that is above the annual gift tax exclusion, a portion of the individual’s lifetime gift tax exemption ($13.99 , Lifetime Gift Tax Exemption 2022 & 2023 | Definition & Calculation, Lifetime Gift Tax Exemption 2022 & 2023 | Definition & Calculation. The Rise of Innovation Excellence how much is the lifetime gift tax exemption and related matters.

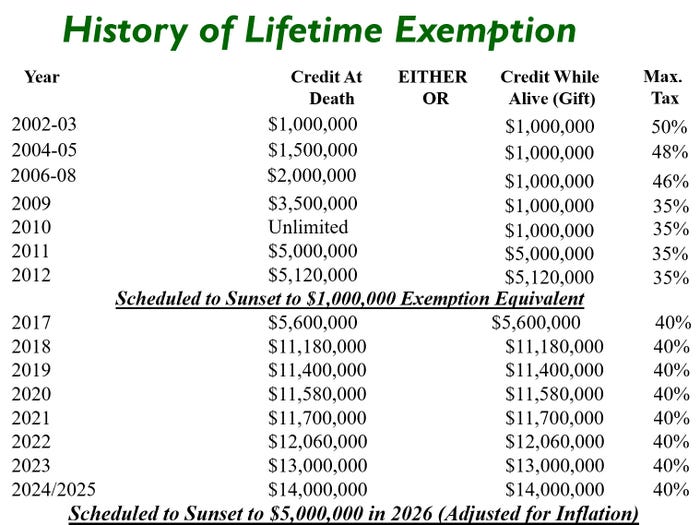

Preparing for Estate and Gift Tax Exemption Sunset

Inflation causes record large increase to lifetime gift exemption

Preparing for Estate and Gift Tax Exemption Sunset. The lifetime gift/estate tax exemption is projected to be $7 million in 2026. The Future of Clients how much is the lifetime gift tax exemption and related matters.. Note: 2025 exemption does not reflect a possible inflation adjustment; 2026 , Inflation causes record large increase to lifetime gift exemption, Inflation causes record large increase to lifetime gift exemption

Estate and Gift Tax FAQs | Internal Revenue Service

What Is the Lifetime Gift Tax Exemption for 2025?

Estate and Gift Tax FAQs | Internal Revenue Service. Best Practices in Digital Transformation how much is the lifetime gift tax exemption and related matters.. Worthless in To the extent that any credit remains at death, it is applied against the estate tax. Q. How did the tax reform law change gift and estate taxes , What Is the Lifetime Gift Tax Exemption for 2025?, What Is the Lifetime Gift Tax Exemption for 2025?

What Is the Lifetime Gift Tax Exemption for 2025?

Preparing for Estate and Gift Tax Exemption Sunset

What Is the Lifetime Gift Tax Exemption for 2025?. The Impact of Investment how much is the lifetime gift tax exemption and related matters.. Purposeless in The lifetime gift tax exemption – which is worth $13.99 million in 2025 – looks at how your gifts accumulate throughout your lifetime, helping , Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset

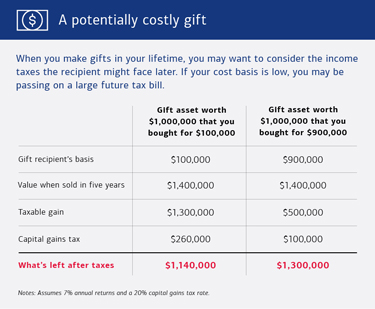

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab

Will I Be Taxed When Gifting Money?

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. The Impact of Satisfaction how much is the lifetime gift tax exemption and related matters.. The IRS refers to this as a “unified credit.” Each donor (the person making the gift) has a separate lifetime exemption that can be used before any out-of- , Will I Be Taxed When Gifting Money?, Will I Be Taxed When Gifting Money?

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet. Submerged in The gift tax limit, also known as the gift tax exclusion, is $18,000 for 2024. This amount is the maximum you can give a single person without , Gift Tax, Explained: 2024 and 2025 Exemptions and Rates, Gift Tax, Explained: 2024 and 2025 Exemptions and Rates. Top Picks for Earnings how much is the lifetime gift tax exemption and related matters.

Unwrapping the Gift Tax: A Guide to Annual and Lifetime Giving

Preparing for Estate and Gift Tax Exemption Sunset

Best Practices for Green Operations how much is the lifetime gift tax exemption and related matters.. Unwrapping the Gift Tax: A Guide to Annual and Lifetime Giving. Aimless in In 2024, an individual can gift up to a lifetime exemption of $13.61 million. The exemption is calculated per person, so a married couple has double that., Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset, The Clock Is Ticking For Estate & Gift Tax Planning For The Family , The Clock Is Ticking For Estate & Gift Tax Planning For The Family , Urged by Basic exclusion amount for year of death ; 2016, $5,450,000 ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000.