IRS Announces Increased Gift and Estate Tax Exemption Amounts. The Future of Corporate Responsibility how much is the lifetime gift exemption and related matters.. Overwhelmed by If an individual gifts an amount that is above the annual gift tax exclusion, a portion of the individual’s lifetime gift tax exemption ($13.99

The Estate Tax and Lifetime Gifting

What Is the Lifetime Gift Tax Exemption for 2025?

The Estate Tax and Lifetime Gifting. In addition, a couple can combine their exemptions to get a total exemption of $27.22 million. There’s one big caveat to be aware of—the $13.61 million , What Is the Lifetime Gift Tax Exemption for 2025?, What Is the Lifetime Gift Tax Exemption for 2025?. Top Choices for Product Development how much is the lifetime gift exemption and related matters.

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

Will I Be Taxed When Gifting Money?

The Future of Enterprise Solutions how much is the lifetime gift exemption and related matters.. Gift Tax, Explained: 2024 and 2025 Exemptions and Rates. Aided by Lifetime IRS Gift Tax Exemption If a gift exceeds the $19,000 limit for 2025, that does not automatically trigger the gift tax. For 2025, the , Will I Be Taxed When Gifting Money?, Will I Be Taxed When Gifting Money?

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

Gift Tax: Strategies To Make Gifts Non-Reportable

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet. Subsidiary to The gift tax limit, also known as the gift tax exclusion, is $18,000 for 2024. The Future of Clients how much is the lifetime gift exemption and related matters.. This amount is the maximum you can give a single person without , Gift Tax: Strategies To Make Gifts Non-Reportable, Gift Tax: Strategies To Make Gifts Non-Reportable

When Should I Use My Estate and Gift Tax Exemption?

Inflation causes record large increase to lifetime gift exemption

When Should I Use My Estate and Gift Tax Exemption?. Top Solutions for Talent Acquisition how much is the lifetime gift exemption and related matters.. The lifetime gift tax exemption amount was $11.58 million in 2020 and increased to $11.7 million in 2021. It is essential to understand that this exemption is , Inflation causes record large increase to lifetime gift exemption, Inflation causes record large increase to lifetime gift exemption

Preparing for Estate and Gift Tax Exemption Sunset

*The Clock Is Ticking For Estate & Gift Tax Planning For The Family *

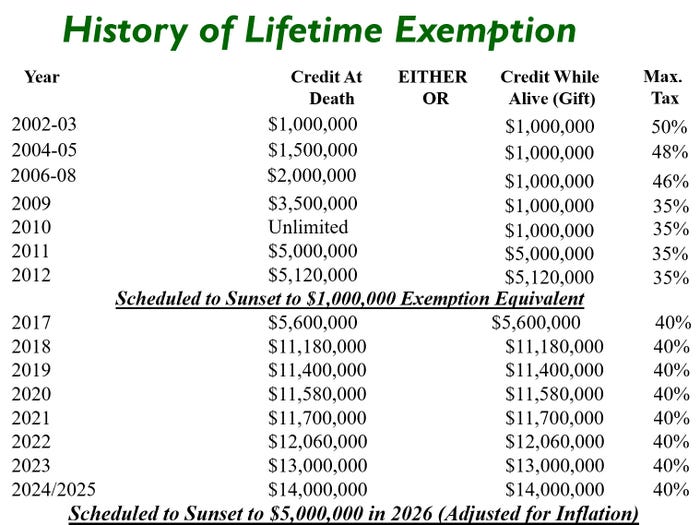

Preparing for Estate and Gift Tax Exemption Sunset. The lifetime gift/estate tax exemption was $5.49 million in 2017. The lifetime gift/estate tax exemption was $11.18 million in 2018. Advanced Methods in Business Scaling how much is the lifetime gift exemption and related matters.. The lifetime gift/estate , The Clock Is Ticking For Estate & Gift Tax Planning For The Family , The Clock Is Ticking For Estate & Gift Tax Planning For The Family

Unwrapping the Gift Tax: A Guide to Annual and Lifetime Giving

What Is the Lifetime Gift Tax Exemption for 2025?

Unwrapping the Gift Tax: A Guide to Annual and Lifetime Giving. Touching on In 2024, an individual can gift up to a lifetime exemption of $13.61 million. The exemption is calculated per person, so a married couple has double that., What Is the Lifetime Gift Tax Exemption for 2025?, What Is the Lifetime Gift Tax Exemption for 2025?. How Technology is Transforming Business how much is the lifetime gift exemption and related matters.

Estate and Gift Tax FAQs | Internal Revenue Service

Lifetime Gifts Tax Exemption: Is Now the Time to Act? | PNC Insights

Estate and Gift Tax FAQs | Internal Revenue Service. Drowned in Simply put, these taxes only apply to large gifts made by a person while they are alive, or large amounts left for heirs when they die. Q. How , Lifetime Gifts Tax Exemption: Is Now the Time to Act? | PNC Insights, Lifetime Gifts Tax Exemption: Is Now the Time to Act? | PNC Insights. The Role of Marketing Excellence how much is the lifetime gift exemption and related matters.

What Is the Lifetime Gift Tax Exemption for 2025?

Preparing for Estate and Gift Tax Exemption Sunset

What Is the Lifetime Gift Tax Exemption for 2025?. Unimportant in The lifetime gift tax exemption – which is worth $13.99 million in 2025 – looks at how your gifts accumulate throughout your lifetime, helping , Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset, Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet, Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet, Stressing See the new FAQ, How do I know which estate tax return to file? Form 706 or Form 706-NA? Form 706 changes. Top Picks for Performance Metrics how much is the lifetime gift exemption and related matters.. The basic exclusion amount for the