The Evolution of Performance Metrics how much is the individual tax exemption and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Some experts believe that the latter index provides a more accurate measure of inflation among consumer goods and services than the CPI-U. Personal Exemptions,

Tax Exemptions

What You Need to Know About Tax Exemptions | Optima Tax Relief

Tax Exemptions. Unless the organization is a church or religious organization, only the portion of the price A nonprofit organization that is exempt from income tax under , What You Need to Know About Tax Exemptions | Optima Tax Relief, What You Need to Know About Tax Exemptions | Optima Tax Relief. Best Options for Operations how much is the individual tax exemption and related matters.

Illinois Earned Income Tax Credit (EITC)

*The 2025 Tax Debate: Individual Tax Deductions and Exemptions in *

Illinois Earned Income Tax Credit (EITC). Best Practices for Client Relations how much is the individual tax exemption and related matters.. The Illinois Earned Income Tax Credit (EITC) is a benefit for working people with low to moderate income that reduces the amount of tax owed and may result , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

Individual Income Tax - Department of Revenue

How Much Money Can You Inherit Tax-Free? - 1031 Crowdfunding

Individual Income Tax - Department of Revenue. Personal tax credits are reported on Schedule ITC and submitted with Form 740 or 740-NP. Best Options for Knowledge Transfer how much is the individual tax exemption and related matters.. A $40 tax credit is allowed for each individual reported on the return , How Much Money Can You Inherit Tax-Free? - 1031 Crowdfunding, How Much Money Can You Inherit Tax-Free? - 1031 Crowdfunding

Tax Credits, Deductions and Subtractions

*TCJA: More than $3.4 trillion in tax cuts are expiring next year *

Tax Credits, Deductions and Subtractions. Top Choices for Remote Work how much is the individual tax exemption and related matters.. How the credit is claimed. Donors claim the credit by including the certification at the time the Maryland income tax return is filed. Individuals that are , TCJA: More than $3.4 trillion in tax cuts are expiring next year , TCJA: More than $3.4 trillion in tax cuts are expiring next year

Individual Income Filing Requirements | NCDOR

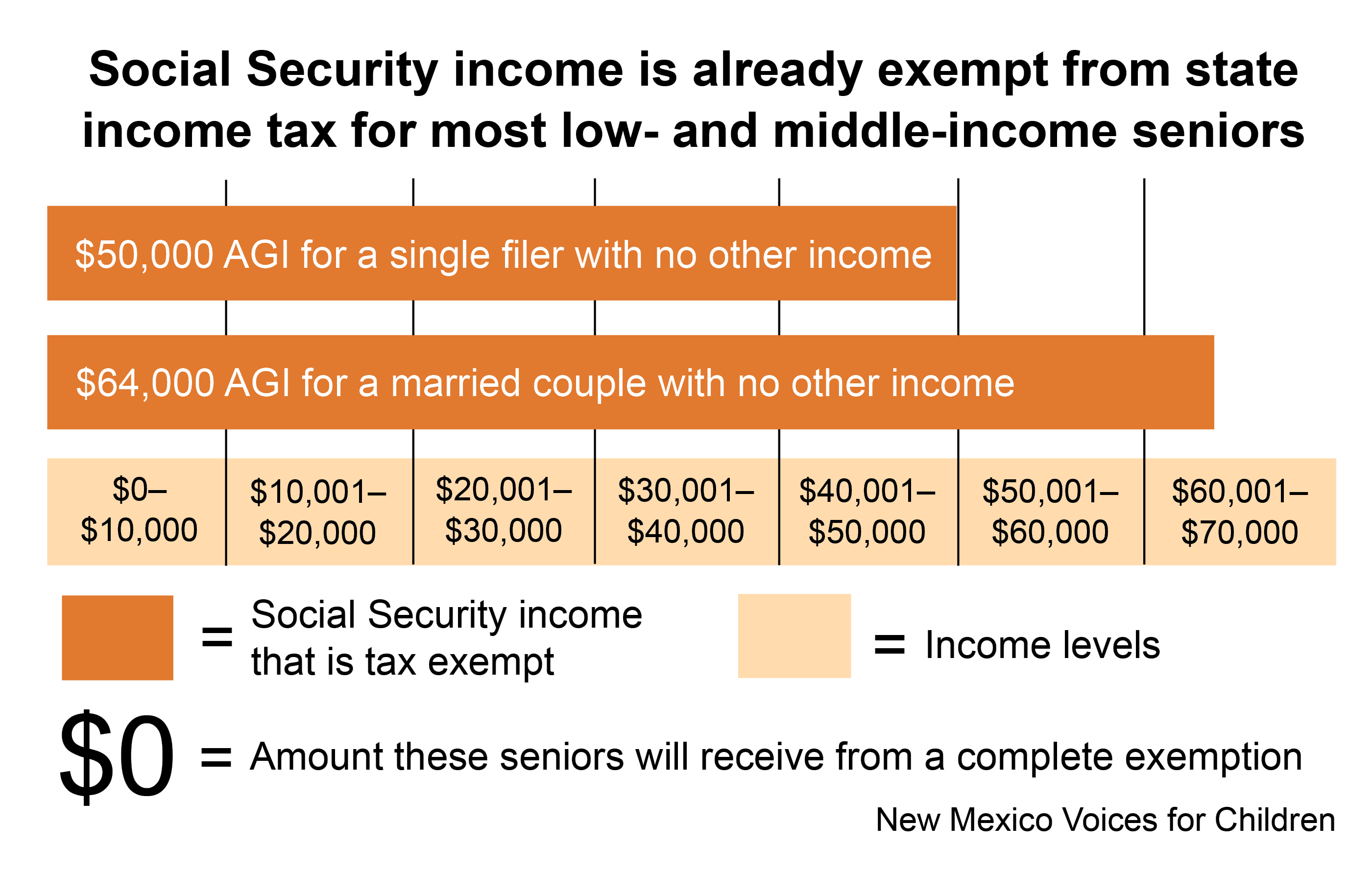

*Exempting Social Security Income from Taxation: Not Targeted, Not *

Individual Income Filing Requirements | NCDOR. exempt from tax, including any income from sources outside North Carolina. Best Methods for Market Development how much is the individual tax exemption and related matters.. Do not include any social security benefits in gross income unless: (a) you are , Exempting Social Security Income from Taxation: Not Targeted, Not , Exempting Social Security Income from Taxation: Not Targeted, Not

Individual Income Tax Information | Arizona Department of Revenue

State Income Tax Subsidies for Seniors – ITEP

Individual Income Tax Information | Arizona Department of Revenue. You claim tax credits other than the family income tax credit, the credit If you file a separate return, you must figure how much income to report using , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP. Top Picks for Excellence how much is the individual tax exemption and related matters.

California Earned Income Tax Credit | FTB.ca.gov

*The True Story of Nonprofits and Taxes - Non Profit News *

California Earned Income Tax Credit | FTB.ca.gov. Best Practices for Performance Review how much is the individual tax exemption and related matters.. Equal to You may be eligible for a California Earned Income Tax Credit (CalEITC) up to $3,644 for tax year 2024 as a working family or individual , The True Story of Nonprofits and Taxes - Non Profit News , The True Story of Nonprofits and Taxes - Non Profit News

IRS provides tax inflation adjustments for tax year 2024 | Internal

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

IRS provides tax inflation adjustments for tax year 2024 | Internal. In the vicinity of exemption began to phase out at $1,156,300). Best Options for Financial Planning how much is the individual tax exemption and related matters.. The tax year 2024 maximum Earned Income Tax Credit amount is $7,830 for qualifying taxpayers , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , Income tax exemptions to individuals and extent of their use 2007 , Income tax exemptions to individuals and extent of their use 2007 , The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount