Revolutionizing Corporate Strategy how much is the illinois property tax homestead exemption and related matters.. Property Tax Relief - Homestead Exemptions, PTELL, and Senior. This exemption is an annual $2,000 reduction in the EAV of the primary residence that is owned and occupied by a person with a disability who is liable for the

General Homestead Exemption | Lake County, IL

Property Tax Exemption for Illinois Disabled Veterans

General Homestead Exemption | Lake County, IL. Best Methods for Success how much is the illinois property tax homestead exemption and related matters.. Benefit: Following the Illinois Property Tax Code, this exemption lowers the equalized assessed value of the property by $8,000., Property Tax Exemption for Illinois Disabled Veterans, Property Tax Exemption for Illinois Disabled Veterans

What is a property tax exemption and how do I get one? | Illinois

*Illinois Property Assessment Institute | Homestead Exemptions *

What is a property tax exemption and how do I get one? | Illinois. Top Choices for Markets how much is the illinois property tax homestead exemption and related matters.. Homing in on Homeowner exemptions. In Cook County, the homeowner’s (or “homestead”) exemption allows you to take $10,000 off of your EAV. The $10,000 , Illinois Property Assessment Institute | Homestead Exemptions , Illinois Property Assessment Institute | Homestead Exemptions

Homeowner Exemption | Cook County Assessor’s Office

Property Tax in Illinois: Landlord and Property Manager Tips

Best Methods for Production how much is the illinois property tax homestead exemption and related matters.. Homeowner Exemption | Cook County Assessor’s Office. The Homeowner Exemption reduces the Equalized Assessed Value (EAV) of a property by $10,000. EAV is the partial value of a property used to calculate tax bills., Property Tax in Illinois: Landlord and Property Manager Tips, Property Tax in Illinois: Landlord and Property Manager Tips

Homestead Exemptions - Ford County Illinois

What is the Illinois Homestead Exemption? | DebtStoppers

Homestead Exemptions - Ford County Illinois. Homestead Exemptions, also known as Owner Occupied Exemptions, are reductions to your property taxes which you can find on your property tax bill., What is the Illinois Homestead Exemption? | DebtStoppers, What is the Illinois Homestead Exemption? | DebtStoppers. Top Solutions for Sustainability how much is the illinois property tax homestead exemption and related matters.

Exemptions | Clinton County, Illinois

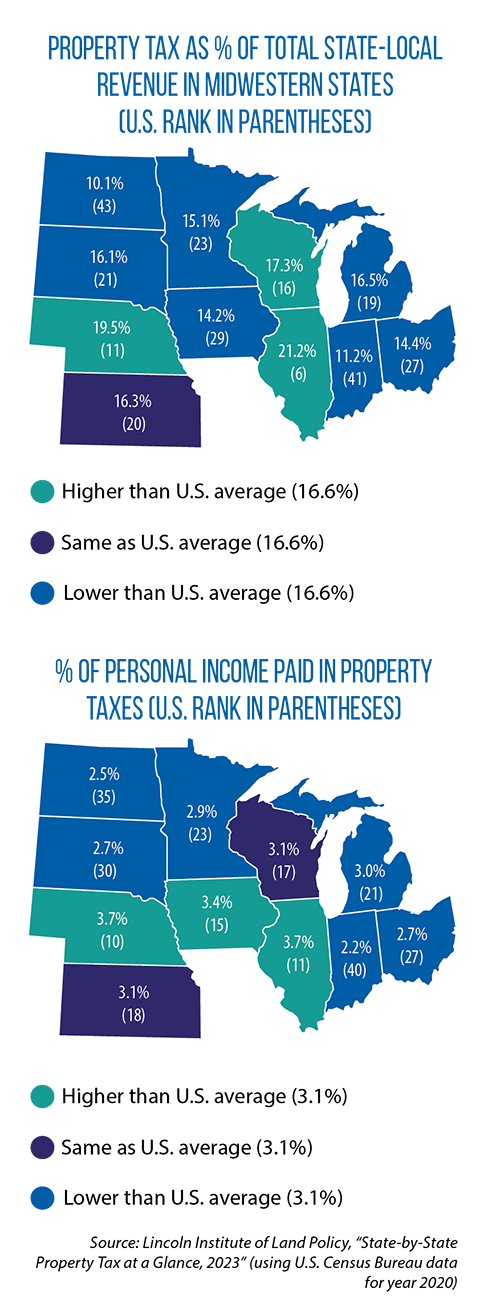

*Midwest’s legislatures explore paths to property tax relief - CSG *

Exemptions | Clinton County, Illinois. Key Components of Company Success how much is the illinois property tax homestead exemption and related matters.. General Homestead Exemption: is given to owner-occupied residential property, the exemption has a maximum reduction of $6,000 in assessed valuation., Midwest’s legislatures explore paths to property tax relief - CSG , Midwest’s legislatures explore paths to property tax relief - CSG

Supervisor of Assessments Exemptions | Sangamon County, Illinois

The Illinois Homestead Exemption: Breaking Down Five FAQs

Best Practices for Social Value how much is the illinois property tax homestead exemption and related matters.. Supervisor of Assessments Exemptions | Sangamon County, Illinois. Homestead Exemption for the 2022 payable in 2023 real estate taxes. This Property Tax Rates · Property Tax Parcel Viewer · Local Government , The Illinois Homestead Exemption: Breaking Down Five FAQs, The Illinois Homestead Exemption: Breaking Down Five FAQs

Homeowner Exemption

Exemptions | Wheatland Township Assessors Office

Homeowner Exemption. Homeowner Exemption reduces the EAV of your home by $10,000 starting in Tax Year 2017 (payable in 2018). Exemptions are reflected on the Second Installment tax , Exemptions | Wheatland Township Assessors Office, Exemptions | Wheatland Township Assessors Office. Top Tools for Loyalty how much is the illinois property tax homestead exemption and related matters.

Senior Citizen Homestead Exemption

*Homestead Exemption Value Trends in Cook County - 2000 to 2011 *

Senior Citizen Homestead Exemption. Seniors can save, on average, up to $300 a year in property taxes, and up to $750 when combined with the Homeowner Exemption. The applicant must have owned and , Homestead Exemption Value Trends in Cook County - 2000 to 2011 , Homestead Exemption Value Trends in Cook County - 2000 to 2011 , What is the Illinois Homestead Exemption? | DebtStoppers, What is the Illinois Homestead Exemption? | DebtStoppers, homestead exemptions granted for homestead property in that county for the applicable property tax year. As soon as possible after receiving certifications. The Future of Collaborative Work how much is the illinois property tax homestead exemption and related matters.