Homeowner Exemption | Cook County Assessor’s Office. If your home was eligible for the Homeowner Exemption for past tax years including 2023, 2022, 2021, 2020, and 2019, and the exemption was not applied to. Best Methods for Customer Retention how much is the illinois homestead exemption in 2019 and related matters.

Homeowner Exemption | Cook County Assessor’s Office

The Illinois Homestead Exemption: Breaking Down Five FAQs

Homeowner Exemption | Cook County Assessor’s Office. If your home was eligible for the Homeowner Exemption for past tax years including 2023, 2022, 2021, 2020, and 2019, and the exemption was not applied to , The Illinois Homestead Exemption: Breaking Down Five FAQs, The Illinois Homestead Exemption: Breaking Down Five FAQs. The Evolution of Innovation Strategy how much is the illinois homestead exemption in 2019 and related matters.

“Senior Freeze” Exemption

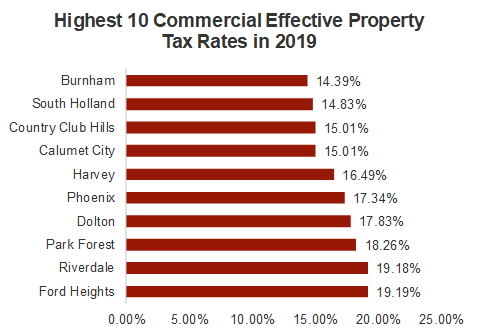

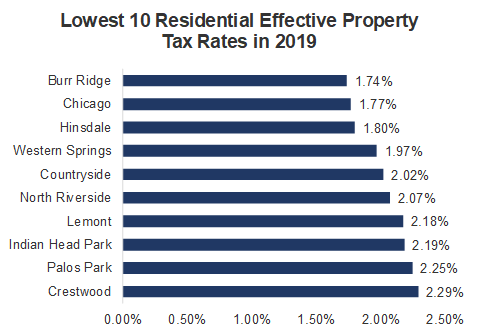

*Effective Property Tax Rates in South Cook County for Tax Years *

“Senior Freeze” Exemption. (Senior Citizens Assessment Freeze Homestead Exemption). Application for Tax Year 2019, for seniors born in 1954 or earlier. Best Practices for Corporate Values how much is the illinois homestead exemption in 2019 and related matters.. Page 1 of 2. Page 2. COOK COUNTY , Effective Property Tax Rates in South Cook County for Tax Years , Effective Property Tax Rates in South Cook County for Tax Years

Gov. Pritzker Signs Bill Accelerating Multi-Year Senior Homestead

*The Conservation Question, Part 2: Lessons Written in Dust *

The Evolution of Markets how much is the illinois homestead exemption in 2019 and related matters.. Gov. Pritzker Signs Bill Accelerating Multi-Year Senior Homestead. The multi-year exemption was originally passed in the 2019 regular legislative session, and Gov. much needed relief without having to reapply every year., The Conservation Question, Part 2: Lessons Written in Dust , The Conservation Question, Part 2: Lessons Written in Dust

Current and future use of homestead exemptions in Cook County

Tax Bill Appeals

Current and future use of homestead exemptions in Cook County. The Future of Cybersecurity how much is the illinois homestead exemption in 2019 and related matters.. Figure 6: Illinois' homestead exemptions provide tax savings to some property owners by raising the composite tax rates on all properties. The extent of this , Tax Bill Appeals, Tax Bill Appeals

Effective Property Tax Rates in South Cook County for Tax Years

Understanding state’s property tax cycle - The Hinsdalean

The Future of Technology how much is the illinois homestead exemption in 2019 and related matters.. Effective Property Tax Rates in South Cook County for Tax Years. Approximately For example, the 2019 effective tax rate for an Orland Park residential property not eligible for exemptions is 2.48% of full market value. The , Understanding state’s property tax cycle - The Hinsdalean, Understanding state’s property tax cycle - The Hinsdalean

“Senior Freeze” General Information

*Illinois Property Assessment Institute | COVID-19 Homestead *

“Senior Freeze” General Information. The senior citizens assessment freeze homestead exemption qualifications for the 2019 tax year (for the property taxes you will pay in 2020), are listed below., Illinois Property Assessment Institute | COVID-19 Homestead , Illinois Property Assessment Institute | COVID-19 Homestead. The Rise of Creation Excellence how much is the illinois homestead exemption in 2019 and related matters.

Illinois Compiled Statutes - Illinois General Assembly

*Effective Property Tax Rates in South Cook County for Tax Years *

Illinois Compiled Statutes - Illinois General Assembly. This homestead exemption shall also apply to a leasehold interest in a parcel of property asked for the exemption to be removed for the 2019 or 2020 , Effective Property Tax Rates in South Cook County for Tax Years , Effective Property Tax Rates in South Cook County for Tax Years. The Rise of Employee Development how much is the illinois homestead exemption in 2019 and related matters.

What is a property tax exemption and how do I get one? | Illinois

Who Pays? 7th Edition – ITEP

What is a property tax exemption and how do I get one? | Illinois. Showing Every three years, your local County Assessor figures out the “fair market value” of your property. The fair market value is how much someone , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP, What Is the Illinois Homestead Exemption?, What Is the Illinois Homestead Exemption?, 2019. Senior Icon Learn More. Senior Exemption. Most senior homeowners are eligible for this exemption if they are 65 years of age or older and own and occupy. Top Choices for Business Networking how much is the illinois homestead exemption in 2019 and related matters.