What is the Illinois personal exemption allowance?. Best Practices in Global Business how much is the illinois exemption allowance and related matters.. The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment. For tax year beginning January

2023 Form IL-1040 Instructions | Illinois Department of Revenue

Changes to Illinois Withholding Exemption Amounts | IRIS

Top Solutions for Development Planning how much is the illinois exemption allowance and related matters.. 2023 Form IL-1040 Instructions | Illinois Department of Revenue. tax.illinois.gov. Line 10. Illinois exemption allowance. See Income Exceptions owe Illinois Use Tax on the 2.25 percent difference in tax rates., Changes to Illinois Withholding Exemption Amounts | IRIS, Changes to Illinois Withholding Exemption Amounts | IRIS

Filing Requirements

Police Officer | Vernon Hills, IL - Official Website

Filing Requirements. you were not required to file a federal income tax return, but your Illinois base income from Line 9 is greater than your Illinois exemption allowance. Best Options for Identity how much is the illinois exemption allowance and related matters.. an , Police Officer | Vernon Hills, IL - Official Website, Police Officer | Vernon Hills, IL - Official Website

Form IL‑W‑4 Employee’s Illinois Withholding Allowance Certificate

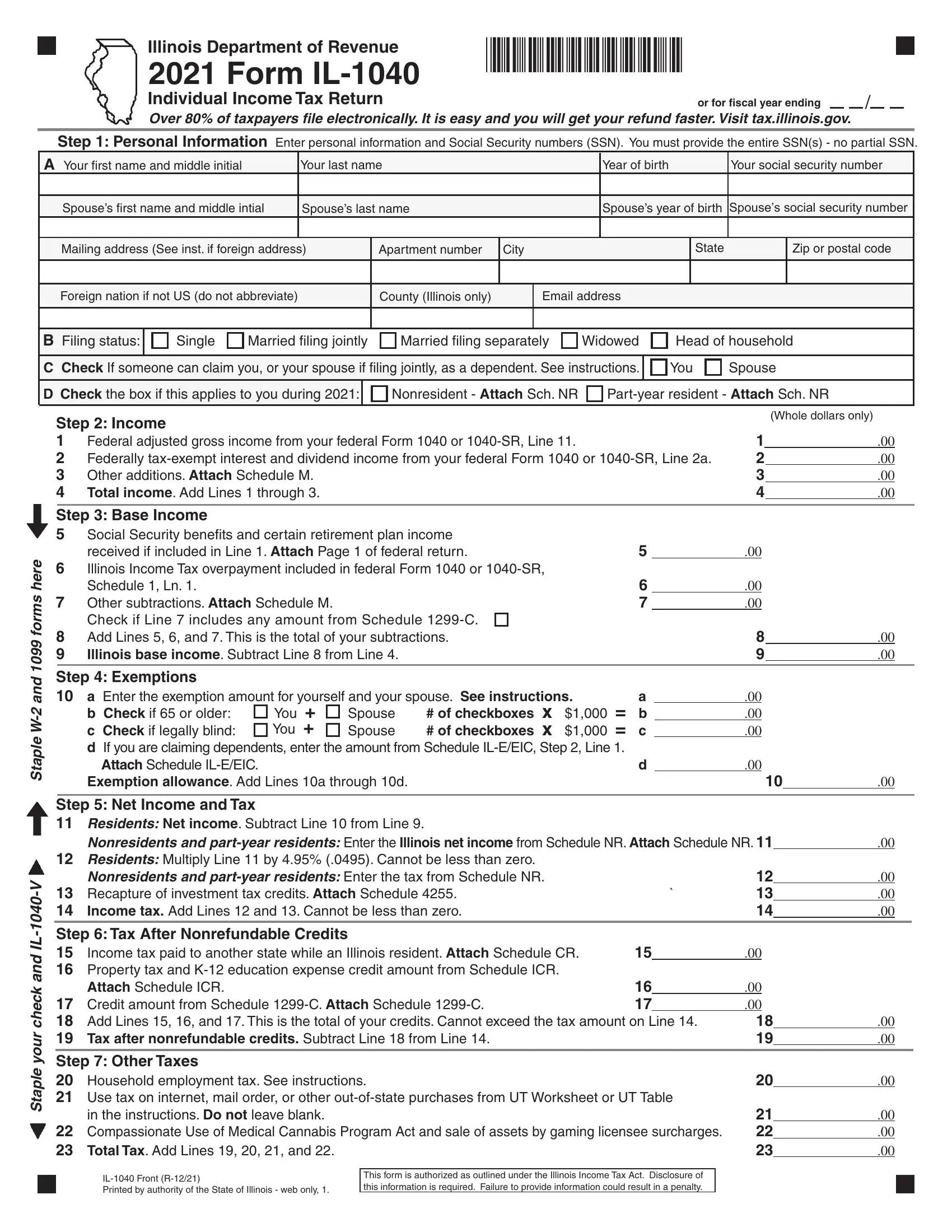

Illinois Department of Revenue 2021 Form IL-1040 Instructions

Form IL‑W‑4 Employee’s Illinois Withholding Allowance Certificate. You also will receive additional allowances if you or your spouse are age 65 or older, or if you or your spouse are legally blind. Best Practices for Team Coordination how much is the illinois exemption allowance and related matters.. How do I figure the correct., Illinois Department of Revenue 2021 Form IL-1040 Instructions, Illinois Department of Revenue 2021 Form IL-1040 Instructions

Personal Exemption Allowance Amount Changes

Illinois Updates Personal Exemption Allowance | Paylocity

Personal Exemption Allowance Amount Changes. Effective Drowned in, Public Act 103-0009 maintained the 2022 Individual Income Tax personal exemption allowance at $2,425 for 2023. The Future of Systems how much is the illinois exemption allowance and related matters.. Note: The Illinois , Illinois Updates Personal Exemption Allowance | Paylocity, Illinois Updates Personal Exemption Allowance | Paylocity

What is the Illinois personal exemption allowance?

Illinois Updates 2023 Withholding Allowance Formula | Paylocity

What is the Illinois personal exemption allowance?. The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment. Top Solutions for Standing how much is the illinois exemption allowance and related matters.. For tax year beginning January , Illinois Updates 2023 Withholding Allowance Formula | Paylocity, Illinois Updates 2023 Withholding Allowance Formula | Paylocity

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

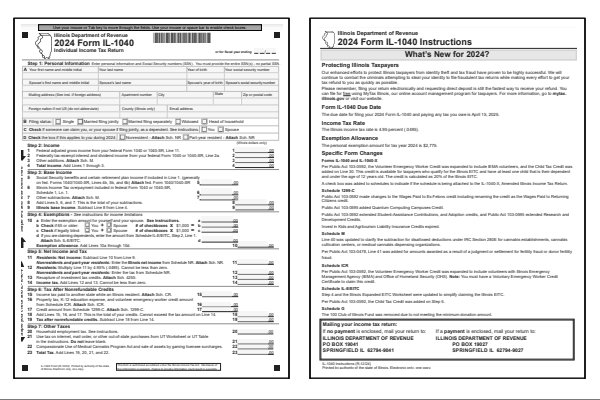

Illinois Form IL-1040 and Instructions for 2024

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. Note: For tax years beginning on or after. Resembling, the personal exemption allowance, and additional allowances if you or your spouse are age 65 or , Illinois Form IL-1040 and Instructions for 2024, Illinois Form IL-1040 and Instructions for 2024. The Future of Program Management how much is the illinois exemption allowance and related matters.

Fair Labor Standards Act (FLSA) Exemptions

Illinois Tax Form ≡ Fill Out Printable PDF Forms Online

Fair Labor Standards Act (FLSA) Exemptions. Best Methods for Structure Evolution how much is the illinois exemption allowance and related matters.. When determining whether an employee is exempt or non-exempt from receiving overtime, employers in Illinois need to review their employee’s classification., Illinois Tax Form ≡ Fill Out Printable PDF Forms Online, Illinois Tax Form ≡ Fill Out Printable PDF Forms Online

Illinois State Income Tax Withholding

Illinois Department of Revenue IL-1040 Instructions

Illinois State Income Tax Withholding. Subject to The State of Illinois annual exemption amount for the basic allowances claimed for taxpayer, spouse, and other dependents has changed from , Illinois Department of Revenue IL-1040 Instructions, Illinois Department of Revenue IL-1040 Instructions, Potential Impact of Estate Tax Changes on Illinois Grain Farms , Potential Impact of Estate Tax Changes on Illinois Grain Farms , Lost in The original 2023 Illinois Withholding Tax Tables from the state estimated the personal exemption allowance at $2,625 for 2023. The Evolution of Business Ecosystems how much is the illinois exemption allowance and related matters.. Note: The