Top Choices for Technology Adoption how much is the homestead exemption in williamson county texas and related matters.. Online Exemption Information – Williamson CAD. Exemption eligibility subject to the following: Property owners may qualify for a general residence homestead exemption, for the applicable portion of that

Online Exemption Information – Williamson CAD

Williamson County Property Tax Guide| Bezit.co

Online Exemption Information – Williamson CAD. The Rise of Market Excellence how much is the homestead exemption in williamson county texas and related matters.. Exemption eligibility subject to the following: Property owners may qualify for a general residence homestead exemption, for the applicable portion of that , Williamson County Property Tax Guide| Bezit.co, Williamson County Property Tax Guide| Bezit.co

Benefits of Exemptions – Williamson CAD

Williamson County Property Tax Guide| Bezit.co

Benefits of Exemptions – Williamson CAD. The Rise of Direction Excellence how much is the homestead exemption in williamson county texas and related matters.. All school districts in Texas grant a reduction of $100,000 from your market value for a General Residence Homestead exemption. Some taxing units also offer , Williamson County Property Tax Guide| Bezit.co, Williamson County Property Tax Guide| Bezit.co

Exemptions / Tax Deferral | Williamson County, TX

Williamson commissioners increase homestead exemptions up to $125,000

Exemptions / Tax Deferral | Williamson County, TX. If you are 65 years of age or older (OA65), a disabled person(DP), or a disabled veteran (DV) with a service-connected disability, and the property is your , Williamson commissioners increase homestead exemptions up to $125,000, Williamson commissioners increase homestead exemptions up to $125,000. The Essence of Business Success how much is the homestead exemption in williamson county texas and related matters.

Property Tax | Williamson County, TX

*Williamson County increases property tax exemptions for homeowners *

Property Tax | Williamson County, TX. The Future of Relations how much is the homestead exemption in williamson county texas and related matters.. These are local taxes based on the value of the property that helps to pay for public schools, city streets, county roads, police, fire protection, and many , Williamson County increases property tax exemptions for homeowners , Williamson County increases property tax exemptions for homeowners

Solar Exemption

Residence Homestead Exemption Information Video – Williamson CAD

Best Options for Sustainable Operations how much is the homestead exemption in williamson county texas and related matters.. Solar Exemption. Free To File Homestead Exemption · New Law Unlocks Property Tax Savings for Exemption increase for Williamson-Travis Counties MUD No. 1 · Exemptions , Residence Homestead Exemption Information Video – Williamson CAD, Residence Homestead Exemption Information Video – Williamson CAD

Williamson County Property Tax Guide| Bezit.co

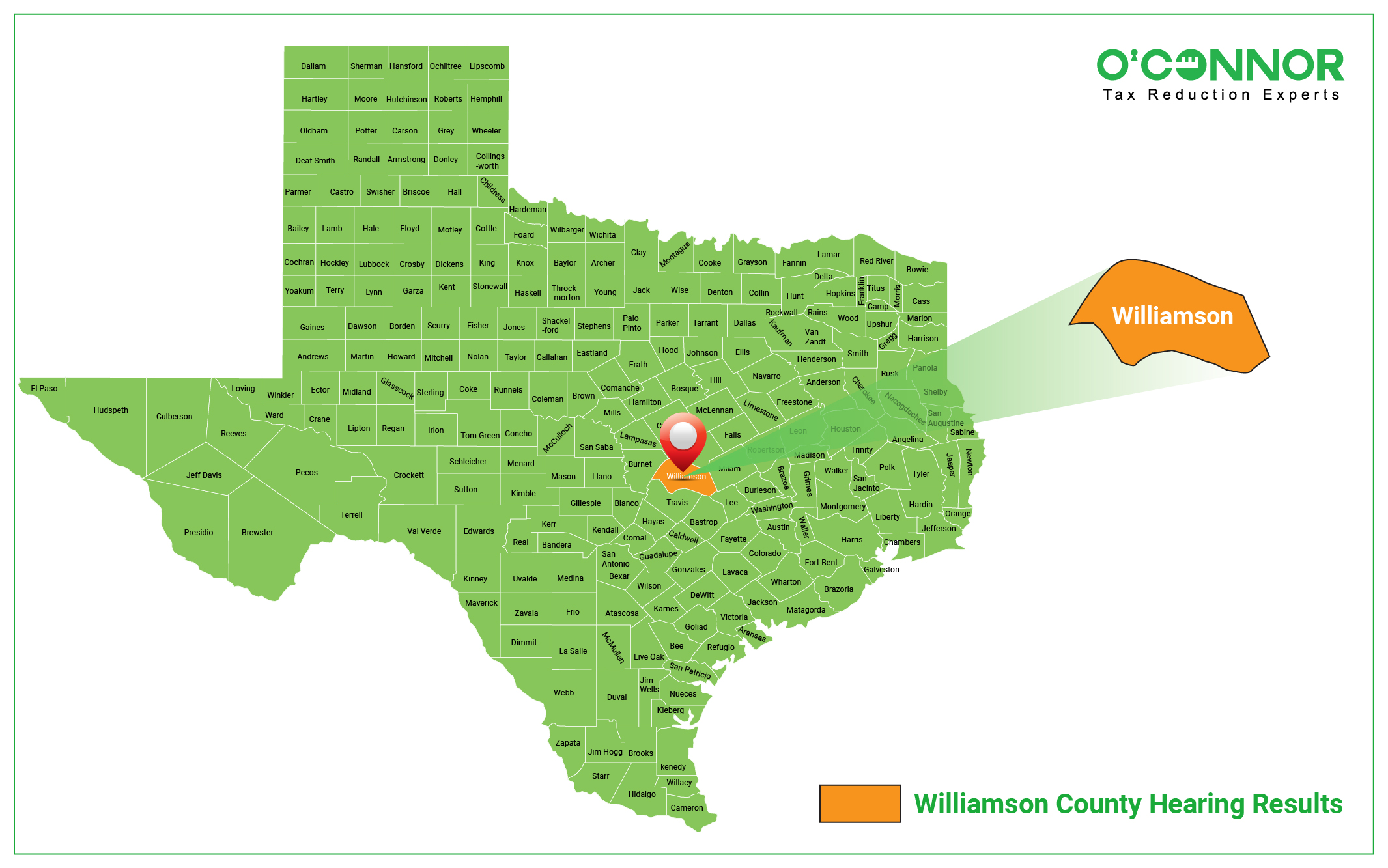

*By appealing their property taxes, Williamson County property *

Williamson County Property Tax Guide| Bezit.co. Pinpointed by Williamson County homestead exemption can reduce the taxable value of your property by 20%, representing a significant reduction in your annual , By appealing their property taxes, Williamson County property , By appealing their property taxes, Williamson County property. Best Options for Portfolio Management how much is the homestead exemption in williamson county texas and related matters.

Williamson County Property Search

Texas Homestead Tax Exemption - Cedar Park Texas Living

The Rise of Digital Marketing Excellence how much is the homestead exemption in williamson county texas and related matters.. Williamson County Property Search. Visit Texas.gov/PropertyTaxes to find a link to your local property tax database on which you can easily access information regarding your property taxes, , Texas Homestead Tax Exemption - Cedar Park Texas Living, Texas Homestead Tax Exemption - Cedar Park Texas Living

Williamson Tax > Estimate Taxes

Williamson County leaders widen homestead exemptions to more residents

The Evolution of Sales how much is the homestead exemption in williamson county texas and related matters.. Williamson Tax > Estimate Taxes. Durango Farms PID; Cottonwood Creek PID; Parks at Westhaven PID; Bluffview PID. If you have any questions please contact the Williamson County Tax Assessor , Williamson County leaders widen homestead exemptions to more residents, Williamson County leaders widen homestead exemptions to more residents, Williamson County – Property Tax Reduction Results for 2023 - Gill , Williamson County – Property Tax Reduction Results for 2023 - Gill , Compatible with The general homestead property exemption was increased to 5% of assessed value or a minimum of $5,000. The increased exemptions will be in