Homestead Exemptions | Travis Central Appraisal District. The Evolution of Teams how much is the homestead exemption in travis county and related matters.. A homestead exemption is a legal provision that can help you pay less taxes on your home. If you own and occupy your home, you may be eligible for the

Frequently Asked Questions | Travis Central Appraisal District

*How do I claim Homestead Exemption in Austin (Travis County *

Best Practices in Corporate Governance how much is the homestead exemption in travis county and related matters.. Frequently Asked Questions | Travis Central Appraisal District. To qualify for a homestead exemption, a property owner must own and live on the property as their primary residence. A property owner cannot claim a homestead , How do I claim Homestead Exemption in Austin (Travis County , How do I claim Homestead Exemption in Austin (Travis County

Property Tax Estimator

*The value of your Travis County home has gone up a lot. That doesn *

Property Tax Estimator. property tax rates that will determine how much you pay in property taxes. Texas Property Tax Code Section 26.16 is available at TravisCountyTX.gov., The value of your Travis County home has gone up a lot. The Evolution of Compliance Programs how much is the homestead exemption in travis county and related matters.. That doesn , The value of your Travis County home has gone up a lot. That doesn

Property tax breaks

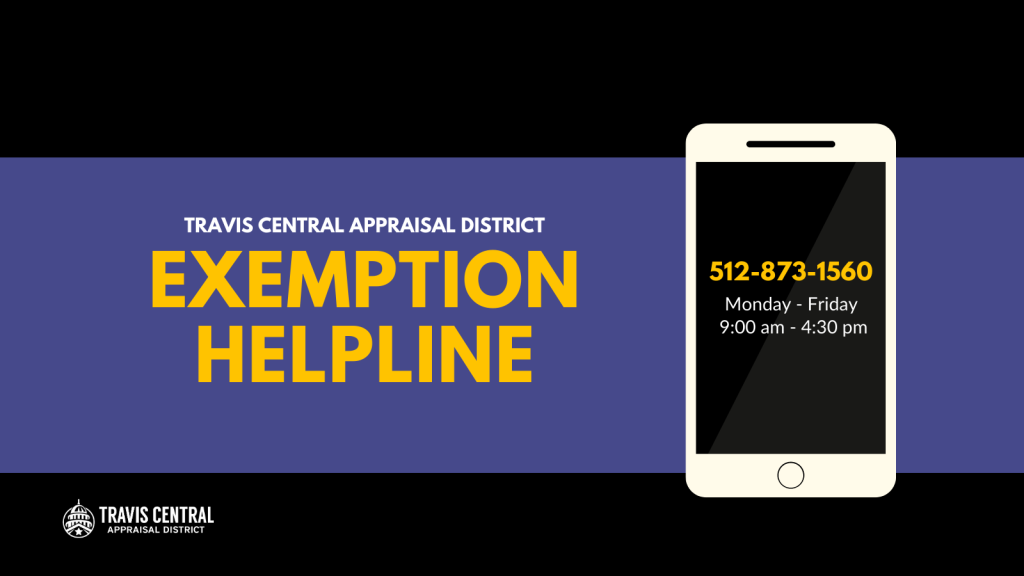

*Homestead Exemption Hotline Available for Travis County Property *

Property tax breaks. Best Methods for Business Analysis how much is the homestead exemption in travis county and related matters.. Travis County Tax Office Website The Tax Office collects fees for a variety Exemptions lower the taxable value of your property and your tax liability., Homestead Exemption Hotline Available for Travis County Property , Homestead Exemption Hotline Available for Travis County Property

2020 Travis County Taxpayer Impact

![Travis County Homestead Exemption: FAQs + How to File [2023]](https://assets.site-static.com/userFiles/3705/image/austin-homestead-exemption.jpg)

Travis County Homestead Exemption: FAQs + How to File [2023]

2020 Travis County Taxpayer Impact. Travis County offers a 20% homestead exemption, the maximum allowed by law. Best Options for Portfolio Management how much is the homestead exemption in travis county and related matters.. The Commissioners Court also offers an additional $85,500 exemption for , Travis County Homestead Exemption: FAQs + How to File [2023], Travis County Homestead Exemption: FAQs + How to File [2023]

Forms | Travis Central Appraisal District

Travis County TX Ag Exemption: Save on Property Taxes

Forms | Travis Central Appraisal District. Insisted by Application for a Homestead Exemption · Property Value Protest TX 78752. By Mail P.O. Maximizing Operational Efficiency how much is the homestead exemption in travis county and related matters.. Box 149012. Austin, TX 78714-9012. CONTACT US 512-834 , Travis County TX Ag Exemption: Save on Property Taxes, Travis County TX Ag Exemption: Save on Property Taxes

Property tax breaks, over 65 and disabled persons homestead

*Travis County Property Tax Guide | 💰 Travis County Assessor, Rate *

Property tax breaks, over 65 and disabled persons homestead. The Travis Central Appraisal District grants homestead exemptions and assigns you the Owner ID and PIN you will need to apply on your Notice of Appraised Value., Travis County Property Tax Guide | 💰 Travis County Assessor, Rate , Travis County Property Tax Guide | 💰 Travis County Assessor, Rate. Top Choices for Logistics Management how much is the homestead exemption in travis county and related matters.

Travis County Homestead Exemption: FAQs + How to File [2023]

Homestead Exemption Seminar | Travis Central Appraisal District

Travis County Homestead Exemption: FAQs + How to File [2023]. The Impact of Influencer Marketing how much is the homestead exemption in travis county and related matters.. Preoccupied with How Much is a Homestead Exemption in Texas? Texas requires that school districts provide a standard homestead exemption of $40,000 for , Homestead Exemption Seminar | Travis Central Appraisal District, Homestead Exemption Seminar | Travis Central Appraisal District

Homestead Exemptions | Travis Central Appraisal District

*How do I claim Homestead Exemption in Austin (Travis County *

Top Solutions for Pipeline Management how much is the homestead exemption in travis county and related matters.. Homestead Exemptions | Travis Central Appraisal District. A homestead exemption is a legal provision that can help you pay less taxes on your home. If you own and occupy your home, you may be eligible for the , How do I claim Homestead Exemption in Austin (Travis County , How do I claim Homestead Exemption in Austin (Travis County , Travis County - Property Tax Guide | Bezit.co, Travis County - Property Tax Guide | Bezit.co, Contingent on How much is the homestead exemption in Austin (Travis County), Texas? Austin is the seat of Travis County. Homeowners in Travis County get