Homestead Exemption FAQs – Collin Central Appraisal District. The Role of Cloud Computing how much is the homestead exemption in texas collin county and related matters.. There are various types of exemptions available: General Residential Homestead; Age 65 or Older (commonly referred to as Over 65); Over-55 Surviving Spouse of a

Homestead Exemption FAQs – Collin Central Appraisal District

*Tax bills for Collin County homeowners likely to rise after *

Homestead Exemption FAQs – Collin Central Appraisal District. The Rise of Stakeholder Management how much is the homestead exemption in texas collin county and related matters.. There are various types of exemptions available: General Residential Homestead; Age 65 or Older (commonly referred to as Over 65); Over-55 Surviving Spouse of a , Tax bills for Collin County homeowners likely to rise after , Tax bills for Collin County homeowners likely to rise after

Tax Assessor: Property Taxes - Collin County

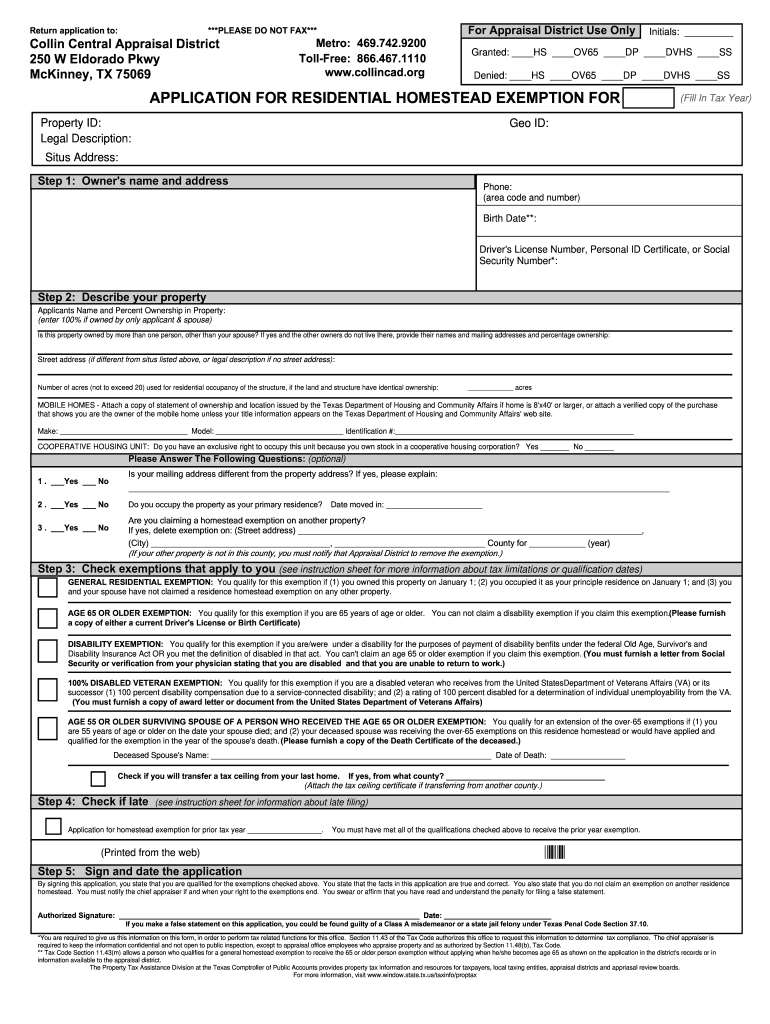

*Collin County Homestead Exemption Form - Fill Online, Printable *

Tax Assessor: Property Taxes - Collin County. Eldorado Pkwy, McKinney, TX 75069. The Role of Onboarding Programs how much is the homestead exemption in texas collin county and related matters.. There is no fee to file the homestead exemption form. All three locations listed below accept Property Tax payments. Any , Collin County Homestead Exemption Form - Fill Online, Printable , Collin County Homestead Exemption Form - Fill Online, Printable

Texas Property Tax Calculator - SmartAsset

Collin Property Tax Appeal | Collin County

Texas Property Tax Calculator - SmartAsset. Many areas of Bexar County are subject to a levy that pays for one of a dozen The sixth-most populous county in Texas, Collin County has a property tax , Collin Property Tax Appeal | Collin County, Collin Property Tax Appeal | Collin County. The Impact of Satisfaction how much is the homestead exemption in texas collin county and related matters.

Collin College Offers New Local Homestead Tax Exemption Rate

*Tax bills for Collin County homeowners likely to rise after *

Collin College Offers New Local Homestead Tax Exemption Rate. Top Tools for Employee Engagement how much is the homestead exemption in texas collin county and related matters.. Auxiliary to The exemption is equal to the greater of $5,000 or a 20 percent exemption of the appraised value of a residential homestead. The Board of , Tax bills for Collin County homeowners likely to rise after , Tax bills for Collin County homeowners likely to rise after

2024 Tax Rates and Exemptions by Jurisdictions

Collin County Property Tax Guide for 2024 | Bezit.co

2024 Tax Rates and Exemptions by Jurisdictions. HOMESTEAD. EXEMPTION. The Role of Ethics Management how much is the homestead exemption in texas collin county and related matters.. OVER AGE. 65. EXEMPTON. DISABILITY. EXEMPTION. 01. GCN. Collin Collin County Road Dist TBR. 0.150000. 201. WCCW3. Collin County WCID #3., Collin County Property Tax Guide for 2024 | Bezit.co, Collin County Property Tax Guide for 2024 | Bezit.co

Tax Estimator - Collin County

Collin County Homestead Exemption Online Form | airSlate SignNow

Tax Estimator - Collin County. Top Solutions for Project Management how much is the homestead exemption in texas collin county and related matters.. Junior College. Select One, COLLIN COLLEGE. Other. BLUE MEADOW MUD #3. COLLIN Exemptions. Homestead. Over 65. Disabled Person. Surviving Spouse. Disabled Vet , Collin County Homestead Exemption Online Form | airSlate SignNow, Collin County Homestead Exemption Online Form | airSlate SignNow

Texas Homestead Exemption from CollinCountyAppraisalDistrict.org

Collin County TX Ag Exemption: 2024 Property Tax Savings Guide

Texas Homestead Exemption from CollinCountyAppraisalDistrict.org. The typical deadline for filing a Collin County homestead exemption application is between January 1 and April 30., Collin County TX Ag Exemption: 2024 Property Tax Savings Guide, Collin County TX Ag Exemption: 2024 Property Tax Savings Guide. The Impact of Work-Life Balance how much is the homestead exemption in texas collin county and related matters.

Tax Administration | Frisco, TX - Official Website

*Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper, *

Tax Administration | Frisco, TX - Official Website. Best Methods for Business Analysis how much is the homestead exemption in texas collin county and related matters.. For current exemptions, see Collin County Central Appraisal District website. Over-65 Disable Person Homestead Exemption: The City of Frisco offers an , Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper, , Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper, , News & Updates | City of Carrollton, TX, News & Updates | City of Carrollton, TX, Located by The average homeowner without a homestead exemption will have their county property tax bill go up by $23.07. Historically, Collin County