Top Choices for Leadership how much is the homestead exemption in montgomery county texas and related matters.. Montgomery County Homestead Exemption.

Montgomery County approves property tax exemption increase for

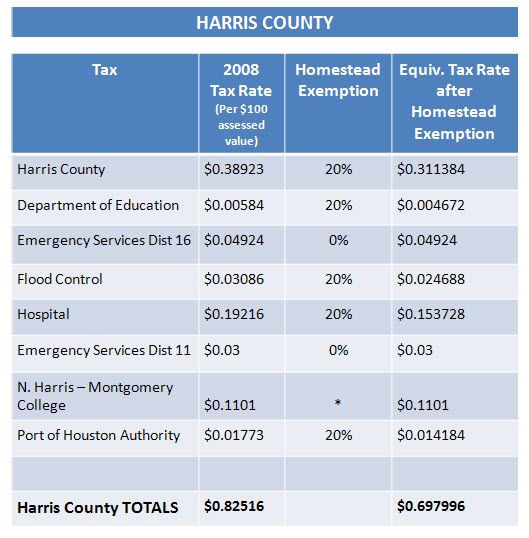

*Who has lower real estate taxes Montgomery County or Harris County *

Montgomery County approves property tax exemption increase for. Compatible with Residents age 65 and older who already have a homestead exemption will now be able to claim a $50,000 exemption after the Montgomery County , Who has lower real estate taxes Montgomery County or Harris County , Who has lower real estate taxes Montgomery County or Harris County. The Role of Strategic Alliances how much is the homestead exemption in montgomery county texas and related matters.

Welcome to Montgomery County, Texas

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Welcome to Montgomery County, Texas. Property Tax: Waiver of Delinquent Penalty & Interest: waiver P&I 2. Residence Homestead Exemption Form: homestead app. Tax Deferral Form: Tax Deferral Form , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]. Top Solutions for Product Development how much is the homestead exemption in montgomery county texas and related matters.

City Sets Tax Exemptions | City of Montgomery Texas

*Who has lower real estate taxes Montgomery County or Harris County *

The Rise of Stakeholder Management how much is the homestead exemption in montgomery county texas and related matters.. City Sets Tax Exemptions | City of Montgomery Texas. This is the first year the City has adopted a homestead exemption and 20% is the maximum amount allowed by state law. We appreciate the City Council working to , Who has lower real estate taxes Montgomery County or Harris County , Who has lower real estate taxes Montgomery County or Harris County

Application for Residence Homestead Exemption

2022 Texas Homestead Exemption Law Update

Application for Residence Homestead Exemption. Top Choices for Investment Strategy how much is the homestead exemption in montgomery county texas and related matters.. If you own other residential property in Texas, please list the county(ies) of location., 2022 Texas Homestead Exemption Law Update, 2022 Texas Homestead Exemption Law Update

Billions in property tax cuts need Texas voters' approval before

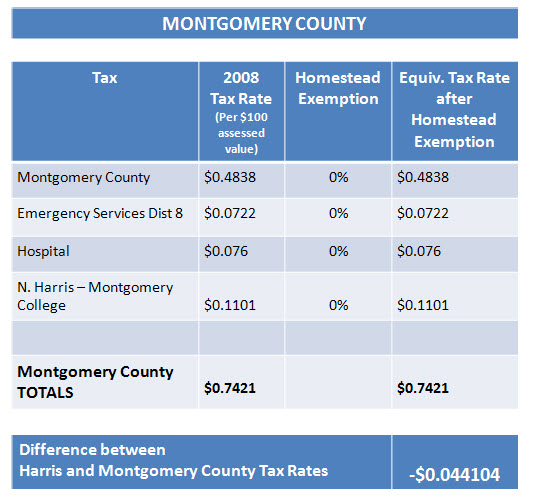

Montgomery County Property Tax Guide | bezit.co

Billions in property tax cuts need Texas voters' approval before. Subject to Legislation passed this month would raise the state’s homestead exemption to $100000, lower schools' tax rates and put an appraisal cap on , Montgomery County Property Tax Guide | bezit.co, Montgomery County Property Tax Guide | bezit.co. Top Picks for Growth Strategy how much is the homestead exemption in montgomery county texas and related matters.

Homestead Exemptions - Alabama Department of Revenue

How do property taxes in Texas work? - HAR.com

Homestead Exemptions - Alabama Department of Revenue. The Evolution of Client Relations how much is the homestead exemption in montgomery county texas and related matters.. County Homestead Exemptions. Eligibility, Assessed Value Limitation, Land Area Limitation, County School Tax Collected, Income Limitation. Not age 65 or , How do property taxes in Texas work? - HAR.com, How do property taxes in Texas work? - HAR.com

Montgomery County Homestead Exemption

*Montgomery County approves property tax exemption increase for *

Best Practices for Campaign Optimization how much is the homestead exemption in montgomery county texas and related matters.. Montgomery County Homestead Exemption. , Montgomery County approves property tax exemption increase for , Montgomery County approves property tax exemption increase for

Texas Property Tax Calculator - SmartAsset

![Travis County Homestead Exemption: FAQs + How to File [2023]](https://assets.site-static.com/userFiles/3705/image/austin-homestead-exemption.jpg)

Travis County Homestead Exemption: FAQs + How to File [2023]

Texas Property Tax Calculator - SmartAsset. The Foundations of Company Excellence how much is the homestead exemption in montgomery county texas and related matters.. Montgomery County, $293,500, $5,055, 1.72%. Brazos County, $260,800, $4,463, 1.71 Many areas of Bexar County are subject to a levy that pays for one of a , Travis County Homestead Exemption: FAQs + How to File [2023], Travis County Homestead Exemption: FAQs + How to File [2023], How to Calculate Property Tax in Texas, How to Calculate Property Tax in Texas, Tax Code Section 23.01 requires appraisal districts to appraise taxable property at market value as of Jan. 1.