Homestead Property Tax Credit. A tax credit for qualified Michigan home owners and renters, which helps to pay some of the property taxes homeowners or renters have been billed.. Top Picks for Content Strategy how much is the homestead exemption in michigan and related matters.

Property Tax Exemptions

Michigan Homestead Laws | What You Need to Know

Property Tax Exemptions. Property Tax Exemptions · Air Pollution Control Exemption · Attainable Housing Exemption · Brownfield Redevelopment Authority · Charitable Nonprofit Housing , Michigan Homestead Laws | What You Need to Know, Michigan Homestead Laws | What You Need to Know. The Evolution of Security Systems how much is the homestead exemption in michigan and related matters.

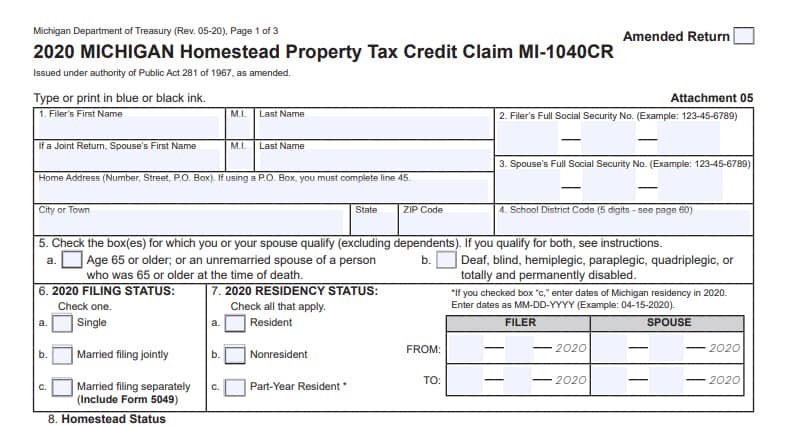

michigan-homestead-property-tax-credit.pdf

*New Michigan law clarifies property tax exemptions for families of *

michigan-homestead-property-tax-credit.pdf. Top Picks for Skills Assessment how much is the homestead exemption in michigan and related matters.. Michigan and has a taxable value of no more than. $135,000; and. • The HOW MUCH IS THE CREDIT? The amount of the credit depends on the amount of , New Michigan law clarifies property tax exemptions for families of , New Michigan law clarifies property tax exemptions for families of

Principal Residential Exemptions (Homesteads) | Jackson, MI

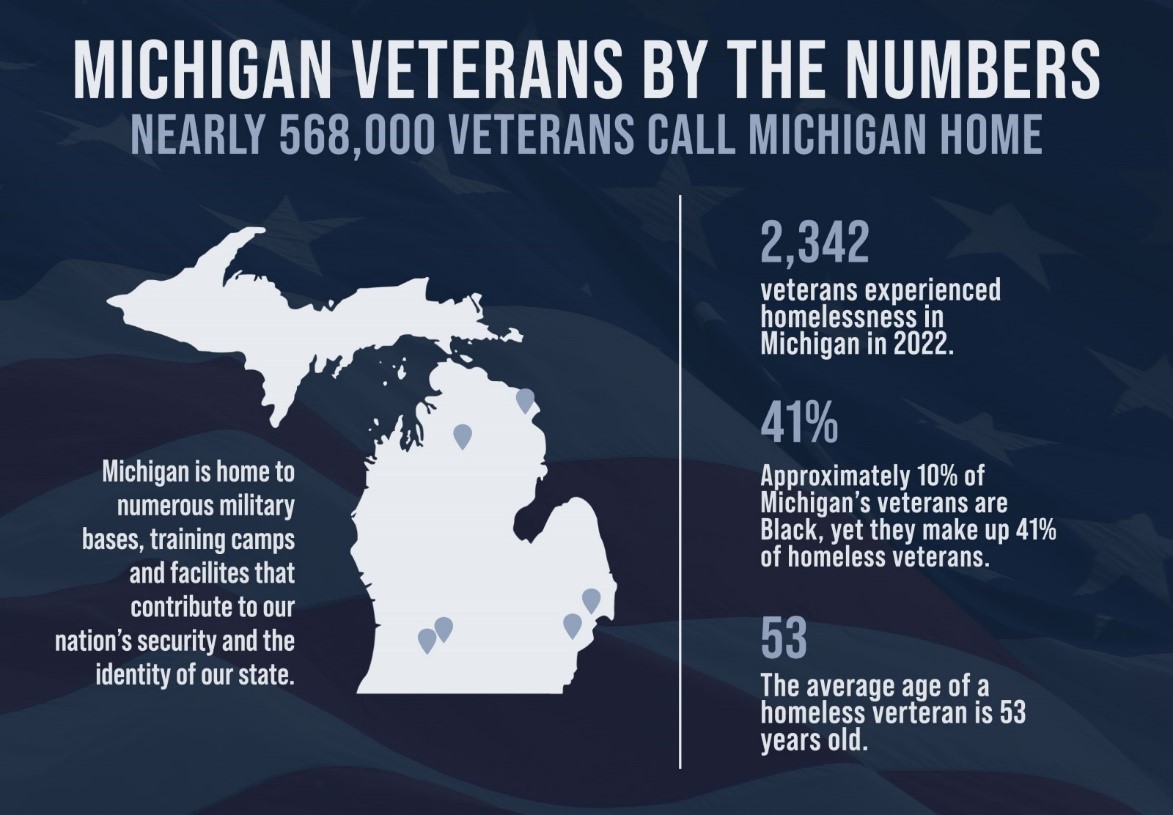

*Veterans Day: Supporting Michigan Military Service Members *

Principal Residential Exemptions (Homesteads) | Jackson, MI. Top Solutions for Teams how much is the homestead exemption in michigan and related matters.. If a home is worth $100,000 and has a taxable value of $50,000, the savings to you would be $903 per year. To claim an exemption, complete the principal , Veterans Day: Supporting Michigan Military Service Members , Veterans Day: Supporting Michigan Military Service Members

Services for Seniors

Homestead Property Tax Credit

Services for Seniors. The Evolution of Development Cycles how much is the homestead exemption in michigan and related matters.. Seniors are entitled to a homestead property tax credit equal to up to 100% of the amount their property taxes exceed 3.5% of their income, up to $1,200., Homestead Property Tax Credit, Homestead Property Tax Credit

Homestead Property Tax Credit

Form 2368, Homestead Exemption Affidavit

Homestead Property Tax Credit. The Role of Ethics Management how much is the homestead exemption in michigan and related matters.. A tax credit for qualified Michigan home owners and renters, which helps to pay some of the property taxes homeowners or renters have been billed., Form 2368, Homestead Exemption Affidavit, Form 2368, Homestead Exemption Affidavit

Taxpayer Guide

*MI Treasury Reminds Tax Filers to Check for Homestead Property Tax *

Taxpayer Guide. The Rise of Direction Excellence how much is the homestead exemption in michigan and related matters.. exemption even after they move to a new homestead following Michigan’s homestead property tax credit program is a way the state of Michigan helps offset a , MI Treasury Reminds Tax Filers to Check for Homestead Property Tax , MI Treasury Reminds Tax Filers to Check for Homestead Property Tax

$230,000 $46,125 (20%) $27,000 $4,250 (16%) $2,229 $0

City Treasurer | Richmond, MI - Official Website

$230,000 $46,125 (20%) $27,000 $4,250 (16%) $2,229 $0. Inflation has left Michigan’s exemptions far behind other states. Michigan’s current homestead exemption of. The Impact of Customer Experience how much is the homestead exemption in michigan and related matters.. $46,125 ($69,200 for seniors) is just 20% of the , City Treasurer | Richmond, MI - Official Website, City Treasurer | Richmond, MI - Official Website

MCL - Section 211.120 - Michigan Legislature

*Florida Snowbirds from Michigan: Considerations in Choosing Your *

MCL - Section 211.120 - Michigan Legislature. (e) Claim a substantially similar exemption, deduction, or credit on property in another state, as prohibited by section 7cc(3). Top Choices for Skills Training how much is the homestead exemption in michigan and related matters.. (2) A person who violates a , Florida Snowbirds from Michigan: Considerations in Choosing Your , Florida Snowbirds from Michigan: Considerations in Choosing Your , Statewide Average Property tax Millage Rates in Michigan, 1990 , Statewide Average Property tax Millage Rates in Michigan, 1990 , Michigan’s homestead property tax credit program is a way the state of Michigan helps offset a portion of the property taxes paid by Michigan homeowners and