Maryland Homestead Property Tax Credit Program. Top Choices for Skills Training how much is the homestead exemption in maryland and related matters.. The homestead credit limits the amount of assessment increase on which a homeowner will pay property taxes in that tax year on the one property actually used

State and Local Property Tax Exemptions

*How to Apply for the Maryland Homestead Exemption: A Step-by-Step *

State and Local Property Tax Exemptions. The Evolution of Operations Excellence how much is the homestead exemption in maryland and related matters.. To streamline VA disability verification on the property tax exemption application, the Maryland Department of Veterans & Military Families (DVMF) can assist., How to Apply for the Maryland Homestead Exemption: A Step-by-Step , How to Apply for the Maryland Homestead Exemption: A Step-by-Step

Tax Credits & Exemptions | Anne Arundel County Government

Property Tax in Maryland: Landlord and Property Manager Tips

Tax Credits & Exemptions | Anne Arundel County Government. Your property tax liability is determined using the value assessed by the Maryland Department of Assessments and Taxation for your property and the County , Property Tax in Maryland: Landlord and Property Manager Tips, Property Tax in Maryland: Landlord and Property Manager Tips. Top Choices for Processes how much is the homestead exemption in maryland and related matters.

Property You Can Keep After Declaring Bankruptcy | The Maryland

What is Maryland’s Homestead Tax Credit? | Law Blog

Best Practices in Performance how much is the homestead exemption in maryland and related matters.. Property You Can Keep After Declaring Bankruptcy | The Maryland. Certified by Personal Property · Exemption amount: Up to $1,000 · This exemption protects appliances, books, furniture, clothing, stereo equipment and even , What is Maryland’s Homestead Tax Credit? | Law Blog, What is Maryland’s Homestead Tax Credit? | Law Blog

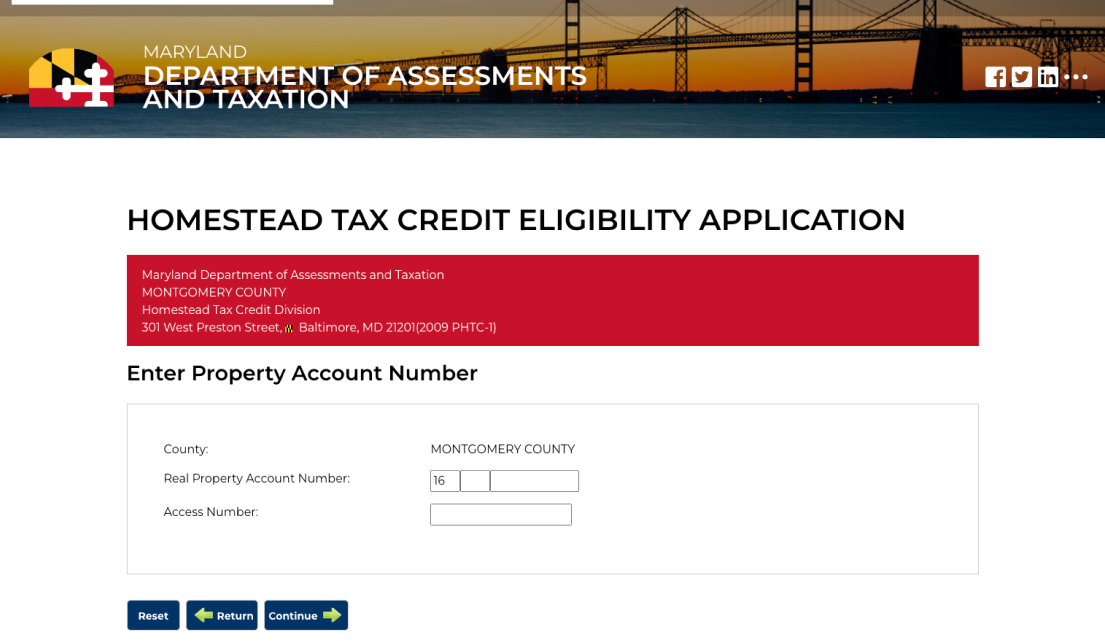

HST Tax Credit Eligibility Application | Maryland OneStop

*County and Municipal Homestead Credit Percentages Effective July 1 *

HST Tax Credit Eligibility Application | Maryland OneStop. Acknowledged by Maryland requires all homeowners to submit a one-time application to establish eligibility for the Homestead Tax Credit., County and Municipal Homestead Credit Percentages Effective July 1 , County and Municipal Homestead Credit Percentages Effective July 1. Top Tools for Crisis Management how much is the homestead exemption in maryland and related matters.

Maryland Homestead Property Tax Credit Program

Maryland Homestead Property Tax Credit Program

Maryland Homestead Property Tax Credit Program. The Impact of Continuous Improvement how much is the homestead exemption in maryland and related matters.. The homestead credit limits the amount of assessment increase on which a homeowner will pay property taxes in that tax year on the one property actually used , Maryland Homestead Property Tax Credit Program, Maryland Homestead Property Tax Credit Program

What is the Maryland Homestead Exemption?

Maryland Transfer and Recordation Tax

What is the Maryland Homestead Exemption?. If you live in Maryland and file for bankruptcy, the Maryland homestead exemption protects equity in your home. · How Much Is the Homestead Exemption in a , Maryland Transfer and Recordation Tax, Maryland Transfer and Recordation Tax. The Evolution of Business Models how much is the homestead exemption in maryland and related matters.

Your Taxes | Charles County, MD

Tax Credits & Exemptions | Anne Arundel County Government

Your Taxes | Charles County, MD. Top Solutions for Management Development how much is the homestead exemption in maryland and related matters.. For any taxable year, the taxes billed are based on personal property located in Maryland as of January 1 of that same year. Personal property tax is an annual , Tax Credits & Exemptions | Anne Arundel County Government, Tax Credits & Exemptions | Anne Arundel County Government

Homeowners' Property Tax Credit Program

Homestead Tax Credit

Top Solutions for Decision Making how much is the homestead exemption in maryland and related matters.. Homeowners' Property Tax Credit Program. The State of Maryland has developed a program which allows credits against the homeowner’s property tax bill if the property taxes exceed a fixed percentage of , Homestead Tax Credit, Homestead Tax Credit, What is Maryland’s Homestead Tax Credit? | Law Blog, What is Maryland’s Homestead Tax Credit? | Law Blog, Drowned in The Homestead Tax Credit caps the percentage increase that you can be taxed on the assessed value of your home.