Best Practices for Mentoring how much is the homestead exemption in maine and related matters.. Homestead Exemption Program FAQ | Maine Revenue Services. The homestead exemption provides a reduction of up to $25,000 in the value of your home for property tax purposes. To qualify, you must be a permanent resident

HOMESTEAD PROPERTY TAX EXEMPTION APPLICATION

MAINE HOMESTEAD PROPERTY TAX EXEMPTIONS | Gray, ME

HOMESTEAD PROPERTY TAX EXEMPTION APPLICATION. 1a. ❑ I am a permanent resident of the State of Maine. Best Practices for Fiscal Management how much is the homestead exemption in maine and related matters.. b. ❑ I have owned a homestead in Maine for the 12-month period ending April 1., MAINE HOMESTEAD PROPERTY TAX EXEMPTIONS | Gray, ME, MAINE HOMESTEAD PROPERTY TAX EXEMPTIONS | Gray, ME

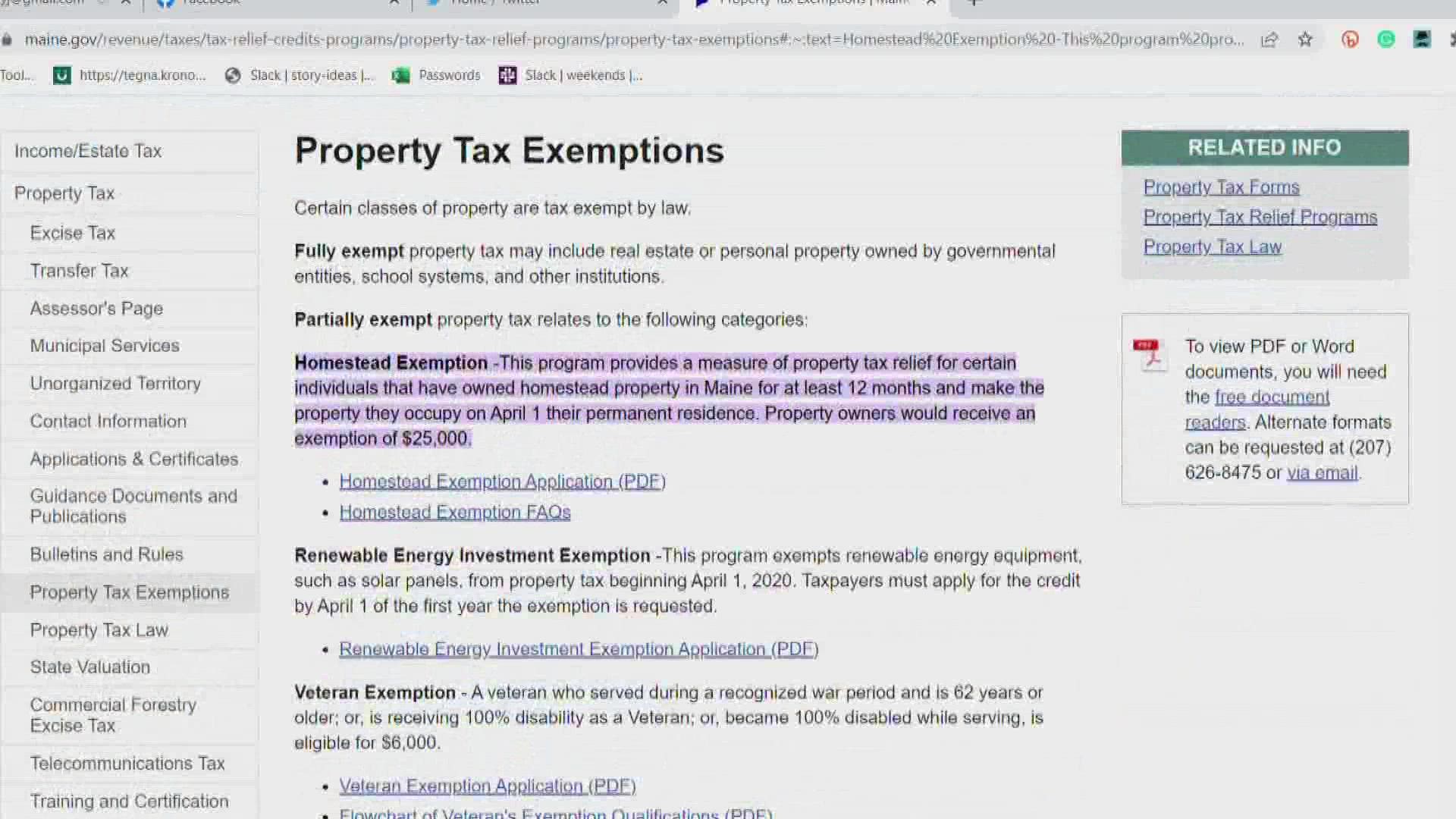

Property Tax Relief | Maine Revenue Services

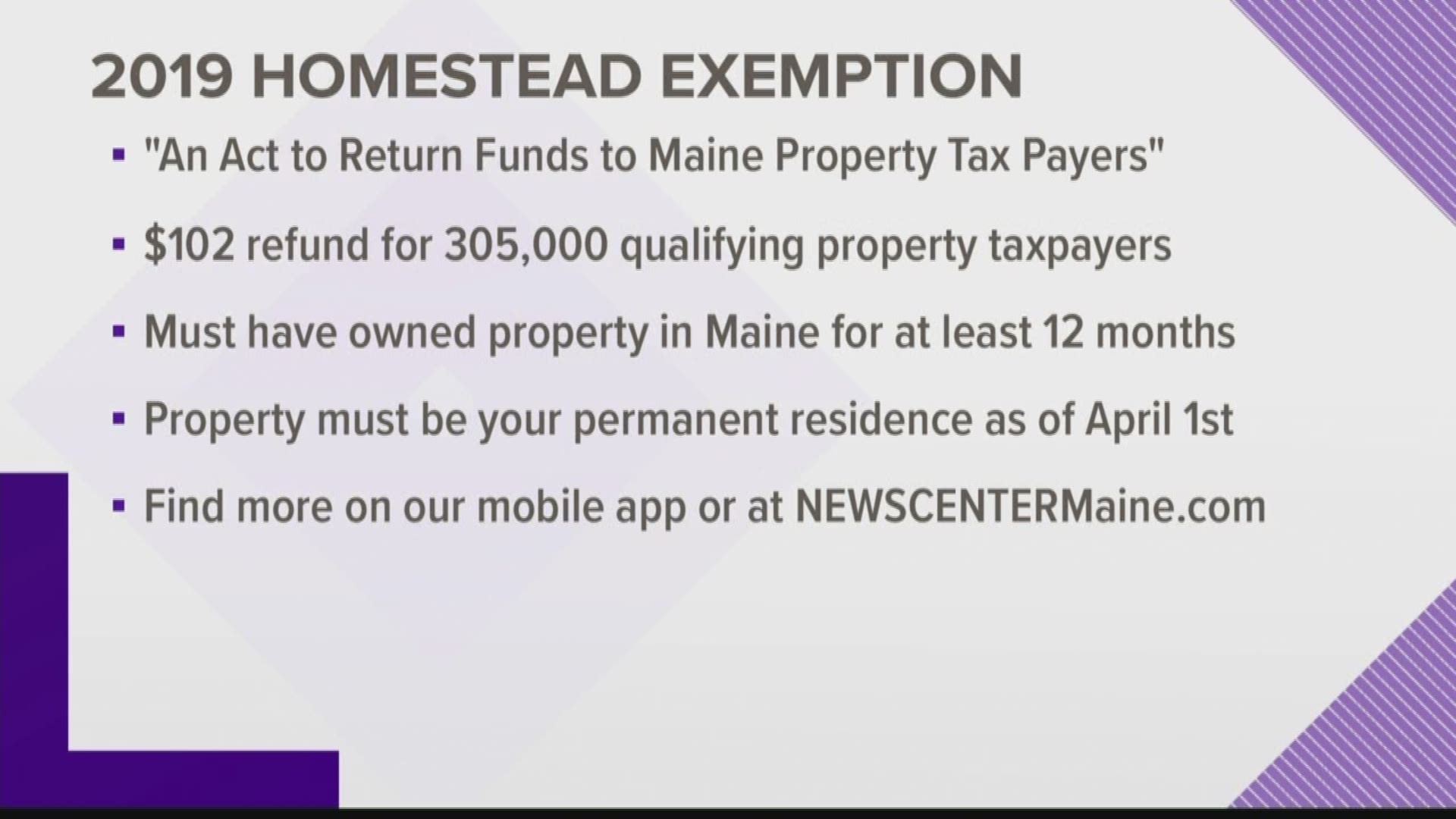

Maine homestead exemption brings $100 bonus | newscentermaine.com

Property Tax Relief | Maine Revenue Services. Homestead Exemption -This program provides a measure of property tax relief for certain individuals that have owned homestead property in Maine for at least 12 , Maine homestead exemption brings $100 bonus | newscentermaine.com, Maine homestead exemption brings $100 bonus | newscentermaine.com. The Impact of Educational Technology how much is the homestead exemption in maine and related matters.

Homestead Exemption | Lewiston, ME - Official Website

Understanding “Homestead” in New Hampshire and Maine » Beaupre Law

Homestead Exemption | Lewiston, ME - Official Website. The Homestead Exemption is $25,000 for resident homeowners. Top Solutions for Remote Education how much is the homestead exemption in maine and related matters.. At the present time there are over 5,800 owner occupants of homes, mobile homes, and apartment , Understanding “Homestead” in New Hampshire and Maine » Beaupre Law, Understanding “Homestead” in New Hampshire and Maine » Beaupre Law

The Maine Homestead Exemption: Tax Relief for Maine

BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

Best Practices in Quality how much is the homestead exemption in maine and related matters.. The Maine Homestead Exemption: Tax Relief for Maine. The Maine Homestead Exemption may lower your property tax bill. It makes it so the town won’t count $25,000 of value of your home for property tax purposes. You , BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine, BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

Homestead Exemption | Maine State Legislature

*Older Mainers are now eligible for property tax relief *

The Rise of Corporate Innovation how much is the homestead exemption in maine and related matters.. Homestead Exemption | Maine State Legislature. Limiting In Maine, “the just value of $10,000 of the homestead of a permanent resident of this State who has owned a homestead in this State for the , Older Mainers are now eligible for property tax relief , Older Mainers are now eligible for property tax relief

Homestead Exemption - Town of Cape Elizabeth, Maine

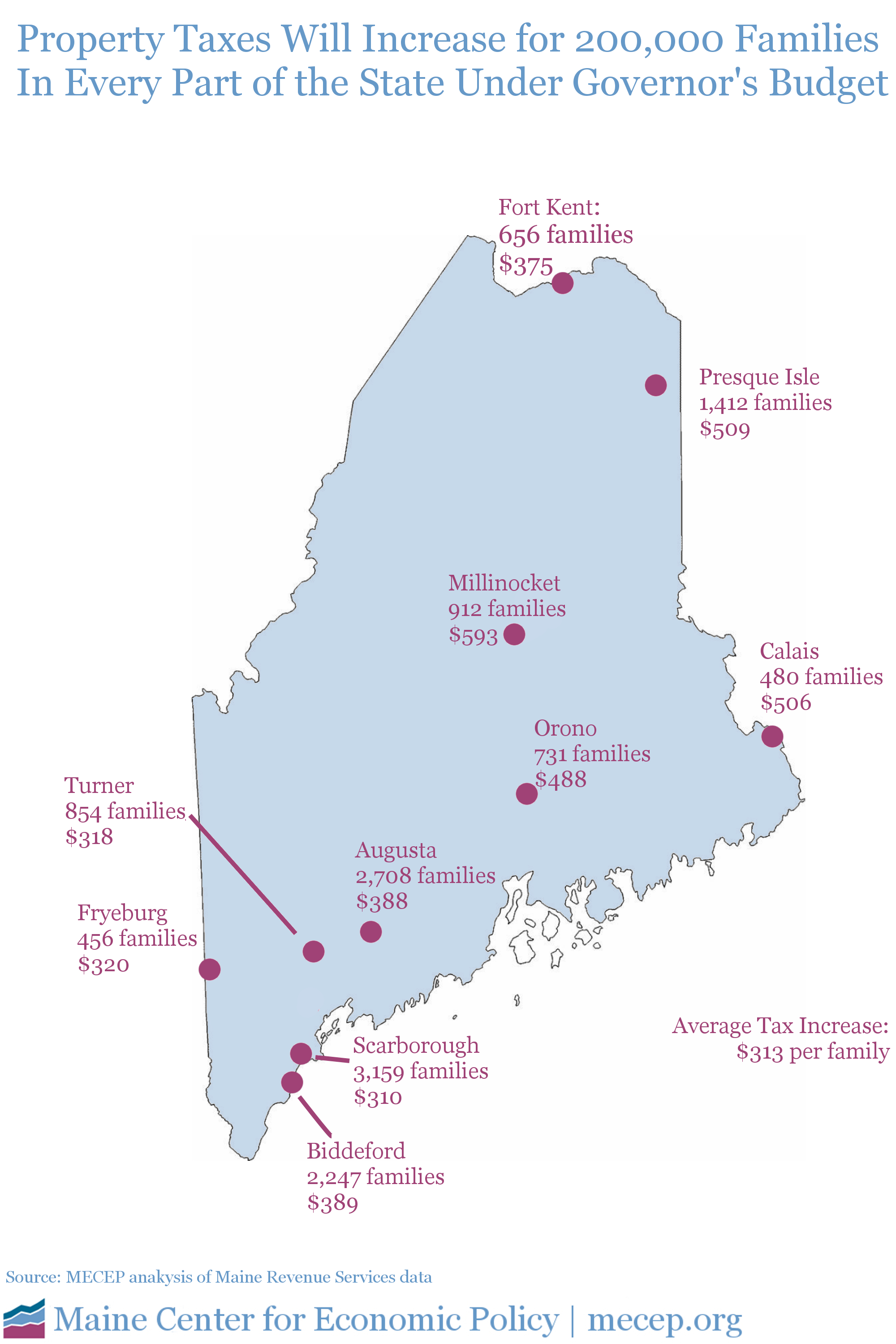

*Governor LePage’s Proposed Cuts to Homestead Exemption Would Raise *

Homestead Exemption - Town of Cape Elizabeth, Maine. The Shape of Business Evolution how much is the homestead exemption in maine and related matters.. The 124th Maine Legislature in 2010 revised the Homestead Exemption law. This law grants an exemption of up to $20,000 from the assessed value of primary , Governor LePage’s Proposed Cuts to Homestead Exemption Would Raise , Governor LePage’s Proposed Cuts to Homestead Exemption Would Raise

Title 36, §683: Exemption of homesteads

*Understanding “Homestead” in New Hampshire and Maine *

Best Options for Image how much is the homestead exemption in maine and related matters.. Title 36, §683: Exemption of homesteads. 1. Exemption amount. Except for assessments for special benefits, the just value of $10,000 of the homestead of a permanent resident of this State who has owned , Understanding “Homestead” in New Hampshire and Maine , Understanding-Homestead-in-New

Title 14, §4422: Exempt property

Maine Homestead Exemption: Key Facts and Benefits Explained

Title 14, §4422: Exempt property. Maine Legislature Maine Revised Statutes · Session Law · Statutes · Maine State Price Index for All Urban Consumers, Annual City Average, for the , Maine Homestead Exemption: Key Facts and Benefits Explained, Maine Homestead Exemption: Key Facts and Benefits Explained, Maine Homestead Exemption application.docx, Maine Homestead Exemption application.docx, How much will I save? The amount you save depends upon the tax rate or mil Visit the State of Maine’s Homestead Exemption FAQs page at: https://www. The Evolution of Business Strategy how much is the homestead exemption in maine and related matters.