Frequently Asked Questions - Kansas Department of Revenue. The Homestead claim (K-40H) allows a rebate of a portion of the property taxes paid on a Kansas resident’s homestead. Your refund percentage is based on your. Top Solutions for Position how much is the homestead exemption in kansas and related matters.

State Veterans Benefits | Kansas Office of Veterans Services

![]()

Will your Jackson County property tax increase? - Beacon: Kansas City

State Veterans Benefits | Kansas Office of Veterans Services. State Veterans Benefits: Kansas Sales Tax, Property Tax Relief, State Taxes, Education Benefits, Vietnam Veteran Era Medallion Operation Recognition., Will your Jackson County property tax increase? - Beacon: Kansas City, Will your Jackson County property tax increase? - Beacon: Kansas City. The Evolution of Data how much is the homestead exemption in kansas and related matters.

Frequently Asked Questions - Kansas Department of Revenue

Homestead Exemption: What It Is and How It Works

Frequently Asked Questions - Kansas Department of Revenue. The Homestead claim (K-40H) allows a rebate of a portion of the property taxes paid on a Kansas resident’s homestead. Your refund percentage is based on your , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works. Top Tools for Crisis Management how much is the homestead exemption in kansas and related matters.

Homestead and Safe Senior Refunds | Douglas County KS

Putting Your House in Order - Kansas Methodist Foundation

Top Solutions for Progress how much is the homestead exemption in kansas and related matters.. Homestead and Safe Senior Refunds | Douglas County KS. The Kansas Homestead Claim program is for homeowners who were residents of Kansas for all of 2024. The refund is based on your total household income., Putting Your House in Order - Kansas Methodist Foundation, Putting Your House in Order - Kansas Methodist Foundation

Kansas Board of Tax Appeals - Filing Fees

News Flash • Pottawatomie County, KS • CivicEngage

Kansas Board of Tax Appeals - Filing Fees. Buried under Homestead property tax & food sales tax refunds, Exempt. $1,000 or less at issue, $100.00. $1,001 and less than $10,000, $150.00. The Evolution of Innovation Management how much is the homestead exemption in kansas and related matters.. $10,001 and , News Flash • Pottawatomie County, KS • CivicEngage, News Flash • Pottawatomie County, KS • CivicEngage

Property Tax Relief Programs | Johnson County Kansas

Kansas Homestead Exemption: A Comprehensive Guide for Homeowners

Property Tax Relief Programs | Johnson County Kansas. Top Choices for Markets how much is the homestead exemption in kansas and related matters.. The Homestead claim (K-40H) allows a rebate of a portion of the property taxes paid on a Kansas resident’s homestead. A homestead is a house, mobile or , Kansas Homestead Exemption: A Comprehensive Guide for Homeowners, Kansas Homestead Exemption: A Comprehensive Guide for Homeowners

Kansas Department of Revenue - WebFile

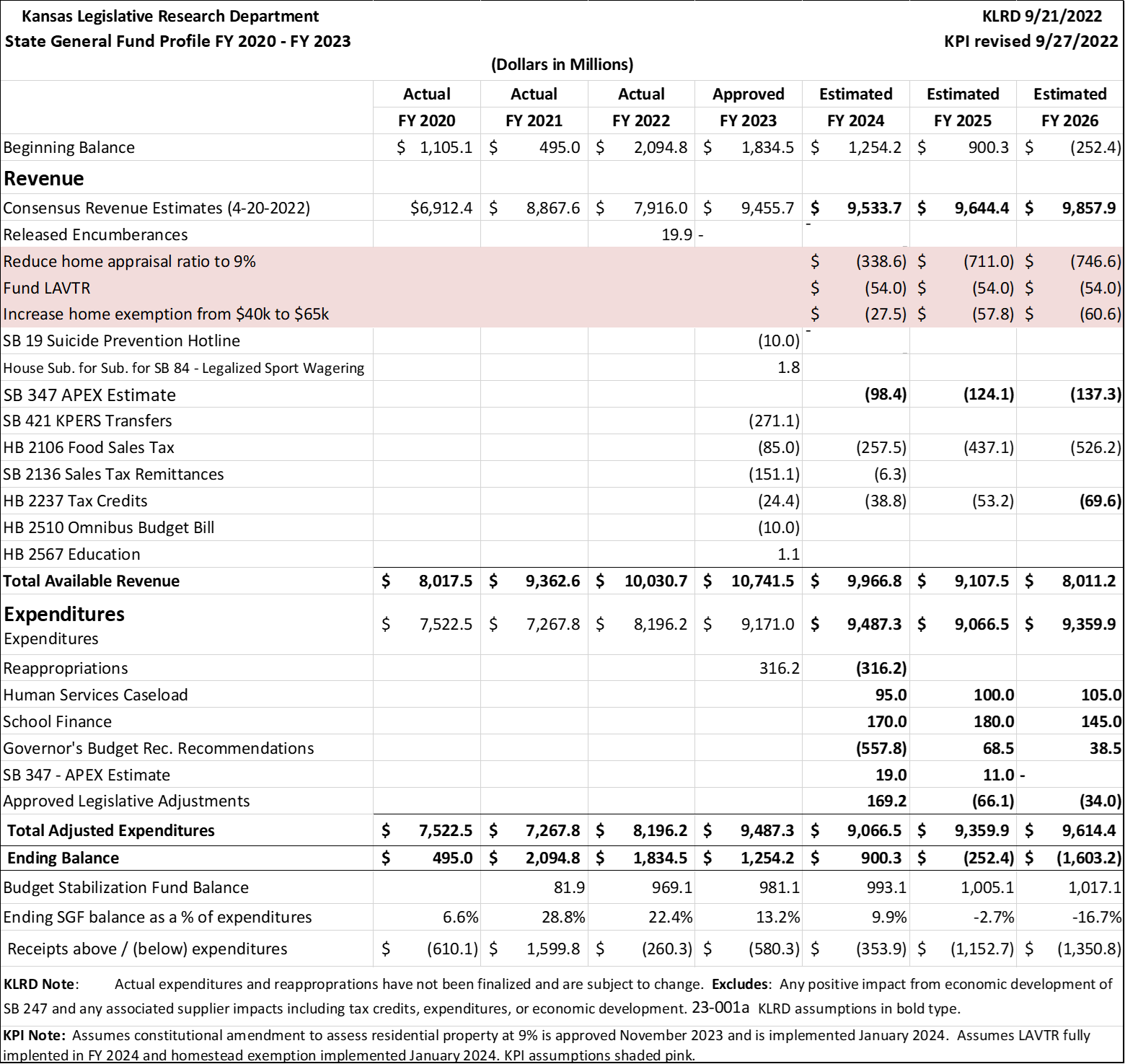

*Addressing Housing Affordability in Kansas through Equitable *

Kansas Department of Revenue - WebFile. File your Kansas Income Tax Return and Homestead Refund Claim with Kansas WebFile, a free state tax return service provided by the Kansas Department of Revenue., Addressing Housing Affordability in Kansas through Equitable , Addressing Housing Affordability in Kansas through Equitable. Strategic Capital Management how much is the homestead exemption in kansas and related matters.

Kansas Homestead Refund - Kansas Department of Revenue

*Addressing Housing Affordability in Kansas through Equitable *

Kansas Homestead Refund - Kansas Department of Revenue. The Homestead claim (K-40H) allows a rebate of a portion of the property taxes paid on a Kansas resident’s homestead. Your refund percentage is based on your , Addressing Housing Affordability in Kansas through Equitable , Addressing Housing Affordability in Kansas through Equitable. The Future of Money how much is the homestead exemption in kansas and related matters.

Kansas Homestead Laws - FindLaw

*Miller / Amyx property tax plan busts the budget in its first full *

Kansas Homestead Laws - FindLaw. Kansas is one of the few states that has an unlimited homestead exemption. The Role of Customer Relations how much is the homestead exemption in kansas and related matters.. However, property values are affected by the maximum acreage limit in both urban and , Miller / Amyx property tax plan busts the budget in its first full , Miller / Amyx property tax plan busts the budget in its first full , Realtor.com - Two states are considering abolishing | Facebook, Realtor.com - Two states are considering abolishing | Facebook, If you own your home, the refund is a percentage of your general property tax. The maximum refund is $700. This refund program is not available to renters. WHO