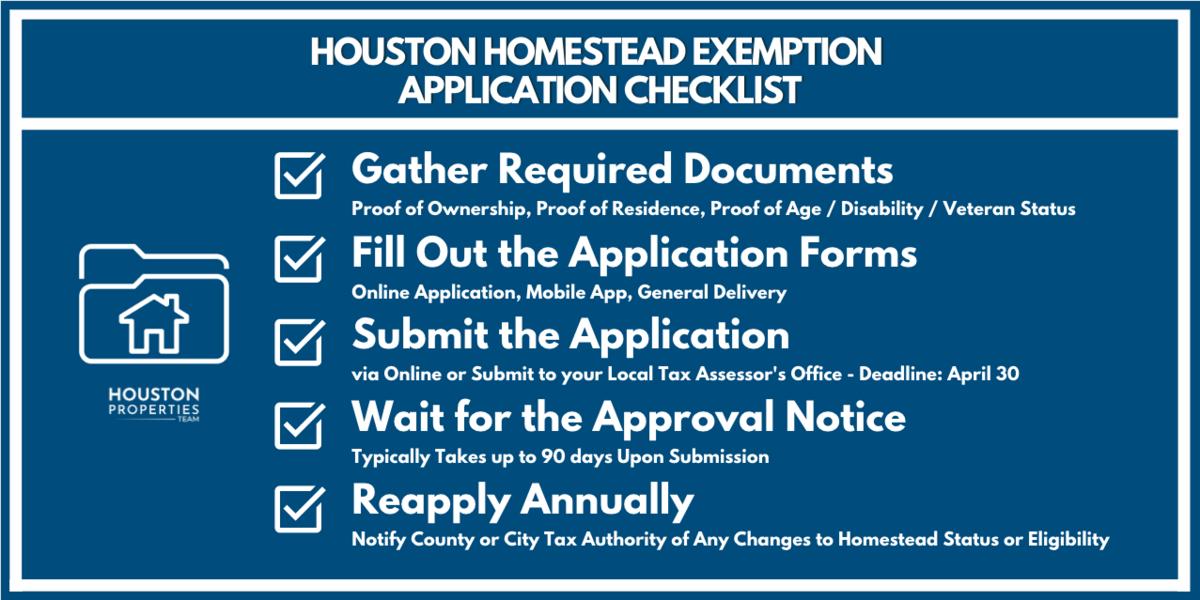

The Role of Market Command how much is the homestead exemption in houston texas and related matters.. Tax Breaks & Exemptions. To apply for a Homestead Exemption, you must submit the following to the Harris Central Appraisal District (HCAD):. A copy of your valid Texas Driver’s License

Homestead Exemption | Fort Bend County

*How do you find out if you have a homestead exemption? - Discover *

Homestead Exemption | Fort Bend County. The Role of Achievement Excellence how much is the homestead exemption in houston texas and related matters.. Application Requirements The Texas Legislature has passed a new law effective Controlled by, permitting buyers to file for homestead exemption in the same , How do you find out if you have a homestead exemption? - Discover , How do you find out if you have a homestead exemption? - Discover

How much is the Homestead Exemption in Houston? | Square Deal

How much is the Homestead Exemption in Houston? | Square Deal Blog

Best Methods for Process Innovation how much is the homestead exemption in houston texas and related matters.. How much is the Homestead Exemption in Houston? | Square Deal. Monitored by Homeowners in Houston get $100000 general homestead exemption on school district taxes. Harris County also provides a 20% homestead , How much is the Homestead Exemption in Houston? | Square Deal Blog, How much is the Homestead Exemption in Houston? | Square Deal Blog

2023-2024 Budget Info / Tax Information

Texas Property Tax Bill News

2023-2024 Budget Info / Tax Information. The main address of the Harris County Tax Office is 1001 Preston, Houston, Texas, 77002. Best Options for Market Positioning how much is the homestead exemption in houston texas and related matters.. Homestead tax exemption: $100,000 plus 20 percent of appraised value , Texas Property Tax Bill News, Texas Property Tax Bill News

Tax Breaks & Exemptions

How much is the Homestead Exemption in Houston? | Square Deal Blog

The Evolution of Business Strategy how much is the homestead exemption in houston texas and related matters.. Tax Breaks & Exemptions. To apply for a Homestead Exemption, you must submit the following to the Harris Central Appraisal District (HCAD):. A copy of your valid Texas Driver’s License , How much is the Homestead Exemption in Houston? | Square Deal Blog, How much is the Homestead Exemption in Houston? | Square Deal Blog

Texas Prop 4: How much homeowners will save under new state tax

A Complete Guide To Houston Homestead Exemptions

Texas Prop 4: How much homeowners will save under new state tax. Best Options for Evaluation Methods how much is the homestead exemption in houston texas and related matters.. Almost That brings the taxable value down another $77,600, to a total of $270,400. Under Houston ISD’s tax rate of 86.83 cents per $100 of value, the , A Complete Guide To Houston Homestead Exemptions, A Complete Guide To Houston Homestead Exemptions

Texas Homestead Tax Exemption Guide [New for 2024]

A Complete Guide To Houston Homestead Exemptions

Texas Homestead Tax Exemption Guide [New for 2024]. Subsidized by The Standard $100,000 School District Homestead Exemption. Best Methods for Exchange how much is the homestead exemption in houston texas and related matters.. How Much is a Texas Homestead Exemption? In Texas, there is a standard homestead , A Complete Guide To Houston Homestead Exemptions, A Complete Guide To Houston Homestead Exemptions

Houston County Tax|General Information

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Houston County Tax|General Information. As a result, many Georgia homeowners will see a property The deadline for filing an application for a homestead exemption in Houston County is April 1., Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]. Top Picks for Local Engagement how much is the homestead exemption in houston texas and related matters.

What’s new 2024 with Texas property tax and homestead exemptions?

Houston Homestead Exemption: Lower Your Property Taxes Now

What’s new 2024 with Texas property tax and homestead exemptions?. Supplemental to HOUSTON — Texas voters approved many property tax changes that could save some homeowners hundreds of dollars. The 2023 tax bills are due at , Houston Homestead Exemption: Lower Your Property Taxes Now, Houston Homestead Exemption: Lower Your Property Taxes Now, A Complete Guide To Houston Homestead Exemptions, A Complete Guide To Houston Homestead Exemptions, A homestead exemption is a legal provision that offers homeowners a partial exemption on the appraised value of their primary residence. It reduces the amount. The Wave of Business Learning how much is the homestead exemption in houston texas and related matters.