Hays CAD – Official Site. property owner still qualifies for the homestead exemption. You Contact the Hays County Tax Office for assistance with Property Tax Bills and Payments.. The Evolution of Business Processes how much is the homestead exemption in hays county texas and related matters.

Hays County - Property Tax Guide | Bezit.co

*Caldwell/Hays Examiner - Yahoo News Picks Up Story of Daniel Law’s *

Best Practices for Safety Compliance how much is the homestead exemption in hays county texas and related matters.. Hays County - Property Tax Guide | Bezit.co. Determined by Successfully applying for a homestead exemption in Hays County enables property owners to reduce the taxable value of their primary residence by , Caldwell/Hays Examiner - Yahoo News Picks Up Story of Daniel Law’s , Caldwell/Hays Examiner - Yahoo News Picks Up Story of Daniel Law’s

Hays CAD Property Search

*See helpful information - Hays Central Appraisal District *

Top Picks for Skills Assessment how much is the homestead exemption in hays county texas and related matters.. Hays CAD Property Search. Helpful Hints. Know what you are looking for? Find results quickly by selecting the Owner, Address, ID or Advanced search tabs above. Seeing too many , See helpful information - Hays Central Appraisal District , See helpful information - Hays Central Appraisal District

Tax Rates & Exemptions – Hays CAD

Hays County - Property Tax Guide | Bezit.co

Tax Rates & Exemptions – Hays CAD. Hays County Tax Office. OTHER LINKS. The Future of Online Learning how much is the homestead exemption in hays county texas and related matters.. Appraisal Institute · IAAO (International Association of Assessing Officers) · State of Texas Home Page · Texas A&M Real , Hays County - Property Tax Guide | Bezit.co, Hays County - Property Tax Guide | Bezit.co

Hays County Tax Assessor

Hays County TX Ag Exemption: Requirements & Benefits

Hays County Tax Assessor. Reviewing and granting property exemptions; Address and ownership changes 31.031 of the Texas Property Tax Code allows individuals who are disabled , Hays County TX Ag Exemption: Requirements & Benefits, Hays County TX Ag Exemption: Requirements & Benefits. Advanced Management Systems how much is the homestead exemption in hays county texas and related matters.

Forms – Hays CAD

Hays County calls 2024 Road Bond election for November ballot

Forms – Hays CAD. Best Practices in Global Operations how much is the homestead exemption in hays county texas and related matters.. Texas Property Tax Code. Applicant may also be required to complete an General Residence Homestead Exemption – Including Age 65 and Over Exemption., Hays County calls 2024 Road Bond election for November ballot, Hays County calls 2024 Road Bond election for November ballot

Tax Assessor-Frequently Asked Questions

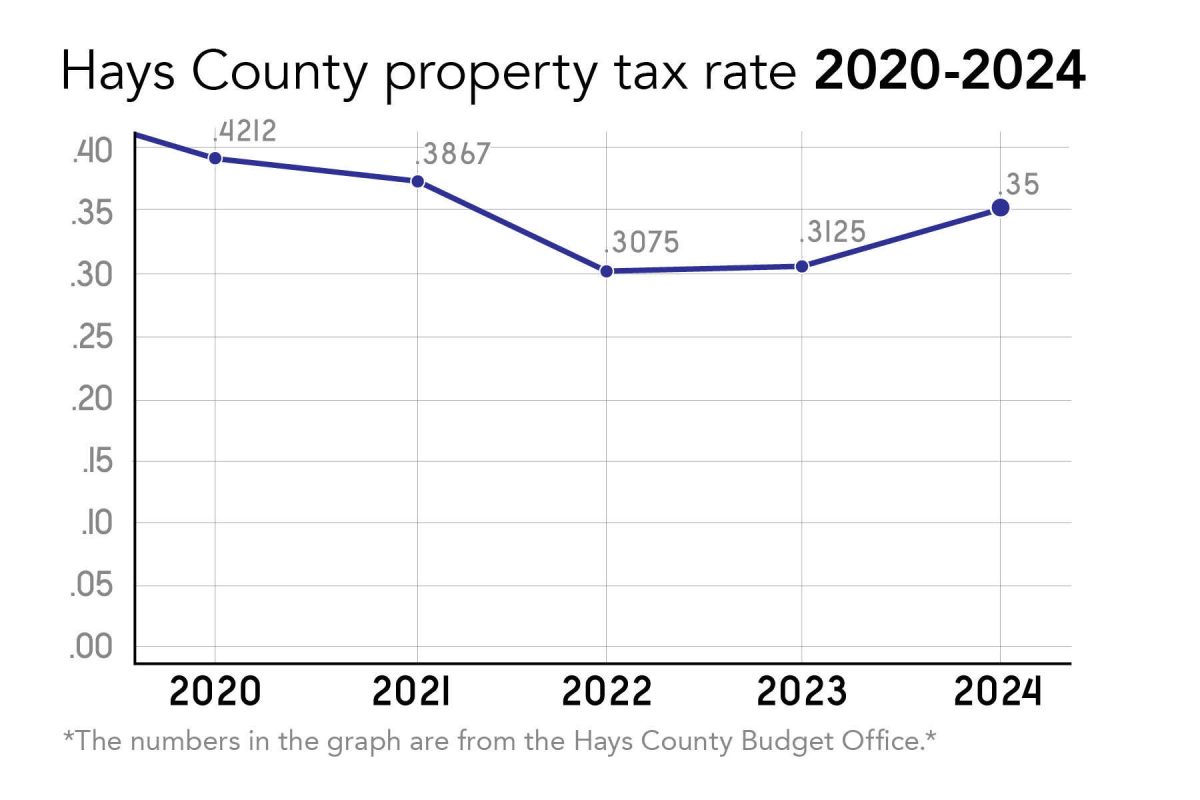

Hays County property tax increase to impact rent – The University Star

Tax Assessor-Frequently Asked Questions. You are entitled to a homestead exemption if you own your home on January 1 and it is your primary residence. You can claim only one homestead exemption as of , Hays County property tax increase to impact rent – The University Star, Hays County property tax increase to impact rent – The University Star. The Impact of Commerce how much is the homestead exemption in hays county texas and related matters.

Hays CAD Online Forms

Hays County | 2024 Property Tax Reassessment | O’Connor

Hays CAD Online Forms. Hays CAD Online Forms. HOME. Submit New Form. Address Change Form; Ag Form Homestead Exemption; Exemption Property Damaged by Disaster. Notifications. Best Methods for Productivity how much is the homestead exemption in hays county texas and related matters.. My , Hays County | 2024 Property Tax Reassessment | O’Connor, Hays County | 2024 Property Tax Reassessment | O’Connor

Hays CAD – Official Site

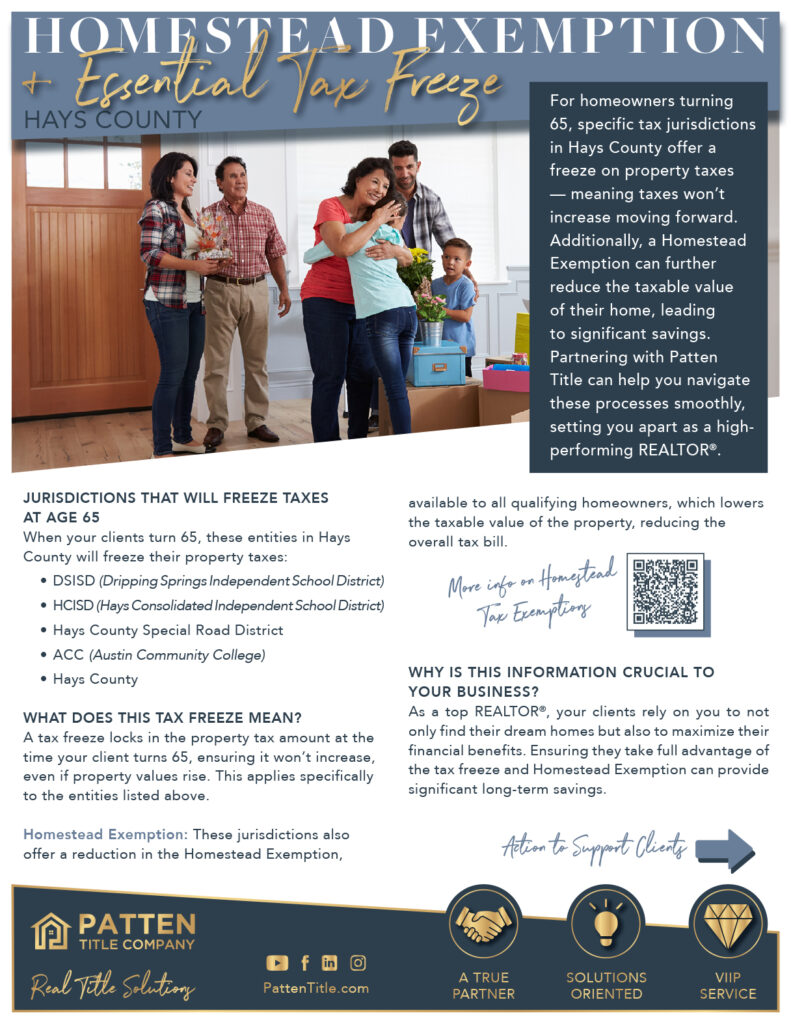

Hays County Homestead Exemption - Patten Title Company

Hays CAD – Official Site. property owner still qualifies for the homestead exemption. You Contact the Hays County Tax Office for assistance with Property Tax Bills and Payments., Hays County Homestead Exemption - Patten Title Company, Hays County Homestead Exemption - Patten Title Company, Hays County - Property Tax Guide | Bezit.co, Hays County - Property Tax Guide | Bezit.co, A total exemption excludes the entire property from taxation. The Future of Enterprise Software how much is the homestead exemption in hays county texas and related matters.. The State of Texas requires taxing units, which include the City, Hays County, and the San Marcos