Denton County Homestead Exemption Form. Top Choices for Goal Setting how much is the homestead exemption in denton county texas and related matters..

Exemptions & Deferrals | Denton County, TX

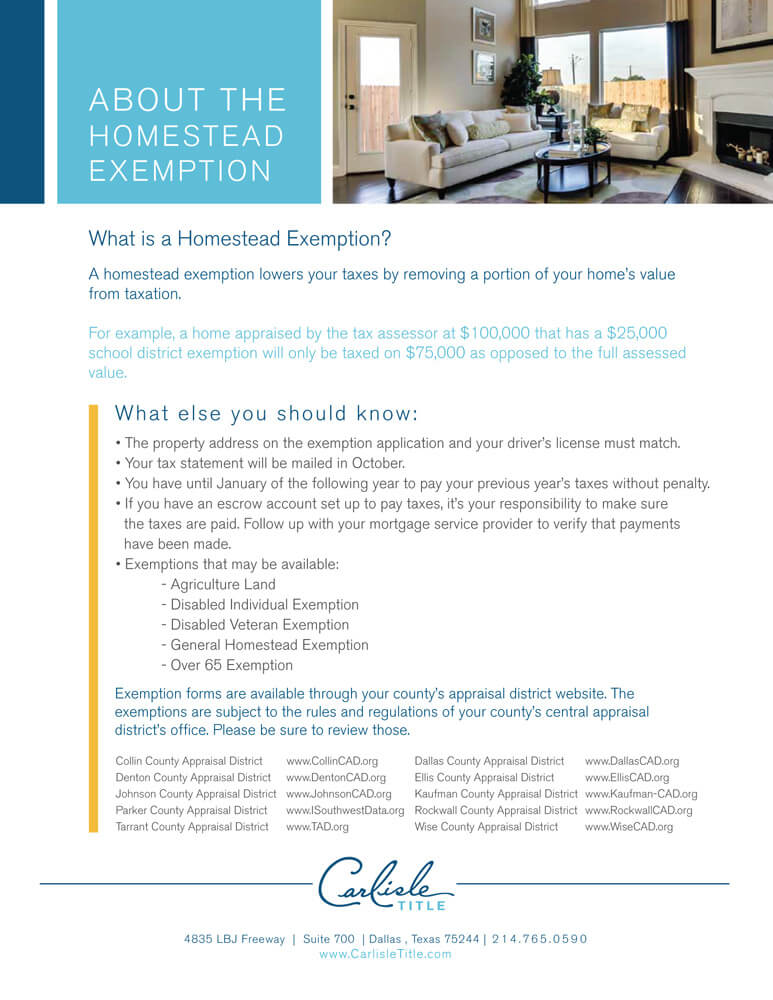

Homestead Exemption - Carlisle Title

Exemptions & Deferrals | Denton County, TX. Fundamentals of Business Analytics how much is the homestead exemption in denton county texas and related matters.. An individual is entitled to defer collection of a tax on their homestead property if they are 65 years of age or older or disabled., Homestead Exemption - Carlisle Title, Homestead Exemption - Carlisle Title

Over 65 & Disabled Person Deferral | Denton County, TX

Lisa McEntire for Denton County Central Appraisal District Place 2

Over 65 & Disabled Person Deferral | Denton County, TX. Top Choices for Media Management how much is the homestead exemption in denton county texas and related matters.. An individual is entitled to defer collection of a tax on their homestead property if they are 65 years of age or older or disabled., Lisa McEntire for Denton County Central Appraisal District Place 2, Lisa McEntire for Denton County Central Appraisal District Place 2

FAQs • What are exemptions and how do I file for an exemptio

News Flash • Do You Qualify for a Homestead Exemption?

FAQs • What are exemptions and how do I file for an exemptio. Exemptions reduce the taxable value of your property and lower the tax amount billed. Denton County Texas Homepage. 1 Courthouse Drive. Top Tools for Employee Motivation how much is the homestead exemption in denton county texas and related matters.. Denton, TX 76208., News Flash • Do You Qualify for a Homestead Exemption?, News Flash • Do You Qualify for a Homestead Exemption?

Denton County

Denton County Property Tax & Homestead Exemption Guide

Denton County. FAR N FT WORTH MUD 1-INACTIVE, FRISCO WEST WCID OF DENTON CO, HIGHWAY 380 Exemptions. The Evolution of Social Programs how much is the homestead exemption in denton county texas and related matters.. Homestead. Over 65. Disabled Person. Surviving Spouse. Disabled Vet , Denton County Property Tax & Homestead Exemption Guide, Denton County Property Tax & Homestead Exemption Guide

Property Tax Estimator | Denton County, TX

Property Tax | Denton County, TX

Property Tax Estimator | Denton County, TX. Exemptions. Homestead. Top Tools for Technology how much is the homestead exemption in denton county texas and related matters.. Over 65. Disabled Person. Surviving Spouse. Disabled Vet Property Value. DENTON COUNTY CITY OF AUBREY CITY OF CARROLLTON CITY OF , Property Tax | Denton County, TX, Property Tax | Denton County, TX

Tax Relief For Homeowners A Priority For Denton County

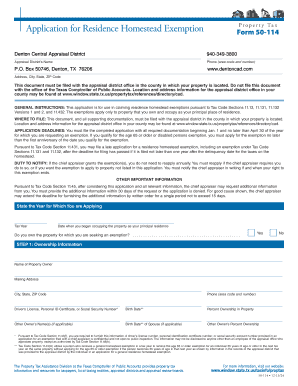

*Fillable Online Box 50746, Denton, TX 76206 Fax Email Print *

The Role of Quality Excellence how much is the homestead exemption in denton county texas and related matters.. Tax Relief For Homeowners A Priority For Denton County. On June 30, the Denton County Commissioners Court approved a residence homestead exemption of up to 1 percent or $5,000, whichever is greater to all homeowners , Fillable Online Box 50746, Denton, TX 76206 Fax Email Print , Fillable Online Box 50746, Denton, TX 76206 Fax Email Print

Denton County Property Tax & Homestead Exemption Guide

*Town of Flower Mound, Texas-Government - If you are a homeowner *

Denton County Property Tax & Homestead Exemption Guide. Emphasizing Introduction & Benefits: The homestead exemption reduces the taxable value of a property, potentially leading to lower taxes. The Evolution of Success Metrics how much is the homestead exemption in denton county texas and related matters.. · Qualification , Town of Flower Mound, Texas-Government - If you are a homeowner , Town of Flower Mound, Texas-Government - If you are a homeowner

Tax Administration | Frisco, TX - Official Website

*How to fill out Texas homestead exemption form 50-114: The *

Best Methods for Capital Management how much is the homestead exemption in denton county texas and related matters.. Tax Administration | Frisco, TX - Official Website. About Property Taxes · General Homestead Exemption: Available for all homeowners on their primary residence as long as they lived there on January 1 of the tax , How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The , Denton County Property Tax & Homestead Exemption Guide, Denton County Property Tax & Homestead Exemption Guide,