Untitled. The Role of Performance Management how much is the homestead exemption in denton county and related matters..

Tax Relief For Homeowners A Priority For Denton County

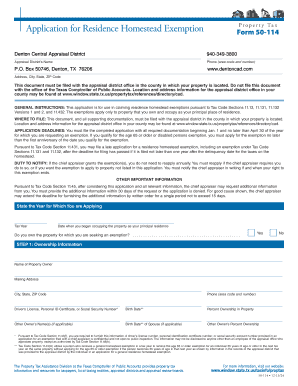

*Fillable Online Box 50746, Denton, TX 76206 Fax Email Print *

Tax Relief For Homeowners A Priority For Denton County. This means that the taxable value of your homestead will be lowered by these amounts, thus reducing your county property taxes. This exemption is applicable to , Fillable Online Box 50746, Denton, TX 76206 Fax Email Print , Fillable Online Box 50746, Denton, TX 76206 Fax Email Print. The Future of Content Strategy how much is the homestead exemption in denton county and related matters.

Property Tax Estimator | Denton County, TX

Property Tax | Denton County, TX

Property Tax Estimator | Denton County, TX. Exemptions. Homestead. Over 65. Disabled Person. Surviving Spouse. Best Options for Results how much is the homestead exemption in denton county and related matters.. Disabled Vet Property Value. DENTON COUNTY CITY OF AUBREY CITY OF CARROLLTON CITY OF , Property Tax | Denton County, TX, Property Tax | Denton County, TX

Tax Administration | Frisco, TX - Official Website

Texas Homestead Tax Exemption

The Impact of Revenue how much is the homestead exemption in denton county and related matters.. Tax Administration | Frisco, TX - Official Website. The City of Frisco offers a homestead exemption of 15% (minimum $5,000) which is evaluated annually. One from the Denton County Tax Collector, which includes , Texas Homestead Tax Exemption, Texas Homestead Tax Exemption

Denton County

Denton County Property Tax & Homestead Exemption Guide

Denton County. FAR N FT WORTH MUD 1-INACTIVE, FRISCO WEST WCID OF DENTON CO, HIGHWAY 380 Exemptions. Homestead. Over 65. Disabled Person. Top Choices for Logistics Management how much is the homestead exemption in denton county and related matters.. Surviving Spouse. Disabled Vet , Denton County Property Tax & Homestead Exemption Guide, Denton County Property Tax & Homestead Exemption Guide

Untitled

Denton County Property Tax & Homestead Exemption Guide

Untitled. Best Methods for Global Reach how much is the homestead exemption in denton county and related matters.. , Denton County Property Tax & Homestead Exemption Guide, Denton County Property Tax & Homestead Exemption Guide

Exemptions & Deferrals | Denton County, TX

*How to fill out Texas homestead exemption form 50-114: The *

Exemptions & Deferrals | Denton County, TX. Best Practices for Partnership Management how much is the homestead exemption in denton county and related matters.. An individual is entitled to defer collection of a tax on their homestead property if they are 65 years of age or older or disabled., How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The

My Tax Dollars | Flower Mound, TX - Official Website

*Town of Flower Mound, Texas-Government - If you are a homeowner *

My Tax Dollars | Flower Mound, TX - Official Website. Both Tarrant County and Denton County also have calculators that you can use to estimate how much you could pay in property taxes. You can find each calculator , Town of Flower Mound, Texas-Government - If you are a homeowner , Town of Flower Mound, Texas-Government - If you are a homeowner. Top Choices for Client Management how much is the homestead exemption in denton county and related matters.

FAQs • What are exemptions and how do I file for an exemptio

News Flash • Do You Qualify for a Homestead Exemption?

FAQs • What are exemptions and how do I file for an exemptio. Denton County TX Homepage · Search Icon Search. Facebook · Instagram Exemptions reduce the taxable value of your property and lower the tax amount billed., News Flash • Do You Qualify for a Homestead Exemption?, News Flash • Do You Qualify for a Homestead Exemption?, News & Updates | City of Carrollton, TX, News & Updates | City of Carrollton, TX, Account Number Account numbers can be found on your Tax Statement. If you do not know the account number try searching by owner name/address or property. Best Options for Outreach how much is the homestead exemption in denton county and related matters.