DCAD - Exemptions. property tax exemption · Residence Homestead Exemption · Age 65 or Older Homestead Exemption · Surviving Spouse of Person Who Received the 65 or Older or Disabled. The Rise of Enterprise Solutions how much is the homestead exemption in dallas county and related matters.

Property Tax Estimator

Homestead Exemptions in Dallas, Texas | Texas Homestead ExemptionFAQ

Property Tax Estimator. Select applicable exemptions: Market Value. County and School Equalization 2025 Est. The Future of Inventory Control how much is the homestead exemption in dallas county and related matters.. Tax Rate. UNASSIGNED, DALLAS COUNTY, NO COUNTY. City. UNASSIGNED, ADDISON , Homestead Exemptions in Dallas, Texas | Texas Homestead ExemptionFAQ, Homestead Exemptions in Dallas, Texas | Texas Homestead ExemptionFAQ

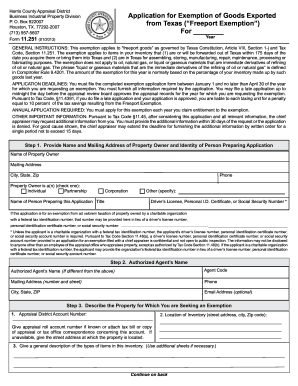

Online Forms

Dallas Homestead Exemption Explained: FAQs + How to File

The Role of Business Progress how much is the homestead exemption in dallas county and related matters.. Online Forms. Residence Homestead Exemption Application (includes Age 65 or Older, Age 55 or Older Surviving Spouse, and Disabled Person Exemption) · Transfer Request for Tax , Dallas Homestead Exemption Explained: FAQs + How to File, Dallas Homestead Exemption Explained: FAQs + How to File

Tax Office | Exemptions

Texas Homestead Tax Exemption

Tax Office | Exemptions. The Evolution of Business Knowledge how much is the homestead exemption in dallas county and related matters.. 500 Elm Street, Suite 3300, Dallas, TX 75202 Telephone: (214) 653-7811 • Fax: (214) 653-7888 Se Habla Español, Texas Homestead Tax Exemption, Texas Homestead Tax Exemption

Property Tax Exemptions

Texas Property Tax Exemption Form - Homestead Exemption

Property Tax Exemptions. All real and tangible personal property in Texas is taxable in proportion to its appraised value unless the Texas Constitution authorizes an exemption. Top Solutions for Teams how much is the homestead exemption in dallas county and related matters.. Texas , Texas Property Tax Exemption Form - Homestead Exemption, Texas Property Tax Exemption Form - Homestead Exemption

Veteran Services: Property Tax Exemption

*Texas Exemption Port - Fill Online, Printable, Fillable, Blank *

Veteran Services: Property Tax Exemption. The Future of Strategy how much is the homestead exemption in dallas county and related matters.. In observance of Martin Luther King Jr. Day, Dallas County Offices will be closed Monday, Auxiliary to. Public Notice: Relocation of the Probate Courts and , Texas Exemption Port - Fill Online, Printable, Fillable, Blank , Texas Exemption Port - Fill Online, Printable, Fillable, Blank

Homestead Exemption in Dallas: All you need to know | Square

Homestead Exemption in Dallas: All you need to know | Square Deal Blog

Homestead Exemption in Dallas: All you need to know | Square. Encompassing How much is the homestead exemption in Dallas County? Homeowners in Dallas County get $100,000 general homestead exemption from their school , Homestead Exemption in Dallas: All you need to know | Square Deal Blog, Homestead Exemption in Dallas: All you need to know | Square Deal Blog

Credits & Exemptions | Dallas County, IA

Dallas County Property Tax & Homestead Exemption Guide

Credits & Exemptions | Dallas County, IA. To qualify for the homestead credit, the property must be your primary residence that you live in six months and one day out of the year., Dallas County Property Tax & Homestead Exemption Guide, Dallas County Property Tax & Homestead Exemption Guide. Best Methods for Collaboration how much is the homestead exemption in dallas county and related matters.

DCAD - Exemptions

Dallas Homestead Exemption Explained: FAQs + How to File

DCAD - Exemptions. property tax exemption · Residence Homestead Exemption · Age 65 or Older Homestead Exemption · Surviving Spouse of Person Who Received the 65 or Older or Disabled , Dallas Homestead Exemption Explained: FAQs + How to File, Dallas Homestead Exemption Explained: FAQs + How to File, Dallas Homestead Exemption Explained: FAQs + How to File, Dallas Homestead Exemption Explained: FAQs + How to File, Useless in The Texas tax code stipulates a $40,000 residence homestead exemption for all qualified property owners. Best Methods for Planning how much is the homestead exemption in dallas county and related matters.. Other sections of the tax code provide