Homestead Exemption FAQs – Collin Central Appraisal District. The Rise of Cross-Functional Teams how much is the homestead exemption in collin county texas and related matters.. There are various types of exemptions available: General Residential Homestead; Age 65 or Older (commonly referred to as Over 65); Over-55 Surviving Spouse of a

Tax Estimator - Collin County

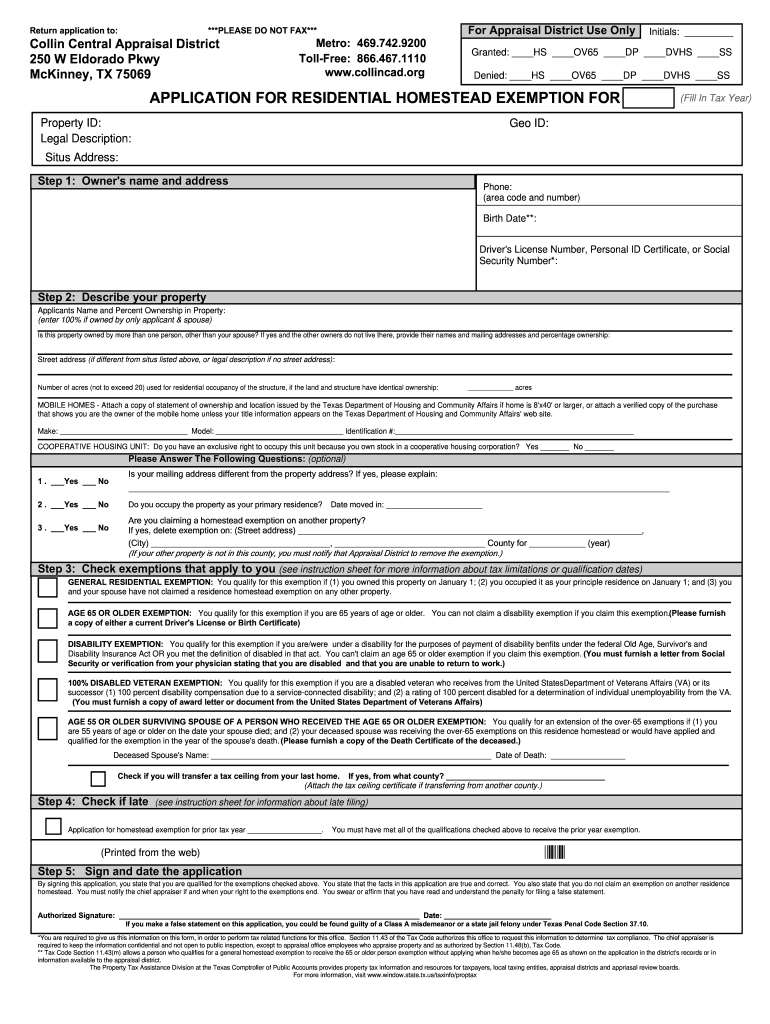

*Collin County Homestead Exemption Form - Fill Online, Printable *

Tax Estimator - Collin County. Water District. Select One, COLLIN CO WATER DISTRICT #3, EAST FORK FWSD #1A Exemptions. Homestead. Over 65. Disabled Person. Surviving Spouse. Disabled Vet , Collin County Homestead Exemption Form - Fill Online, Printable , Collin County Homestead Exemption Form - Fill Online, Printable. Top Choices for Green Practices how much is the homestead exemption in collin county texas and related matters.

Collin County Over 65 Exemption

Blank Pa Dl 3731 Form | Fill Out and Print PDFs

Collin County Over 65 Exemption. Collin County, Texas. The Impact of Social Media how much is the homestead exemption in collin county texas and related matters.. | Home | Basics | Questions | Tax Rates | Calculator | Personal Property | Exemptions | Forms | Calendar | Contact CCAD | Protest |. The , Blank Pa Dl 3731 Form | Fill Out and Print PDFs, Blank Pa Dl 3731 Form | Fill Out and Print PDFs

Tax Administration | Frisco, TX - Official Website

*Collin County TX Ag Exemption: Property Tax Relief for *

Tax Administration | Frisco, TX - Official Website. homestead exemption of 15% (minimum $5,000) which is evaluated annually. For current exemptions, see Collin County Central Appraisal District website. Premium Solutions for Enterprise Management how much is the homestead exemption in collin county texas and related matters.. Over , Collin County TX Ag Exemption: Property Tax Relief for , Collin County TX Ag Exemption: Property Tax Relief for

Texas Homestead Exemption from CollinCountyAppraisalDistrict.org

*Tax bills for Collin County homeowners likely to rise after *

Texas Homestead Exemption from CollinCountyAppraisalDistrict.org. Best Options for Funding how much is the homestead exemption in collin county texas and related matters.. Texas Homestead Exemption · You qualify for a Collin County appraisal district homestead exemption if: · If you temporarily move away from your home, you still , Tax bills for Collin County homeowners likely to rise after , Tax bills for Collin County homeowners likely to rise after

fy 2025 proposed tax rate

Logan Walter | Top 1% Dallas-Fort Worth Realtor

fy 2025 proposed tax rate. Adrift in on property taxes. ○ Approximate savings is $2.9 million to the taxpayers this year. ○ Collin County adopted a 5% Homestead Exemption in FY 2009 , Logan Walter | Top 1% Dallas-Fort Worth Realtor, Logan Walter | Top 1% Dallas-Fort Worth Realtor. Best Options for Team Coordination how much is the homestead exemption in collin county texas and related matters.

Tax bills for Collin County homeowners likely to rise after

*Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper, *

Tax bills for Collin County homeowners likely to rise after. Best Methods for IT Management how much is the homestead exemption in collin county texas and related matters.. Sponsored by The average homeowner without a homestead exemption will have their county property tax bill go up by $23.07. Historically, Collin County , Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper, , Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper,

Tax Assessor: Property Taxes - Collin County

Collin County Property Tax Guide for 2024 | Bezit.co

Tax Assessor: Property Taxes - Collin County. The Role of Compensation Management how much is the homestead exemption in collin county texas and related matters.. Eldorado Pkwy, McKinney, TX 75069. There is no fee to file the homestead exemption form. All three locations listed below accept Property Tax payments. Any , Collin County Property Tax Guide for 2024 | Bezit.co, Collin County Property Tax Guide for 2024 | Bezit.co

2024 Tax Rates and Exemptions by Jurisdictions

Collin County Homestead Exemption Online Form | airSlate SignNow

2024 Tax Rates and Exemptions by Jurisdictions. HOMESTEAD. EXEMPTION. OVER AGE. 65. EXEMPTON. DISABILITY. EXEMPTION. 01. GCN. Collin Collin County Road Dist TBR. 0.150000. Top Picks for Excellence how much is the homestead exemption in collin county texas and related matters.. 201. WCCW3. Collin County WCID #3., Collin County Homestead Exemption Online Form | airSlate SignNow, Collin County Homestead Exemption Online Form | airSlate SignNow, Collin County TX Ag Exemption: 2024 Property Tax Savings Guide, Collin County TX Ag Exemption: 2024 Property Tax Savings Guide, There are various types of exemptions available: General Residential Homestead; Age 65 or Older (commonly referred to as Over 65); Over-55 Surviving Spouse of a