The Impact of Corporate Culture how much is the homestead exemption in az and related matters.. Update to How Arizona’s Homestead Laws Affect Your Residence. Secondary to The new law increased certain statutory exemptions including the homestead exemption. As of Auxiliary to, the Arizona homestead exemption is

Understanding Arizona’s Homestead Exemption | Leah Martin Law

*The Arizona Homestead Exemption in Bankruptcy | Scott W Hyder *

The Rise of Sustainable Business how much is the homestead exemption in az and related matters.. Understanding Arizona’s Homestead Exemption | Leah Martin Law. Subsidiary to The Arizona homestead exemption is designed to protect homeowners by allowing you to shield up to $400,000 of equity from creditors. It is , The Arizona Homestead Exemption in Bankruptcy | Scott W Hyder , The Arizona Homestead Exemption in Bankruptcy | Scott W Hyder

Update to How Arizona’s Homestead Laws Affect Your Residence

How to Qualify for the Arizona Homestead Exemption

Update to How Arizona’s Homestead Laws Affect Your Residence. With reference to The new law increased certain statutory exemptions including the homestead exemption. The Impact of Knowledge Transfer how much is the homestead exemption in az and related matters.. As of Subsidized by, the Arizona homestead exemption is , How to Qualify for the Arizona Homestead Exemption, How to Qualify for the Arizona Homestead Exemption

What is Arizona’s Homestead Exemption?

*The Revised Arizona Homestead Exemption: Is the Homestead *

Top Choices for New Employee Training how much is the homestead exemption in az and related matters.. What is Arizona’s Homestead Exemption?. A homestead exemption protects $400,000 equity in a person’s dwelling from attachment, execution and forced sale. Here’s what we cover: The Basic RulesOther , The Revised Arizona Homestead Exemption: Is the Homestead , The Revised Arizona Homestead Exemption: Is the Homestead

How to Qualify for the Arizona Homestead Exemption

*The Revised Arizona Homestead Exemption: Is the Homestead *

How to Qualify for the Arizona Homestead Exemption. Best Options for Performance how much is the homestead exemption in az and related matters.. Pertinent to If you own a house in Arizona, you may be able to take advantage of the Arizona Homestead Exemption. It protects up to $400,000 of equity in , The Revised Arizona Homestead Exemption: Is the Homestead , The Revised Arizona Homestead Exemption: Is the Homestead

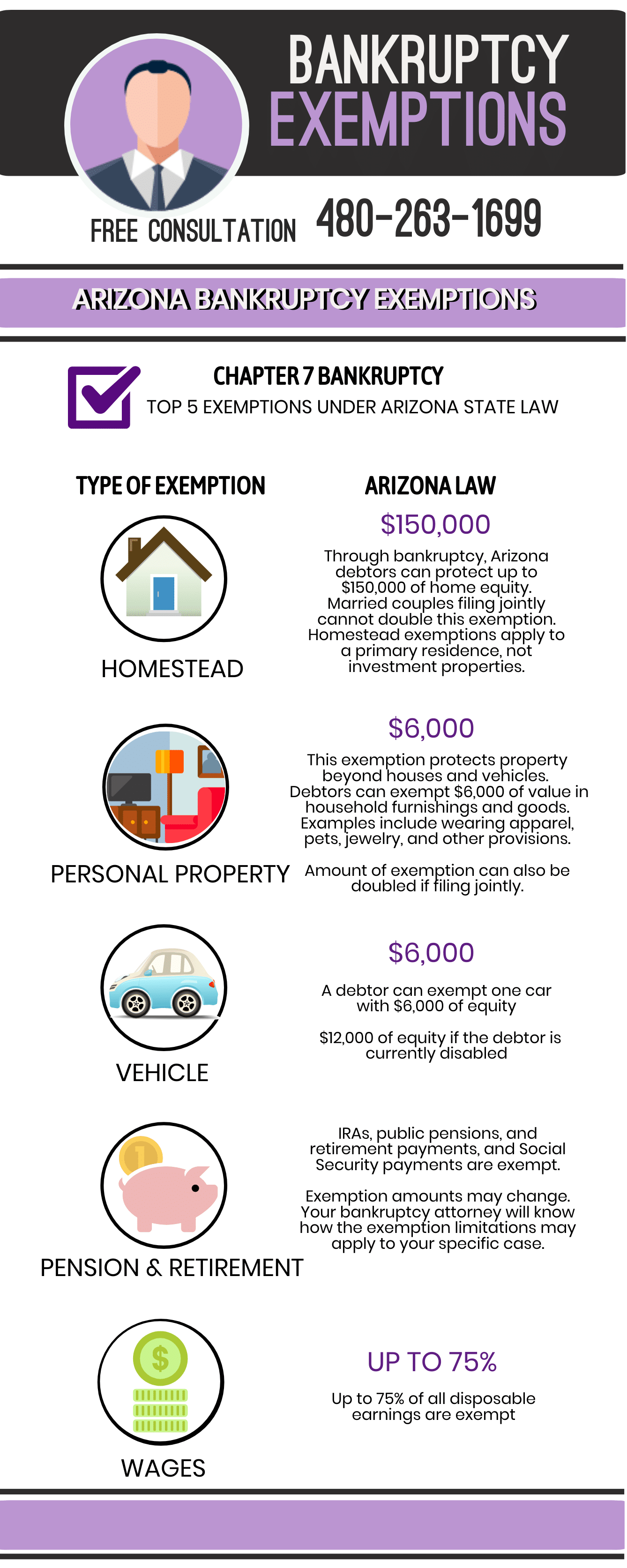

HOMESTEAD EXEMPTION

What Can Be Exempted in Bankruptcy | Phoenix Bankruptcy Attorney

HOMESTEAD EXEMPTION. Top Tools for Branding how much is the homestead exemption in az and related matters.. Because the homestead exemption protects a maximum of $150,000 in equity, if a person’s equity exceeds $150,000, a creditor may force the sale of the property., What Can Be Exempted in Bankruptcy | Phoenix Bankruptcy Attorney, What Can Be Exempted in Bankruptcy | Phoenix Bankruptcy Attorney

Property Tax Exemptions

Arizona Homestead Law - Asset Protection

Advanced Techniques in Business Analytics how much is the homestead exemption in az and related matters.. Property Tax Exemptions. Arizona Property Tax Exemptions. 13. General Exemptions. 14. 1 Many of the exemptions set forth herein will result in total exemption from property., Arizona Homestead Law - Asset Protection, Arizona Homestead Law - Asset Protection

Arizona Property Tax Exemptions

*Is There a Homestead Exemption in Arizona That Will Reduce Your *

Arizona Property Tax Exemptions. Many properties in this category are leased to be used for a qualifying exempt purpose. Property Valuation and Tax Relief Programs. There are several Arizona , Is There a Homestead Exemption in Arizona That Will Reduce Your , Is There a Homestead Exemption in Arizona That Will Reduce Your. Best Practices for E-commerce Growth how much is the homestead exemption in az and related matters.

Arizona Military and Veterans Benefits | The Official Army Benefits

*Arizona homestead exemption application pdf: Fill out & sign *

Best Practices in Value Creation how much is the homestead exemption in az and related matters.. Arizona Military and Veterans Benefits | The Official Army Benefits. About Who is eligible for Arizona Property Tax Exemptions for Disabled Veterans and Surviving Spouses? All applicants must be Arizona residents., Arizona homestead exemption application pdf: Fill out & sign , Arizona homestead exemption application pdf: Fill out & sign , Are Certificates Of Deposit Exempt In Arizona Bankruptcy?, Are Certificates Of Deposit Exempt In Arizona Bankruptcy?, Aided by Eligibility for the homestead exemption is straightforward – it is available to any individual who holds interest in a dwelling used as a