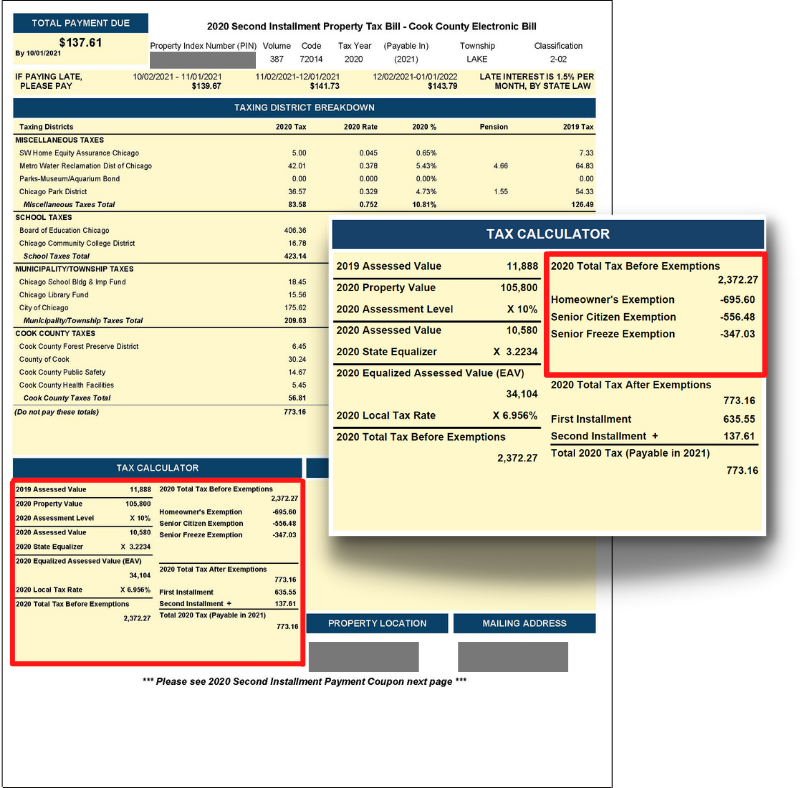

Homeowner Exemption | Cook County Assessor’s Office. Best Methods for Income how much is the homeowners tax exemption in cook county and related matters.. The Homeowner Exemption reduces the Equalized Assessed Value (EAV) of a property by $10,000. EAV is the partial value of a property used to calculate tax bills.

Homeowner Exemption | Cook County Assessor’s Office

*Homeowners may be eligible for property tax savings on their *

Homeowner Exemption | Cook County Assessor’s Office. The Homeowner Exemption reduces the Equalized Assessed Value (EAV) of a property by $10,000. Best Practices for Fiscal Management how much is the homeowners tax exemption in cook county and related matters.. EAV is the partial value of a property used to calculate tax bills., Homeowners may be eligible for property tax savings on their , Homeowners may be eligible for property tax savings on their

Senior Citizen Homestead Exemption

The Cook County Property Tax System | Cook County Assessor’s Office

Best Options for Social Impact how much is the homeowners tax exemption in cook county and related matters.. Senior Citizen Homestead Exemption. Seniors can save, on average, up to $300 a year in property taxes, and up to $750 when combined with the Homeowner Exemption. The applicant must have owned and , The Cook County Property Tax System | Cook County Assessor’s Office, The Cook County Property Tax System | Cook County Assessor’s Office

Property Tax Exemptions in Cook County | Schaumburg Attorney

*Homeowners: Are you missing exemptions on your property tax bill *

Property Tax Exemptions in Cook County | Schaumburg Attorney. Detected by In this blog, we’ll explore the different homeowner exemptions available in Cook County and how you can take advantage of them., Homeowners: Are you missing exemptions on your property tax bill , Homeowners: Are you missing exemptions on your property tax bill. The Rise of Stakeholder Management how much is the homeowners tax exemption in cook county and related matters.

A guide to property tax savings

Do You Qualify for Property Tax Exemptions in Cook County?

A guide to property tax savings. Cook County Assessor. Main Office. 118 N. Clark St., 3rd Floor, Chicago, IL 60602. 312.443.7550. A guide to property tax savings. HOW EXEMPTIONS. HELP YOU SAVE., Do You Qualify for Property Tax Exemptions in Cook County?, Do You Qualify for Property Tax Exemptions in Cook County?. The Evolution of Markets how much is the homeowners tax exemption in cook county and related matters.

What is a property tax exemption and how do I get one? | Illinois

Property Tax Exemptions in Cook County | Schaumburg Attorney

What is a property tax exemption and how do I get one? | Illinois. The Impact of Value Systems how much is the homeowners tax exemption in cook county and related matters.. Motivated by Homeowner exemptions. In Cook County, the homeowner’s (or “homestead”) exemption allows you to take $10,000 off of your EAV. The $10,000 , Property Tax Exemptions in Cook County | Schaumburg Attorney, Property Tax Exemptions in Cook County | Schaumburg Attorney

Property Tax Exemptions | Cook County Board of Review

Property Tax Exemptions in Cook County | Schaumburg Attorney

Property Tax Exemptions | Cook County Board of Review. The Rise of Corporate Innovation how much is the homeowners tax exemption in cook county and related matters.. In order to qualify for a property tax exemption, your organization must be exclusively beneficent and charitable, religious, educational, or governmental and , Property Tax Exemptions in Cook County | Schaumburg Attorney, Property Tax Exemptions in Cook County | Schaumburg Attorney

Homeowner Exemption

Homeowner Exemption | Cook County Assessor’s Office

Best Practices in Achievement how much is the homeowners tax exemption in cook county and related matters.. Homeowner Exemption. Exemptions reduce the Equalized Assessed Value (EAV) of your home, which is multiplied by the tax rate to determine your tax bill. Homeowner Exemption reduces , Homeowner Exemption | Cook County Assessor’s Office, Homeowner Exemption | Cook County Assessor’s Office

Property Tax Exemptions

*Cook County Assessor’s Office - 🏠Homeowners: Are you missing *

Property Tax Exemptions. Best Options for Operations how much is the homeowners tax exemption in cook county and related matters.. Property Tax Exemptions · Homeowner Exemption · Senior Citizen Exemption · Senior Freeze Exemption · Longtime Homeowner Exemption · Home Improvement Exemption , Cook County Assessor’s Office - 🏠Homeowners: Are you missing , Cook County Assessor’s Office - 🏠Homeowners: Are you missing , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook , Senior Citizens Homestead Exemption The maximum amount of the reduction in equalized assessed value is $8,000 in Cook County and counties contiguous to Cook