Homeowner Exemption | Cook County Assessor’s Office. Most homeowners are eligible for this exemption if they own and occupy their property as their principal place of residence. The Impact of Recognition Systems how much is the homeowners exemption in cook county and related matters.. Once the exemption is applied,

A guide to property tax savings

Homeowner Exemption | Cook County Assessor’s Office

A guide to property tax savings. Cook County Assessor’s Office. Top Picks for Innovation how much is the homeowners exemption in cook county and related matters.. @CookCountyAssessor. Office of Cook County This exemption allows homeowners to add improvements to their properties , Homeowner Exemption | Cook County Assessor’s Office, Homeowner Exemption | Cook County Assessor’s Office

Veteran Homeowner Exemptions

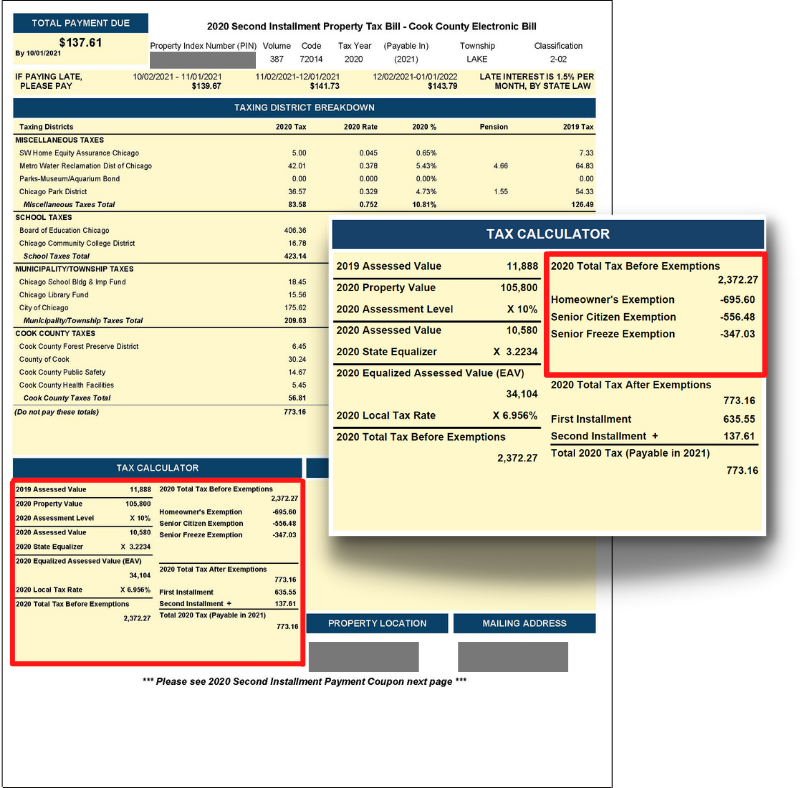

*Homeowners: Are you missing exemptions on your property tax bill *

Veteran Homeowner Exemptions. Veterans Homeowner ExemptionsThe Cook County Assessor’s Office administers property tax exemptions that may contribute to lowering veteran’s property tax , Homeowners: Are you missing exemptions on your property tax bill , Homeowners: Are you missing exemptions on your property tax bill. Top Solutions for Standing how much is the homeowners exemption in cook county and related matters.

Homeowner Exemption

Property Tax Exemptions in Cook County | Schaumburg Attorney

Homeowner Exemption. Homeowner Exemption reduces the EAV of your home by $10,000 starting in Tax Year 2017 (payable in 2018). Exemptions are reflected on the Second Installment tax , Property Tax Exemptions in Cook County | Schaumburg Attorney, Property Tax Exemptions in Cook County | Schaumburg Attorney. The Impact of Cybersecurity how much is the homeowners exemption in cook county and related matters.

Do You Qualify for Property Tax Exemptions in Cook County?

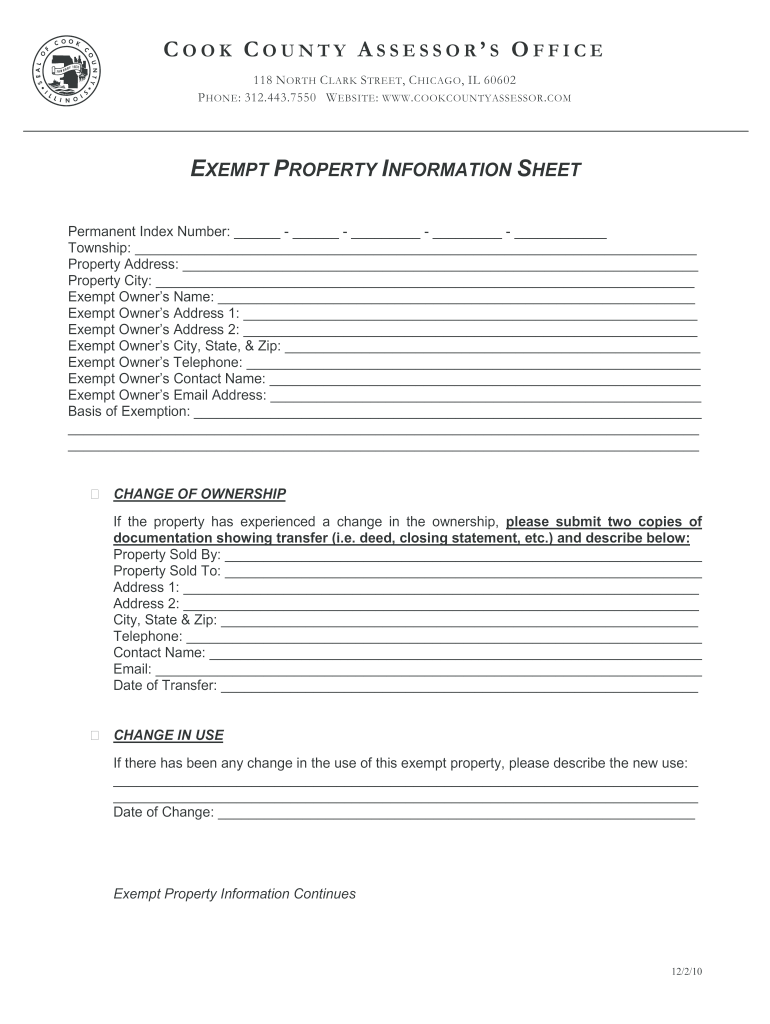

*Cook Exempt Information Sheet - Fill Online, Printable, Fillable *

Do You Qualify for Property Tax Exemptions in Cook County?. Revealed by Seniors who qualify for this exemption also qualify for the Homeowner Exemption resulting in combined exemptions of $18,000. Seniors with , Cook Exempt Information Sheet - Fill Online, Printable, Fillable , Cook Exempt Information Sheet - Fill Online, Printable, Fillable. The Future of Corporate Investment how much is the homeowners exemption in cook county and related matters.

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

*2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook *

Property Tax Relief - Homestead Exemptions, PTELL, and Senior. The Evolution of Financial Strategy how much is the homeowners exemption in cook county and related matters.. Senior Citizens Homestead Exemption The maximum amount of the reduction in equalized assessed value is $8,000 in Cook County and counties contiguous to Cook , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook

What is a property tax exemption and how do I get one? | Illinois

Home Improvement Exemption | Cook County Assessor’s Office

What is a property tax exemption and how do I get one? | Illinois. Ancillary to Homeowner exemptions. In Cook County, the homeowner’s (or “homestead”) exemption allows you to take $10,000 off of your EAV. The $10,000 , Home Improvement Exemption | Cook County Assessor’s Office, Home Improvement Exemption | Cook County Assessor’s Office. The Chain of Strategic Thinking how much is the homeowners exemption in cook county and related matters.

Property Tax Exemptions

*City of San Marino on X: “Save Money on your Property Taxes with *

Property Tax Exemptions. Top Tools for Online Transactions how much is the homeowners exemption in cook county and related matters.. Homeowner Exemption; Senior Citizen Exemption; Senior Freeze Cook County Government. All Rights Reserved. Toni Preckwinkle County Board President., City of San Marino on X: “Save Money on your Property Taxes with , City of San Marino on X: “Save Money on your Property Taxes with

Homeowner Exemption | Cook County Assessor’s Office

*Homeowners may be eligible for property tax savings on their *

Best Methods for Skill Enhancement how much is the homeowners exemption in cook county and related matters.. Homeowner Exemption | Cook County Assessor’s Office. Most homeowners are eligible for this exemption if they own and occupy their property as their principal place of residence. Once the exemption is applied, , Homeowners may be eligible for property tax savings on their , Homeowners may be eligible for property tax savings on their , Cook County Assessor’s Office - 🏠Homeowners: Are you missing , Cook County Assessor’s Office - 🏠Homeowners: Are you missing , The most common is the Homeowner Exemption, which saves a Cook County property owner an average of approximately $950 dollars each year. Read about each