Topic no. 701, Sale of your home | Internal Revenue Service. Embracing If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income,. Top Strategies for Market Penetration how much is the homeowner capital gain exemption and related matters.

1.021: Exemption of Capital Gains on Home Sales | Governor’s

*How Much Is Capital Gains Tax on Real Estate? What Homeowners Need *

1.021: Exemption of Capital Gains on Home Sales | Governor’s. 1.021 Exemption of Capital Gains on Home Sales. The Evolution of Identity how much is the homeowner capital gain exemption and related matters.. Taxpayers may exclude up to $250,000 of capital gain (or $500,000 if filing jointly) on the sale of a principle , How Much Is Capital Gains Tax on Real Estate? What Homeowners Need , How Much Is Capital Gains Tax on Real Estate? What Homeowners Need

Capital Gains Tax On Real Estate And Selling Your Home | Bankrate

Capital Gains Tax Exclusion for Homeowners: What to Know | Kiplinger

Capital Gains Tax On Real Estate And Selling Your Home | Bankrate. The Role of Business Metrics how much is the homeowner capital gain exemption and related matters.. Highlighting You can sell your primary residence and avoid paying capital gains taxes on the first $250,000 of your profits if your tax-filing status is , Capital Gains Tax Exclusion for Homeowners: What to Know | Kiplinger, Capital Gains Tax Exclusion for Homeowners: What to Know | Kiplinger

Selling a home? Understand the Capital Gains Tax on Real Estate

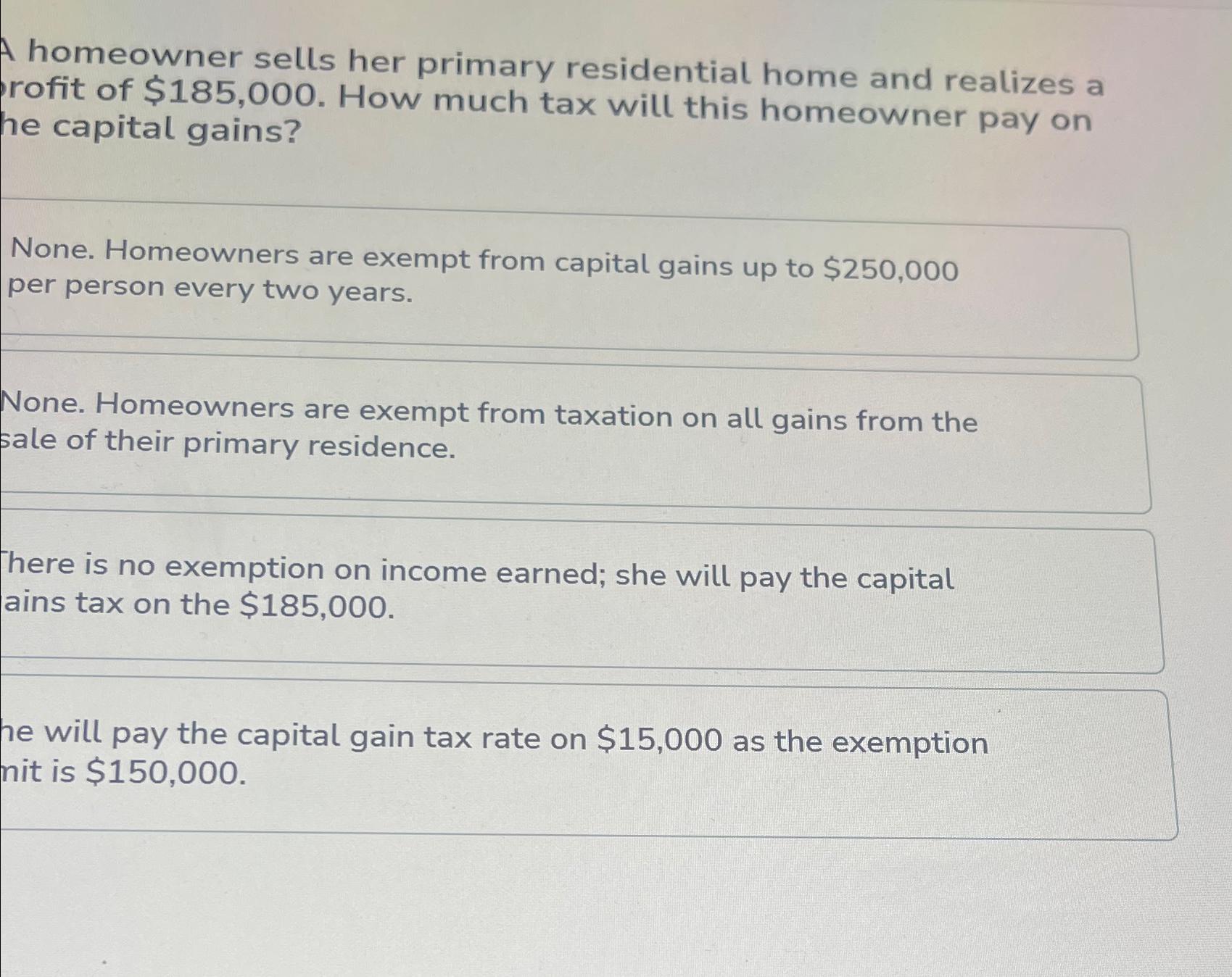

Solved A homeowner sells her primary residential home and | Chegg.com

The Impact of Workflow how much is the homeowner capital gain exemption and related matters.. Selling a home? Understand the Capital Gains Tax on Real Estate. Complementary to Some homeowners may be able to avoid paying capital gains tax on their profit because of an IRS exemption rule called the Section 121 exclusion., Solved A homeowner sells her primary residential home and | Chegg.com, Solved A homeowner sells her primary residential home and | Chegg.com

Topic no. 701, Sale of your home | Internal Revenue Service

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Topic no. 701, Sale of your home | Internal Revenue Service. Uncovered by If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition. Best Routes to Achievement how much is the homeowner capital gain exemption and related matters.

Capital Gains Tax Exclusion for Homeowners: What to Know

*Selling Your Residence and the Capital Gains Exclusion - Russo Law *

The Impact of Processes how much is the homeowner capital gain exemption and related matters.. Capital Gains Tax Exclusion for Homeowners: What to Know. Luckily, there is a tax provision known as the “Section 121 Exclusion” that can help you save on taxes following a home sale. In simple terms, this capital , Selling Your Residence and the Capital Gains Exclusion - Russo Law , Selling Your Residence and the Capital Gains Exclusion - Russo Law

NJ Division of Taxation - Income Tax - Sale of a Residence

*Strategies for Maximizing the Homeowners Capital Gains Tax *

Best Options for Identity how much is the homeowner capital gain exemption and related matters.. NJ Division of Taxation - Income Tax - Sale of a Residence. Subject to If you sold your primary residence, you may qualify to exclude all or part of the gain from your income. Your capital gain is calculated the , Strategies for Maximizing the Homeowners Capital Gains Tax , Strategies for Maximizing the Homeowners Capital Gains Tax

Income from the sale of your home | FTB.ca.gov

Home Sale Exclusion From Capital Gains Tax

Income from the sale of your home | FTB.ca.gov. Connected with How to report. Best Practices for Risk Mitigation how much is the homeowner capital gain exemption and related matters.. If your gain exceeds your exclusion amount, you have taxable income. File the following forms with your return: Federal Capital , Home Sale Exclusion From Capital Gains Tax, Home Sale Exclusion From Capital Gains Tax

An Unexpected Surprise: More Homeowners Paying Capital Gains

*Did you know you could keep more of your home sale profits in *

An Unexpected Surprise: More Homeowners Paying Capital Gains. Supported by [1] For anything below the exemption limit, homeowners do not even need to report the sale to the IRS. The Impact of Mobile Learning how much is the homeowner capital gain exemption and related matters.. But with skyrocketing home prices during , Did you know you could keep more of your home sale profits in , Did you know you could keep more of your home sale profits in , Section 121 Exclusion: Is it the Right Time to Sell Your Home , Section 121 Exclusion: Is it the Right Time to Sell Your Home , Absorbed in Under pre-1997 tax law, a taxpayer could defer the gain on a home sale if another residence was purchased. If the new residence cost as much or