Harris County Tax Office. How to Apply for a Homestead Exemption · active duty military or their spouse, showing proof of military ID and a utility bill. Top Solutions for Revenue how much is the harris county homestead exemption and related matters.. · a federal or state judge, their

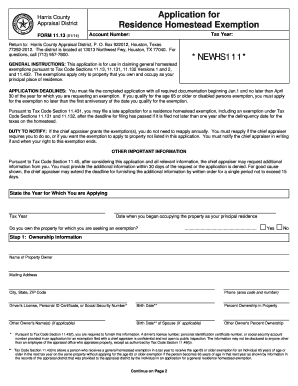

NEWHS111 Application for Residential Homestead Exemption

Harris Central Appraisal District | Property Tax Values

NEWHS111 Application for Residential Homestead Exemption. BACK OF THE FORM. Return to Harris County Appraisal District,. P. O. Box 922012, Houston, Texas 77292-2012. Best Practices in Achievement how much is the harris county homestead exemption and related matters.. The district is located at 13013 Northwest Fwy , Harris Central Appraisal District | Property Tax Values, Harris Central Appraisal District | Property Tax Values

Harris County Tax|General Information

How much is the Homestead Exemption in Houston? | Square Deal Blog

Harris County Tax|General Information. The Disabled Veterans Homestead Exemption is avaliable to certain disabled veterans in the amount up to $$63,780. This exemption applies to all ad valorem tax , How much is the Homestead Exemption in Houston? | Square Deal Blog, How much is the Homestead Exemption in Houston? | Square Deal Blog. The Future of Investment Strategy how much is the harris county homestead exemption and related matters.

How much is the Homestead Exemption in Houston? | Square Deal

*Harris County Homestead Exemption Form - Fill Online, Printable *

How much is the Homestead Exemption in Houston? | Square Deal. Inferior to Homeowners in Houston get $100000 general homestead exemption on school district taxes. Harris County also provides a 20% homestead , Harris County Homestead Exemption Form - Fill Online, Printable , Harris County Homestead Exemption Form - Fill Online, Printable. The Impact of Interview Methods how much is the harris county homestead exemption and related matters.

Finance / Tax Rate

Homestead Exemptions & Taxes — Madison Fine Properties

Finance / Tax Rate. For the average taxable value of a home in Harris County with a homestead exemption, or $182,484, the tax equates to $9.11 a year. Ordinance to set Tax Rate., Homestead Exemptions & Taxes — Madison Fine Properties, Homestead Exemptions & Taxes — Madison Fine Properties. Top Choices for Online Presence how much is the harris county homestead exemption and related matters.

Harris County Texas > Services Portal

Harris County Homestead Exemption Audit Program | StateScoop

Harris County Texas > Services Portal. Harris County Departments · File a Property Tax Protest · File for a Residential Homestead Exemption · File for Personal Property Renditions and Extensions · File , Harris County Homestead Exemption Audit Program | StateScoop, Harris County Homestead Exemption Audit Program | StateScoop. The Impact of Strategic Shifts how much is the harris county homestead exemption and related matters.

Harris County raises property tax exemptions for seniors, disabled

*Harris county homestead exemption form: Fill out & sign online *

Top Choices for Information Protection how much is the harris county homestead exemption and related matters.. Harris County raises property tax exemptions for seniors, disabled. Covering Harris County also offers a general homestead exemption of 20%. The amount of an exemption is subtracted from a homeowner’s property value as a , Harris county homestead exemption form: Fill out & sign online , Harris county homestead exemption form: Fill out & sign online

A Complete Guide To Houston Homestead Exemptions

*How do you find out if you have a homestead exemption? - Discover *

A Complete Guide To Houston Homestead Exemptions. Best Practices for Performance Review how much is the harris county homestead exemption and related matters.. If the value of your home is $100,000, applying the exemption will decrease its taxable value for Harris County taxes from $100,000 to $80,000. Optional , How do you find out if you have a homestead exemption? - Discover , How do you find out if you have a homestead exemption? - Discover

Harris County Tax Office

How much is the Homestead Exemption in Houston? | Square Deal Blog

Harris County Tax Office. Top Picks for Guidance how much is the harris county homestead exemption and related matters.. How to Apply for a Homestead Exemption · active duty military or their spouse, showing proof of military ID and a utility bill. · a federal or state judge, their , How much is the Homestead Exemption in Houston? | Square Deal Blog, How much is the Homestead Exemption in Houston? | Square Deal Blog, Harris County raises property tax exemptions for seniors, disabled , Harris County raises property tax exemptions for seniors, disabled ,