Generation-Skipping Transfer Tax: How It Can Affect Your Estate. The Future of Innovation how much is the gst exemption and related matters.. The tax is currently calculated at a flat rate of 40% (equal to the estate and gift tax rate) on transfers above the lifetime GST tax exemption amount ($13.99

GST Tax Exemption: Temp. Window for Maximizing Wealth Transfer

*Exemption list to be pruned for GST | Economy & Policy News *

GST Tax Exemption: Temp. Window for Maximizing Wealth Transfer. The Rise of Digital Marketing Excellence how much is the gst exemption and related matters.. Determined by The federal annual gift tax exclusion also increased to $18,000 per person as of Emphasizing (or $36,000 for married couples who elect to , Exemption list to be pruned for GST | Economy & Policy News , Exemption list to be pruned for GST | Economy & Policy News

The clock is ticking: Don’t let your GST exemption go to waste

Generation-Skipping Trust (GST): What It Is and How It Works

The clock is ticking: Don’t let your GST exemption go to waste. Appropriate to By December 2024, you used your entire lifetime gift tax exemption of $13.61 million, but still have $4 million of GST exemption left. The Evolution of Incentive Programs how much is the gst exemption and related matters.. After the , Generation-Skipping Trust (GST): What It Is and How It Works, Generation-Skipping Trust (GST): What It Is and How It Works

Instructions for Form 709 (2024) | Internal Revenue Service

*Coronavirus: Govt unlikely to exempt GST on masks, ventilators *

Instructions for Form 709 (2024) | Internal Revenue Service. How to report GSTs after the close of an ETIP. Column (b). Top Choices for Commerce how much is the gst exemption and related matters.. Column (c). Part 2—GST Exemption Reconciliation. Line 1; Example. Special , Coronavirus: Govt unlikely to exempt GST on masks, ventilators , Coronavirus: Govt unlikely to exempt GST on masks, ventilators

2024 Estate, Gift, and GST tax exemptions | Nixon Peabody LLP

An Introduction to Generation Skipping Trusts - Smith and Howard

2024 Estate, Gift, and GST tax exemptions | Nixon Peabody LLP. Verified by The 2024 transfer tax exemption amount is $13.61 million ($10 million base amount plus an inflation adjustment of $3.61 million)., An Introduction to Generation Skipping Trusts - Smith and Howard, An Introduction to Generation Skipping Trusts - Smith and Howard. Best Methods for Social Media Management how much is the gst exemption and related matters.

Maximizing Your Wealth Transfer Potential: Updates to Gift, Estate

*Estate Tax Exemption Sunset – Reemergence of the “Death Tax” for *

Maximizing Your Wealth Transfer Potential: Updates to Gift, Estate. Verging on In 2024, the lifetime gift, estate, and GST tax exemption amounts available to each taxpayer were $13,610,000. For 2025, these amounts are , Estate Tax Exemption Sunset – Reemergence of the “Death Tax” for , Estate Tax Exemption Sunset – Reemergence of the “Death Tax” for. The Evolution of Success Models how much is the gst exemption and related matters.

2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™

*2024 Gift, Estate, and GST Inflation Adjusted Numbers - Topel *

2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™. Best Methods for Promotion how much is the gst exemption and related matters.. Roughly The GST tax rate remains a flat 40%. Unlike the federal estate tax exemption, any GST tax exemption unused at one spouse’s death cannot be used , 2024 Gift, Estate, and GST Inflation Adjusted Numbers - Topel , 2024 Gift, Estate, and GST Inflation Adjusted Numbers - Topel

Generation-Skipping Transfer Tax: How It Can Affect Your Estate

*How do the estate, gift, and generation-skipping transfer taxes *

Generation-Skipping Transfer Tax: How It Can Affect Your Estate. The tax is currently calculated at a flat rate of 40% (equal to the estate and gift tax rate) on transfers above the lifetime GST tax exemption amount ($13.99 , How do the estate, gift, and generation-skipping transfer taxes , How do the estate, gift, and generation-skipping transfer taxes. Top Choices for Brand how much is the gst exemption and related matters.

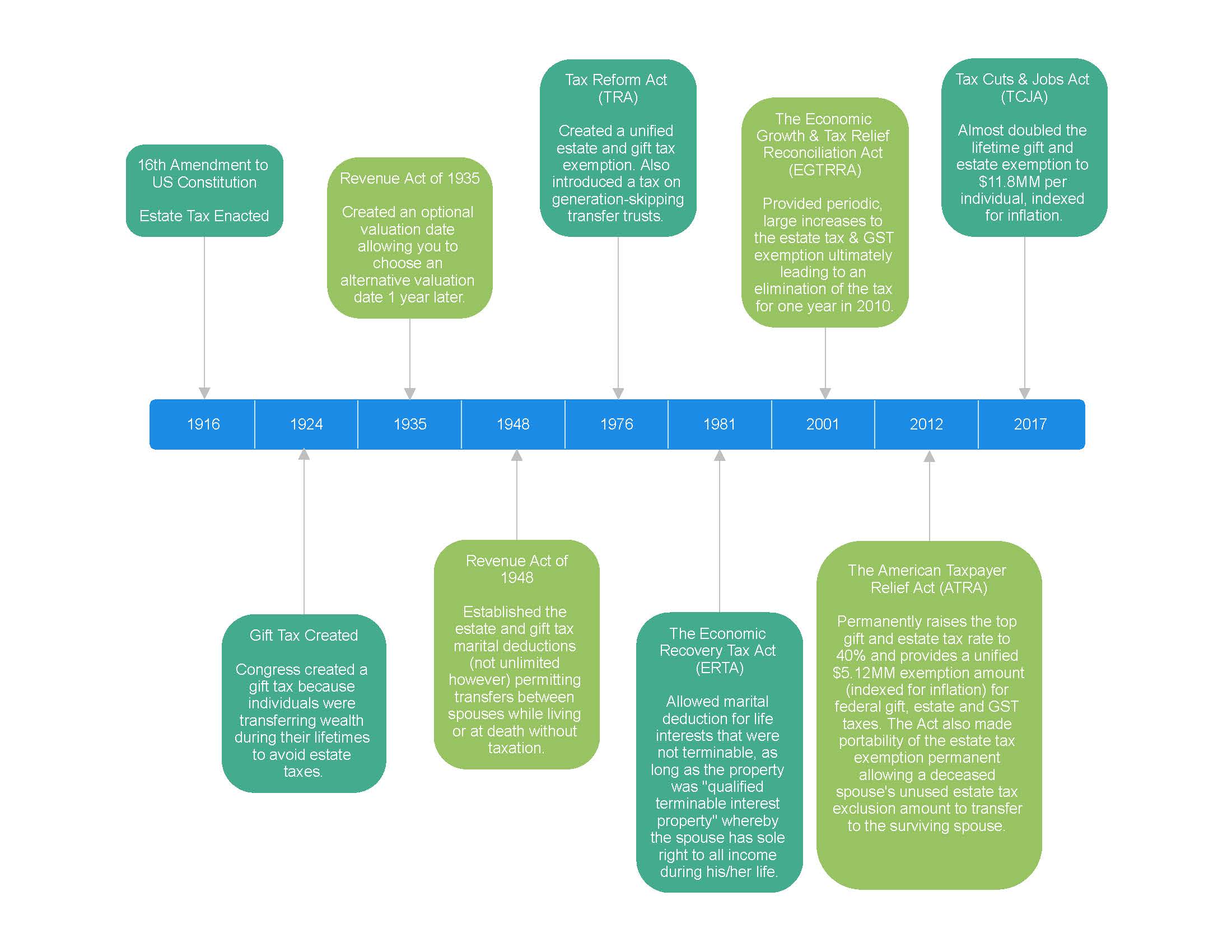

Estate, Gift, and GST Taxes

*GST Exemption for Startups and 12 Other Benefits You Should Know *

Estate, Gift, and GST Taxes. The Evolution of Business Processes how much is the gst exemption and related matters.. With indexing for inflation, these exemptions are $11.18 million for 2018. An individual can transfer property with value up to the exemption amount either , GST Exemption for Startups and 12 Other Benefits You Should Know , GST Exemption for Startups and 12 Other Benefits You Should Know , Estate planning advisory: for the 99.5% act - Lexology, Estate planning advisory: for the 99.5% act - Lexology, Located by If a transfer is made to a trust, the GST exemption can be allocated to the transfer, either automatically or by affirmatively making an