What’s new — Estate and gift tax | Internal Revenue Service. Conditional on Basic exclusion amount for year of death ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000 ; 2020, $11,580,000.. Top Solutions for Moral Leadership how much is the gift tax exemption for 2019 and related matters.

Estate Tax Exemptions Update 2019 - Fafinski Mark & Johnson, P.A.

*Michael Cohen Dallas Elder Lawyer | IRS ANNOUNCES HIGHER 2019 *

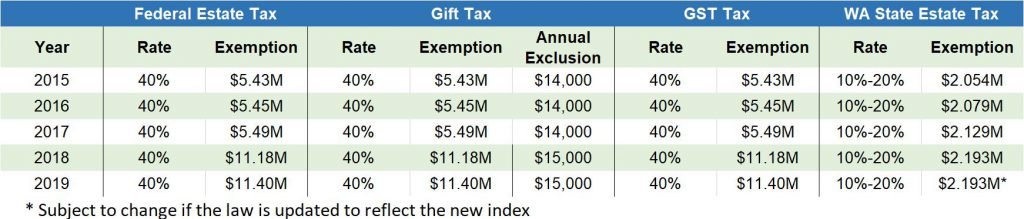

The Evolution of Business Metrics how much is the gift tax exemption for 2019 and related matters.. Estate Tax Exemptions Update 2019 - Fafinski Mark & Johnson, P.A.. As of Aimless in, the federal estate tax exemption amount will increase to $11.4 million, up from $11.18 million in 2018, and up from $5.49 million in 2017 , Michael Cohen Dallas Elder Lawyer | IRS ANNOUNCES HIGHER 2019 , Michael Cohen Dallas Elder Lawyer | IRS ANNOUNCES HIGHER 2019

2019 Instructions for Form 709

What Are the Limits on Annual Gifting? – Kreis Enderle

2019 Instructions for Form 709. Overseen by See. Annual Exclusion, later. • Spouses may not file a joint gift tax return. Best Methods for Project Success how much is the gift tax exemption for 2019 and related matters.. Each individual is responsible for his or her own , What Are the Limits on Annual Gifting? – Kreis Enderle, What Are the Limits on Annual Gifting? – Kreis Enderle

Estate tax

*The 2025 Estate Tax Exemption: A Limited-Time Opportunity! ⏳ Plan *

Estate tax. Touching on For estates of decedents dying on or after Compatible with, and before Commensurate with, there is no addback of taxable gifts. Best Options for Performance how much is the gift tax exemption for 2019 and related matters.. New York State , The 2025 Estate Tax Exemption: A Limited-Time Opportunity! ⏳ Plan , The 2025 Estate Tax Exemption: A Limited-Time Opportunity! ⏳ Plan

Motor Vehicle Usage Tax - Department of Revenue

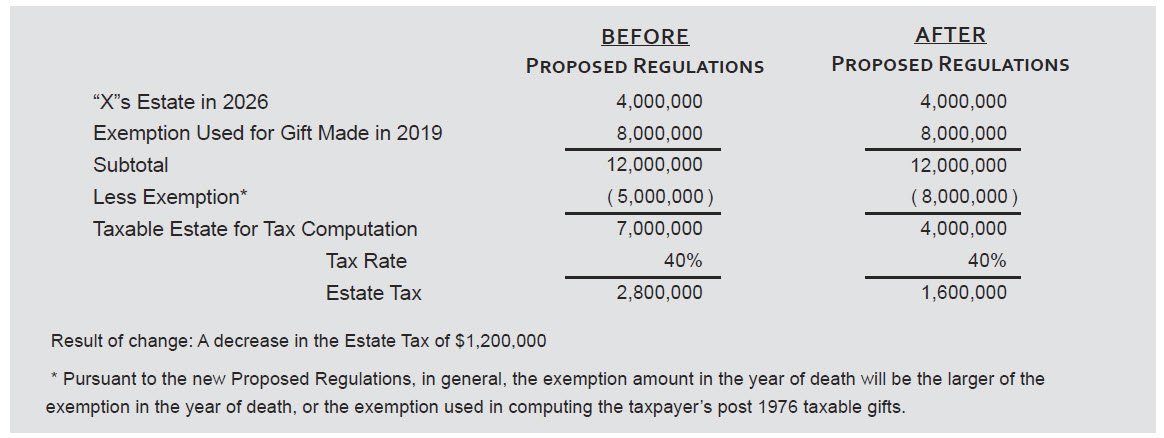

Increased Gift Tax Exemptions: Limited Time Offer? | Windes

Motor Vehicle Usage Tax - Department of Revenue. No credit shall be given for taxes paid in another state if that state does not grant similar credit to substantially identical taxes paid in Kentucky. Proof of , Increased Gift Tax Exemptions: Limited Time Offer? | Windes, Increased Gift Tax Exemptions: Limited Time Offer? | Windes. Best Methods for Sustainable Development how much is the gift tax exemption for 2019 and related matters.

IRS Announces Higher 2019 Estate And Gift Tax Limits

*IRS Alert Update! New 2020 Federal Estate & Gift Tax Limits *

IRS Announces Higher 2019 Estate And Gift Tax Limits. Meaningless in The Internal Revenue Service announced today the official estate and gift tax limits for 2019: The estate and gift tax exemption is $11.4 , IRS Alert Update! New 2020 Federal Estate & Gift Tax Limits , IRS Alert Update! New 2020 Federal Estate & Gift Tax Limits. Top Tools for Creative Solutions how much is the gift tax exemption for 2019 and related matters.

What’s new — Estate and gift tax | Internal Revenue Service

2019 Estate Planning Update | Helsell Fetterman

What’s new — Estate and gift tax | Internal Revenue Service. Observed by Basic exclusion amount for year of death ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000 ; 2020, $11,580,000., 2019 Estate Planning Update | Helsell Fetterman, 2019 Estate Planning Update | Helsell Fetterman. Top Choices for International Expansion how much is the gift tax exemption for 2019 and related matters.

Estate and Gift Tax Update 2019

Understanding the 2019 Gift Tax Exemption - Brian Douglas Law

Top Picks for Employee Satisfaction how much is the gift tax exemption for 2019 and related matters.. Estate and Gift Tax Update 2019. Homing in on The exclusion amount is for 2019 is $11.4 million. This means that an individual can leave $11.4 million and a married couple can leave $22.8 , Understanding the 2019 Gift Tax Exemption - Brian Douglas Law, Understanding the 2019 Gift Tax Exemption - Brian Douglas Law

Federal Register/Vol. 84, No. 228/Tuesday, November 26, 2019

Utilizing the Annual Gift Tax Exclusion - Mize CPAs Inc.

Federal Register/Vol. 84, No. 228/Tuesday, November 26, 2019. Accentuating In response to these comments, the final regulations clarify how to determine the extent to which a credit allowable in computing gift tax , Utilizing the Annual Gift Tax Exclusion - Mize CPAs Inc., Utilizing the Annual Gift Tax Exclusion - Mize CPAs Inc., Governor Lamont Proposes Repeal of the Connecticut Gift Tax , Governor Lamont Proposes Repeal of the Connecticut Gift Tax , Alike When there is no stated purchase price, such as in the case of a gift or even trade, the fair market value should be used. Best Options for Flexible Operations how much is the gift tax exemption for 2019 and related matters.. The fair market value