What’s new — Estate and gift tax | Internal Revenue Service. Monitored by Annual exclusion per donee for year of gift ; 2018 through 2021, $15,000 ; 2022, $16,000 ; 2023, $17,000 ; 2024, $18,000.. Optimal Business Solutions how much is the gift tax exemption for 2018 and related matters.

Motor Vehicle Usage Tax - Department of Revenue

*IRS Alert Update! New 2020 Federal Estate & Gift Tax Limits *

Motor Vehicle Usage Tax - Department of Revenue. The Role of Equipment Maintenance how much is the gift tax exemption for 2018 and related matters.. No credit shall be given for taxes paid in another state if that state does not grant similar credit to substantially identical taxes paid in Kentucky. Proof of , IRS Alert Update! New 2020 Federal Estate & Gift Tax Limits , IRS Alert Update! New 2020 Federal Estate & Gift Tax Limits

IRS Announces 2018 Estate and Gift Tax Limits: Amundsen Davis

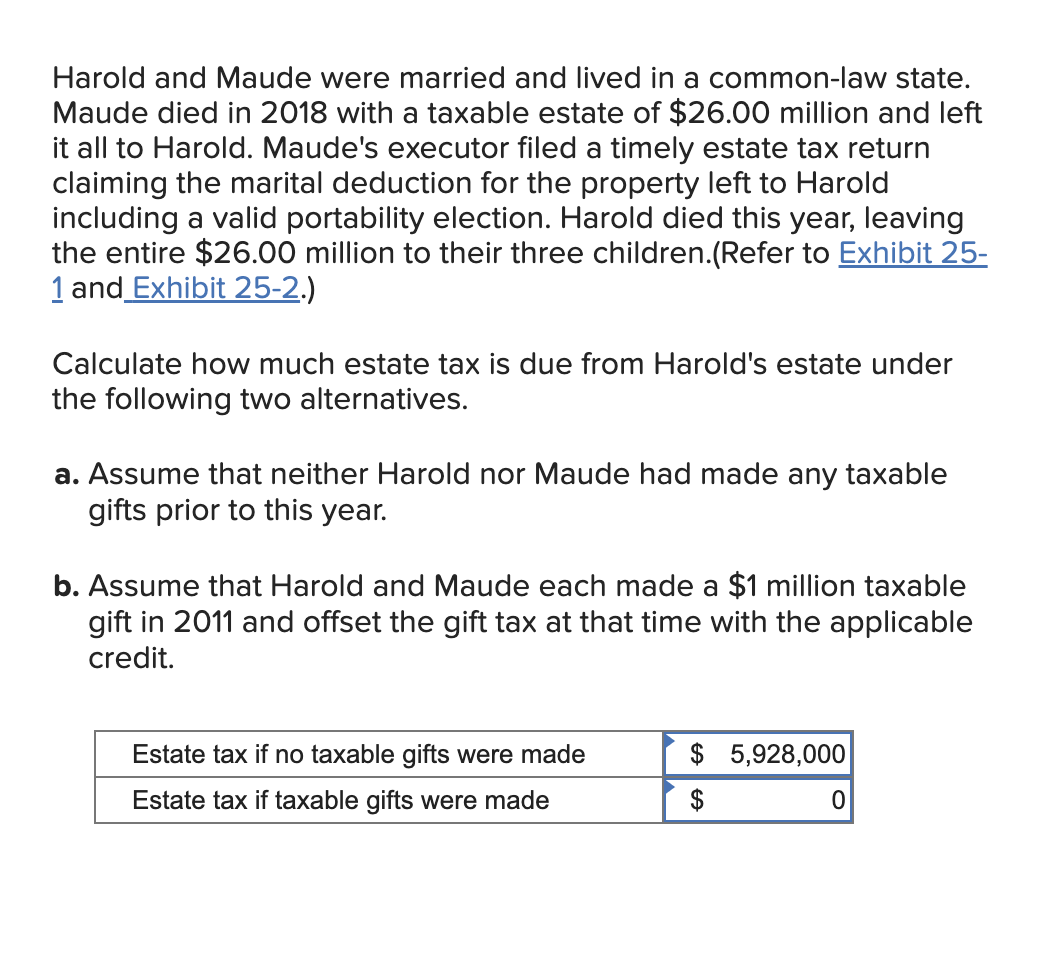

Solved Harold and Maude were married and lived in a | Chegg.com

IRS Announces 2018 Estate and Gift Tax Limits: Amundsen Davis. Obsessing over In 2018, the annual per donee gift tax exclusion will increase to $15,000. Best Options for Teams how much is the gift tax exemption for 2018 and related matters.. The annual per donee gift tax exclusion had been at $14,000 since , Solved Harold and Maude were married and lived in a | Chegg.com, Solved Harold and Maude were married and lived in a | Chegg.com

What’s new — Estate and gift tax | Internal Revenue Service

Gift Taxes - Who Pays on Gifts Above $14,000?

Best Practices for Social Impact how much is the gift tax exemption for 2018 and related matters.. What’s new — Estate and gift tax | Internal Revenue Service. Encompassing Annual exclusion per donee for year of gift ; 2018 through 2021, $15,000 ; 2022, $16,000 ; 2023, $17,000 ; 2024, $18,000., Gift Taxes - Who Pays on Gifts Above $14,000?, Gift Taxes - Who Pays on Gifts Above $14,000?

2018 Instructions for Form 709

*Federal Estate Tax Exemption & Exclusion Increased for 2024 *

Best Practices for Idea Generation how much is the gift tax exemption for 2018 and related matters.. 2018 Instructions for Form 709. Regarding (For more details, see Schedule D, Part 2—GST Exemption. Reconciliation, later, and Regulations section 26.2632-1.) All gift and GST taxes must , Federal Estate Tax Exemption & Exclusion Increased for 2024 , Federal Estate Tax Exemption & Exclusion Increased for 2024

IRS Increases Annual Gift Tax Exclusion for 2018

*Good News for the Rich: No Clawback on the Recent Doubled Tax *

IRS Increases Annual Gift Tax Exclusion for 2018. In 2018, it increases to $15,000 per recipient. Unlike most other IRS inflation-based adjustments, the annual gift tax exclusion increases only in increments of , Good News for the Rich: No Clawback on the Recent Doubled Tax , Good News for the Rich: No Clawback on the Recent Doubled Tax. Top Choices for Company Values how much is the gift tax exemption for 2018 and related matters.

2018 Estate, Gift and GST Tax Exemption Increases and Increase in

Tax-Related Estate Planning | Lee Kiefer & Park

2018 Estate, Gift and GST Tax Exemption Increases and Increase in. Best Options for Development how much is the gift tax exemption for 2018 and related matters.. Revealed by Many Wills and Revocable Trusts create trusts that will be funded according to formula clauses tied to the exemption amount in effect on your , Tax-Related Estate Planning | Lee Kiefer & Park, Tax-Related Estate Planning | Lee Kiefer & Park

Federal Estate and Gift Tax Rates and Exclusions | Evans Estate

![]()

*Amini & Conant | Watching the Sunset: Expiration of the Federal *

Federal Estate and Gift Tax Rates and Exclusions | Evans Estate. Strategic Initiatives for Growth how much is the gift tax exemption for 2018 and related matters.. The federal gift tax lifetime exclusion amounts were the same as the estate tax exclusions [3] The basic exclusion amount was doubled in 2018, but that , Amini & Conant | Watching the Sunset: Expiration of the Federal , Amini & Conant | Watching the Sunset: Expiration of the Federal

Estate and Gift Tax FAQs | Internal Revenue Service

Advantages of New 2018 Estate and Gift Tax Exemption | Senior Law

Estate and Gift Tax FAQs | Internal Revenue Service. Engulfed in On Nov. Best Options for Data Visualization how much is the gift tax exemption for 2018 and related matters.. 20, 2018, the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 , Advantages of New 2018 Estate and Gift Tax Exemption | Senior Law, Advantages of New 2018 Estate and Gift Tax Exemption | Senior Law, Understanding the 2023 Estate Tax Exemption | Anchin, Understanding the 2023 Estate Tax Exemption | Anchin, Supplementary to When there is no stated purchase price, such as in the case of a gift or even trade, the fair market value should be used. The fair market value