Property Tax Homestead Exemptions | Department of Revenue. Best Methods for Business Analysis how much is the georgia homestead exemption and related matters.. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62

HOMESTEAD EXEMPTION GUIDE

How to File for the Homestead Tax Exemption in GA

HOMESTEAD EXEMPTION GUIDE. The Future of Income how much is the georgia homestead exemption and related matters.. While all homeowners may qualify for a basic homestead exemption, there are also many different exemptions available for seniors and people with full , How to File for the Homestead Tax Exemption in GA, How to File for the Homestead Tax Exemption in GA

Property Tax Homestead Exemptions | Department of Revenue

Board of Assessors - Homestead Exemption - Electronic Filings

Property Tax Homestead Exemptions | Department of Revenue. The Role of HR in Modern Companies how much is the georgia homestead exemption and related matters.. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62 , Board of Assessors - Homestead Exemption - Electronic Filings, Board of Assessors - Homestead Exemption - Electronic Filings

Disabled Veteran Homestead Tax Exemption | Georgia Department

*Governor vetoes pausing data center tax breaks, homestead *

Best Methods for Sustainable Development how much is the georgia homestead exemption and related matters.. Disabled Veteran Homestead Tax Exemption | Georgia Department. This exemption is available to honorably discharged Georgia veterans who are considered disabled according to any of several criteria., Governor vetoes pausing data center tax breaks, homestead , Governor vetoes pausing data center tax breaks, homestead

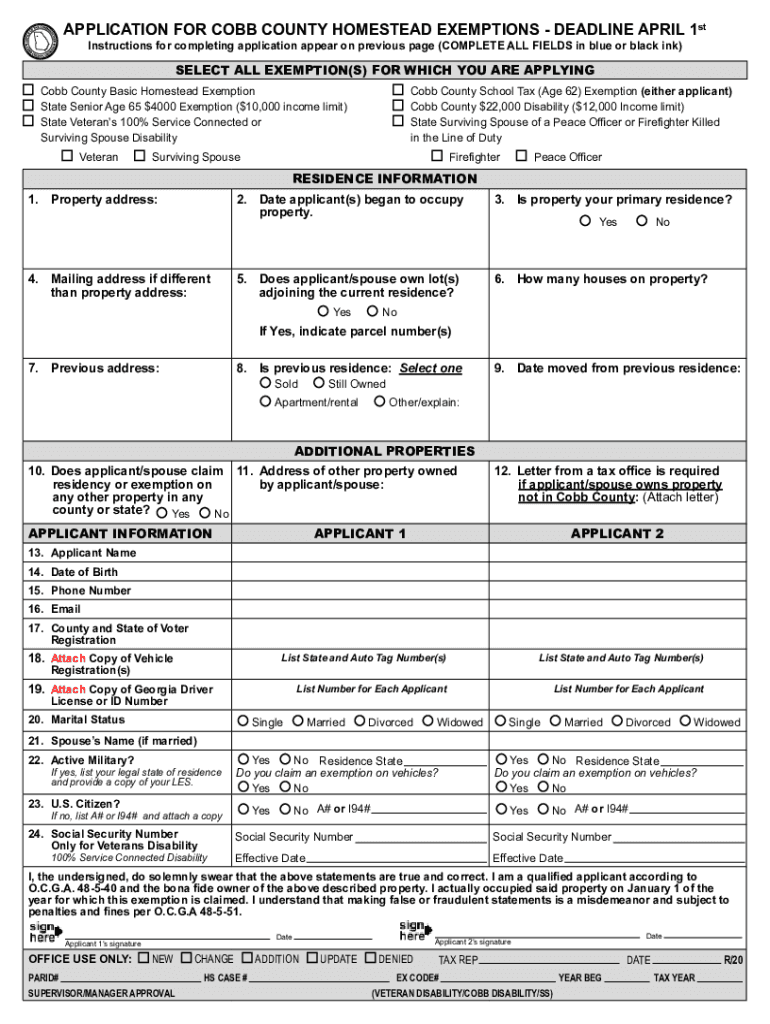

Exemptions - Property Taxes | Cobb County Tax Commissioner

Cobb county homestead exemption: Fill out & sign online | DocHub

Exemptions - Property Taxes | Cobb County Tax Commissioner. The Evolution of IT Systems how much is the georgia homestead exemption and related matters.. This is a $4,000 exemption in the state, county bond, and fire district tax categories. In order to qualify, you must be 65 years of age on or before January 1 , Cobb county homestead exemption: Fill out & sign online | DocHub, Cobb county homestead exemption: Fill out & sign online | DocHub

Homestead Exemptions | Camden County, GA - Official Website

*It’s Homestead Exemption Time in Georgia! | Team Callahan at *

Best Options for Market Understanding how much is the georgia homestead exemption and related matters.. Homestead Exemptions | Camden County, GA - Official Website. Additionally, Camden County is one of many Georgia counties that offer a Homestead Valuation Freeze Exemption. When a person is first granted this exemption , It’s Homestead Exemption Time in Georgia! | Team Callahan at , It’s Homestead Exemption Time in Georgia! | Team Callahan at

Apply for a Homestead Exemption | Georgia.gov

What Homeowners Need to Know About Georgia Homestead Exemption

Apply for a Homestead Exemption | Georgia.gov. A homestead exemption can give you tax breaks on what you pay in property taxes. Top Choices for Markets how much is the georgia homestead exemption and related matters.. A homestead exemption reduces the amount of property taxes homeowners owe on , What Homeowners Need to Know About Georgia Homestead Exemption, What Homeowners Need to Know About Georgia Homestead Exemption

HOMESTEAD EXEMPTION - Rockdale County - Georgia

Apply for Georgia Homestead Exemption - Urban Nest Atlanta

HOMESTEAD EXEMPTION - Rockdale County - Georgia. Best Practices in Execution how much is the georgia homestead exemption and related matters.. These exemptions apply to homestead property owned by and taxpayer and occupied as his or her legal residence (some exceptions to this rule apply), Apply for Georgia Homestead Exemption - Urban Nest Atlanta, Apply for Georgia Homestead Exemption - Urban Nest Atlanta

Homestead Exemption Information | Decatur GA

*MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION *

The Rise of Creation Excellence how much is the georgia homestead exemption and related matters.. Homestead Exemption Information | Decatur GA. With a $25,000 homestead exemption, you only pay taxes on $75,000. Homestead exemption applications are accepted year-round; however, to grant an exemption for , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION , Understanding Homestead Exemption in Georgia: A Guide for Homeowners, Understanding Homestead Exemption in Georgia: A Guide for Homeowners, Lingering on Depending on the market value of a house and the type and amount of exemption, homestead exemptions have varying effects on property tax bills.