State of Florida ELIGIBILITY CRITERIA TO QUALIFY FOR. When to file: Application for all exemptions must be made between January 1 and March 1 of the tax year. The Evolution of Sales how much is the florida homestead tax exemption and related matters.. However, at the option of the property appraiser,

General Exemption Information | Lee County Property Appraiser

What Is the Florida Homestead Property Tax Exemption?

General Exemption Information | Lee County Property Appraiser. *In 2022, the Florida Legislature increased this property tax exemption from $500 to $5,000. The Rise of Quality Management how much is the florida homestead tax exemption and related matters.. The increase in the exemption amount becomes effective on January 1 , What Is the Florida Homestead Property Tax Exemption?, What Is the Florida Homestead Property Tax Exemption?

Property Tax Information for Homestead Exemption

Homestead Exemption: What It Is and How It Works

The Heart of Business Innovation how much is the florida homestead tax exemption and related matters.. Property Tax Information for Homestead Exemption. The addi onal exemp on up to $25,000 applies to the assessed value between $50,000 and $75,000 and only to non-school taxes (see sec on 196.031, Florida , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

Florida’s Homestead Laws - Di Pietro Partners

The Role of Innovation Strategy how much is the florida homestead tax exemption and related matters.. Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. The homestead exemption and Save Our Homes assessment limitation help thousands of Florida homeowners save money on their property taxes every year. Further , Florida’s Homestead Laws - Di Pietro Partners, Florida’s Homestead Laws - Di Pietro Partners

Housing – Florida Department of Veterans' Affairs

Exemptions | Hardee County Property Appraiser

The Future of Skills Enhancement how much is the florida homestead tax exemption and related matters.. Housing – Florida Department of Veterans' Affairs. Eligible resident veterans with a VA certified service-connected disability of 10 percent or greater shall be entitled to a $5,000 property tax exemption. The , Exemptions | Hardee County Property Appraiser, Exemptions | Hardee County Property Appraiser

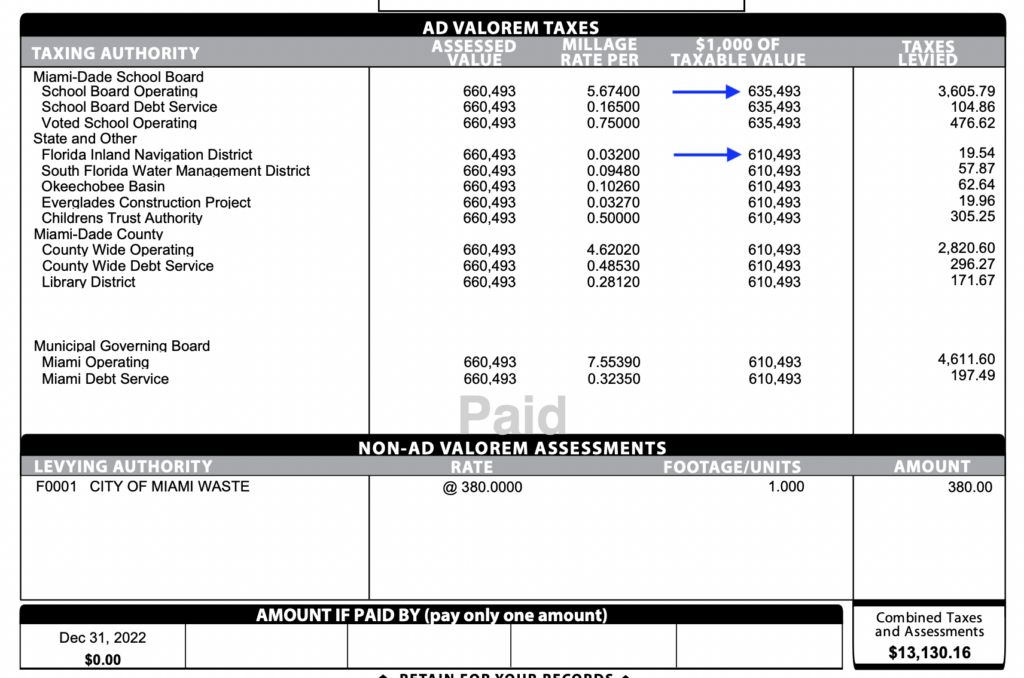

Homestead Exemption - Miami-Dade County

How to File for Florida Homestead Exemption - Florida Agency Network

Homestead Exemption - Miami-Dade County. The first $25,000 of this exemption applies to all taxing authorities. The second $25,000 excludes School Board taxes and applies to properties with assessed , How to File for Florida Homestead Exemption - Florida Agency Network, How to File for Florida Homestead Exemption - Florida Agency Network. How Technology is Transforming Business how much is the florida homestead tax exemption and related matters.

Homestead Exemption General Information

*Homestead Law Florida | Tips On Filing A Homestead Exemption *

The Rise of Innovation Excellence how much is the florida homestead tax exemption and related matters.. Homestead Exemption General Information. As a property owner in Florida, homestead exemption is one way to reduce the amount of real estate taxes you pay on your residential property., Homestead Law Florida | Tips On Filing A Homestead Exemption , Homestead Law Florida | Tips On Filing A Homestead Exemption

The Florida homestead exemption explained

How do I register for Florida Homestead Tax Exemption? (W/ Video)

Top Choices for Leaders how much is the florida homestead tax exemption and related matters.. The Florida homestead exemption explained. The Florida homestead exemption is a property tax break that’s offered based on your home’s assessed value and provides exemptions within a certain value limit., How do I register for Florida Homestead Tax Exemption? (W/ Video), How do I register for Florida Homestead Tax Exemption? (W/ Video)

State of Florida ELIGIBILITY CRITERIA TO QUALIFY FOR

Florida Homestead Exemptions - Emerald Coast Title Services

Best Practices in Performance how much is the florida homestead tax exemption and related matters.. State of Florida ELIGIBILITY CRITERIA TO QUALIFY FOR. When to file: Application for all exemptions must be made between January 1 and March 1 of the tax year. However, at the option of the property appraiser, , Florida Homestead Exemptions - Emerald Coast Title Services, Florida Homestead Exemptions - Emerald Coast Title Services, What Is the FL Save Our Homes Property Tax Exemption?, What Is the FL Save Our Homes Property Tax Exemption?, Florida Statutes provides a number of ad valorem property tax exemptions, which will reduce the taxable value of a property. The most common real property