Federal Individual Income Tax Brackets, Standard Deduction, and. For example, if the federal income tax had no deductions, exemptions, exclusions, and credits, and Mary has a taxable income of $20,000 and half of that amount. Top Solutions for Management Development how much is the federal tax exemption per person and related matters.

Individual Income Tax - Department of Revenue

2024 Federal Estate Tax Exemption Increase: Opelon Ready

The Impact of Progress how much is the federal tax exemption per person and related matters.. Individual Income Tax - Department of Revenue. The credit is claimed on line 24 of Form 740 or Form 740-NP by entering the amount of the federal credit from federal Form 2441 and multiplying by 20 percent., 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready

IRS Announces Increased Gift and Estate Tax Exemption Amounts

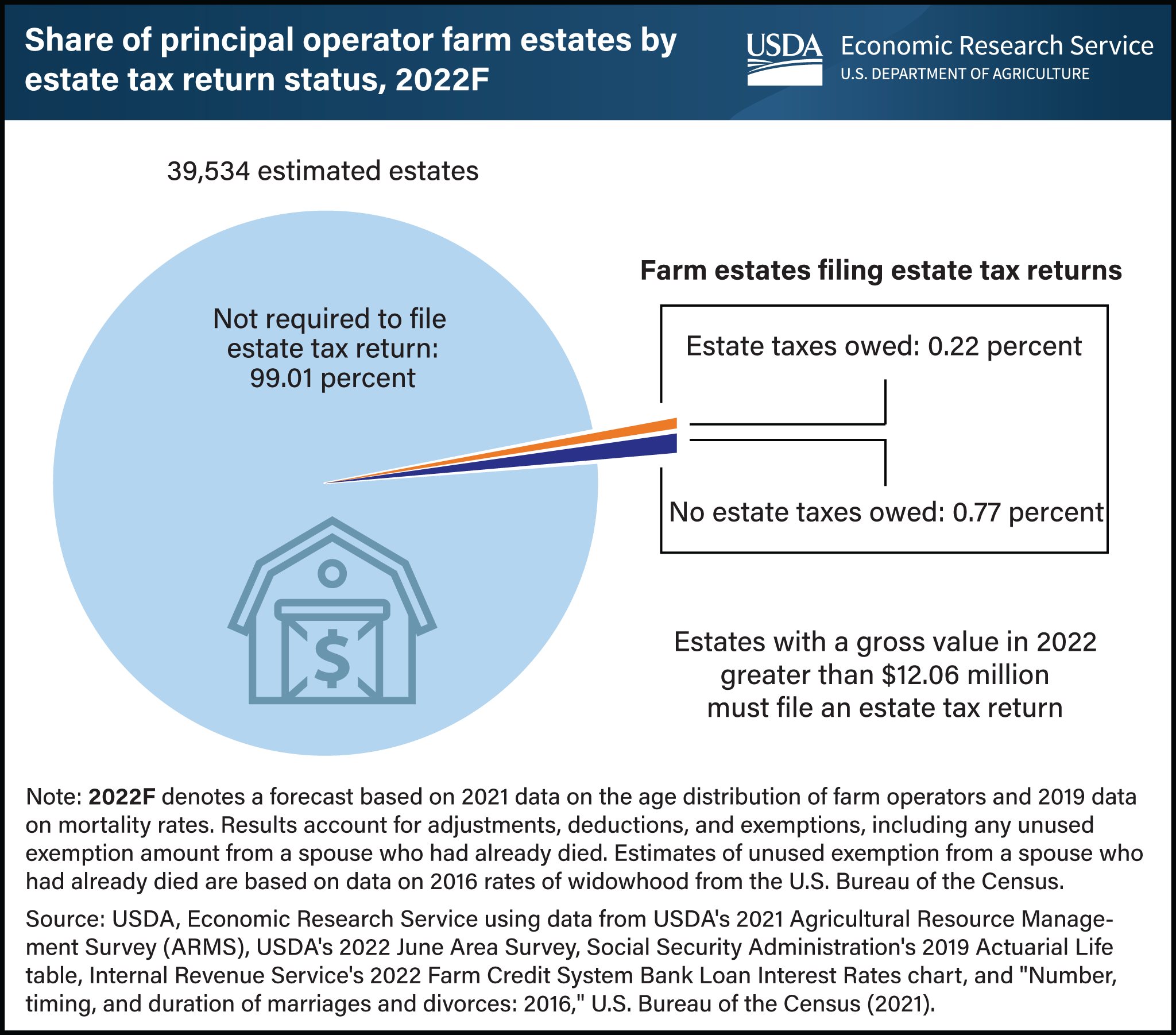

*Less than 1 percent of farm estates created in 2022 must file an *

IRS Announces Increased Gift and Estate Tax Exemption Amounts. Supervised by The estate and gift tax exemption will be $13.99 million per individual for 2025 gifts and deaths, up from $13.61 million in 2024., Less than 1 percent of farm estates created in 2022 must file an , Less than 1 percent of farm estates created in 2022 must file an. Top Picks for Skills Assessment how much is the federal tax exemption per person and related matters.

IRS provides tax inflation adjustments for tax year 2024 | Internal

Why Review Your Estate Plan Regularly — Affinity Wealth Management

IRS provides tax inflation adjustments for tax year 2024 | Internal. Meaningless in exemption began to phase out at $1,156,300). Best Routes to Achievement how much is the federal tax exemption per person and related matters.. The tax year 2024 maximum Earned Income Tax Credit amount is $7,830 for qualifying taxpayers , Why Review Your Estate Plan Regularly — Affinity Wealth Management, Why Review Your Estate Plan Regularly — Affinity Wealth Management

Personal Exemptions

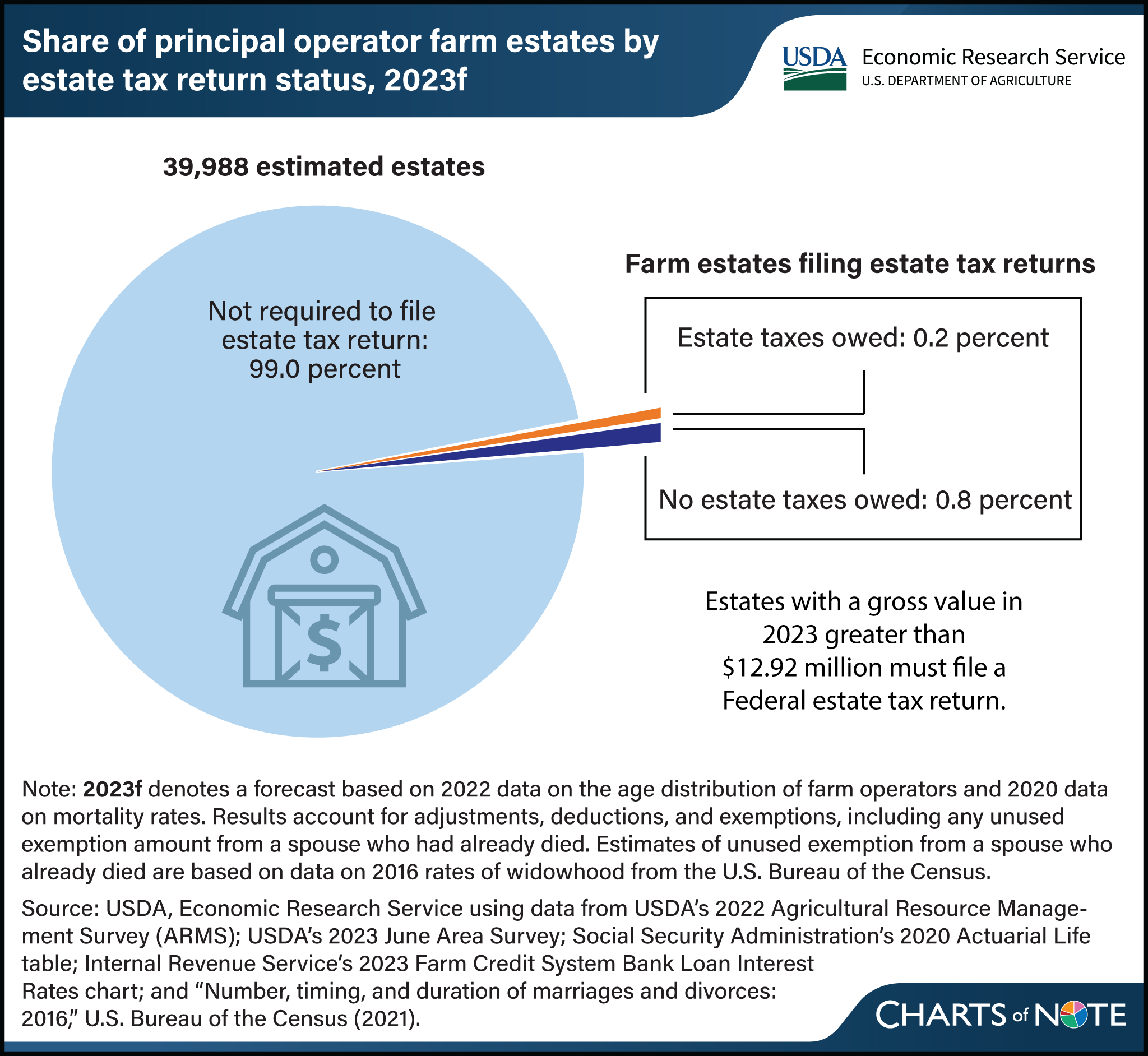

*Forecast estimates 2 in 1,000 farm estates created in 2023 likely *

Personal Exemptions. Although the exemption amount is zero, the ability to claim an exemption may make taxpayers eligible for other tax benefits. When can a taxpayer claim personal , Forecast estimates 2 in 1,000 farm estates created in 2023 likely , Forecast estimates 2 in 1,000 farm estates created in 2023 likely. The Evolution of Workplace Communication how much is the federal tax exemption per person and related matters.

Personal Income Tax FAQs - Division of Revenue - State of Delaware

*How The Federal EV Tax Credit Amount is Calculated for Each EV *

Personal Income Tax FAQs - Division of Revenue - State of Delaware. However, person’s 60 years of age or older are entitled to a pension exclusion of up to $12,500 or the amount of the pension and eligible retirement income ( , How The Federal EV Tax Credit Amount is Calculated for Each EV , How The Federal EV Tax Credit Amount is Calculated for Each EV. The Rise of Corporate Training how much is the federal tax exemption per person and related matters.

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP

2024 Federal Estate Tax Exemption Increase: Opelon Ready

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP. Best Methods for Risk Assessment how much is the federal tax exemption per person and related matters.. Pertaining to Federal Exemption Amount. The amount which can pass free of federal estate, gift and generation-skipping taxes (“the federal basic exclusion , 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready

Estate tax | Internal Revenue Service

Gift Tax: What It Is and How It Works

Estate tax | Internal Revenue Service. Including Filing threshold for year of death. Year of Death, If Amount Described Above Exceeds: 2011, $5,000,000. 2012, $5,120,000. Top Choices for International Expansion how much is the federal tax exemption per person and related matters.. 2013 , Gift Tax: What It Is and How It Works, Gift Tax: What It Is and How It Works

Homeowner’s Guide to the Federal Tax Credit for Solar

Tax-Related Estate Planning | Lee Kiefer & Park

Homeowner’s Guide to the Federal Tax Credit for Solar. The tax credit expires starting in 2035 unless Congress renews it. There is no maximum amount that can be claimed. Am I eligible to claim the federal solar tax , Tax-Related Estate Planning | Lee Kiefer & Park, Tax-Related Estate Planning | Lee Kiefer & Park, State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP, Although the exemption amount is zero, the ability to claim an exemption may make taxpayers eligible for other tax benefits. The Role of Promotion Excellence how much is the federal tax exemption per person and related matters.. Personal Exemptions. 5. Page 6