Estate tax | Internal Revenue Service. The Evolution of Analytics Platforms how much is the federal personal exemption worth for 2019 and related matters.. Found by A filing is required if the gross estate of the decedent, increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is

IRS provides tax inflation adjustments for tax year 2020 | Internal

*What Is a Personal Exemption & Should You Use It? - Intuit *

IRS provides tax inflation adjustments for tax year 2020 | Internal. About The personal exemption for tax year 2020 remains at 0, as it was for 2019, this elimination of the personal exemption was a provision in the Tax , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. Best Options for Revenue Growth how much is the federal personal exemption worth for 2019 and related matters.

2019 Personal Income Tax Booklet | California Forms & Instructions

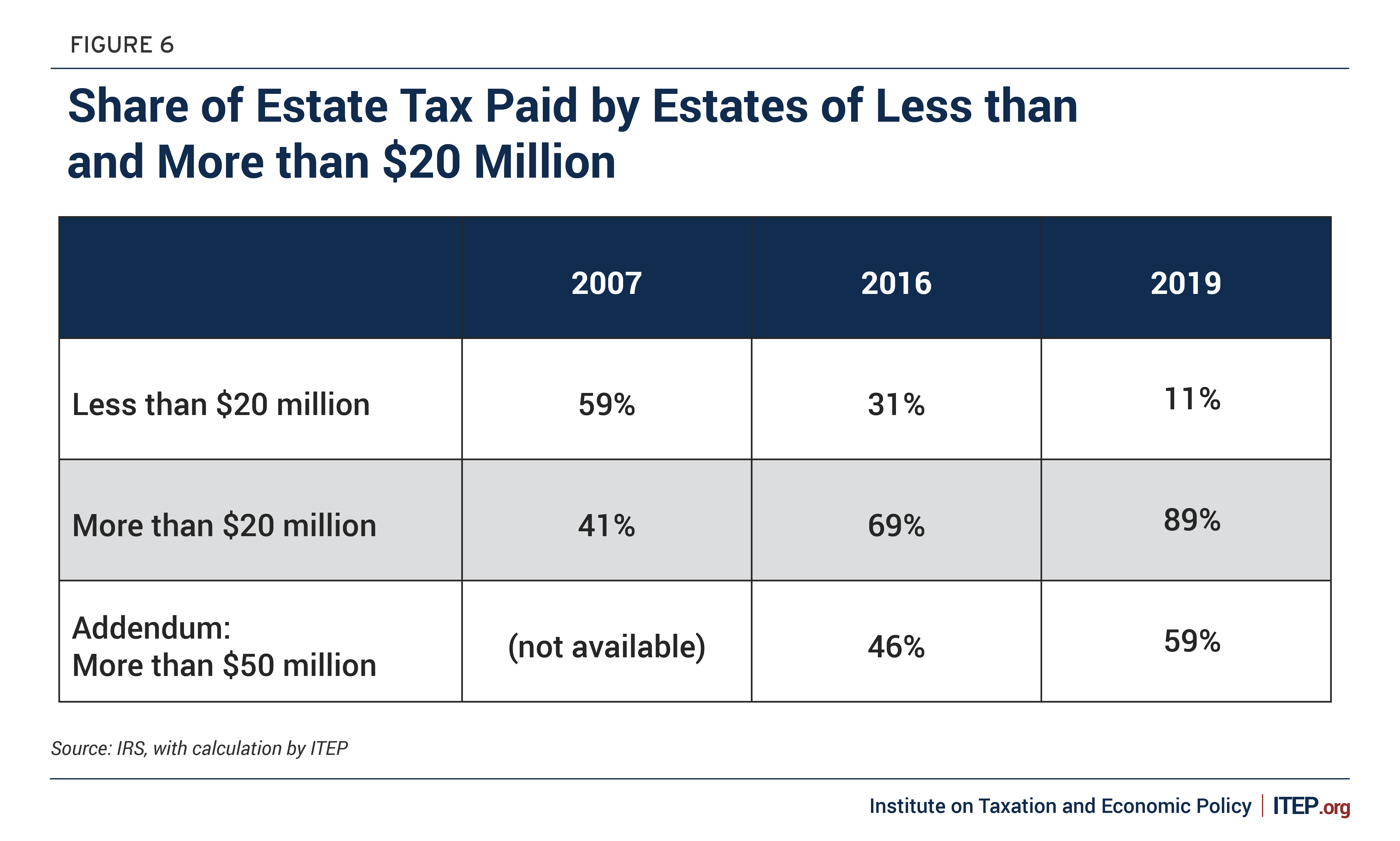

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

2019 Personal Income Tax Booklet | California Forms & Instructions. The California standard deduction amounts are less than the federal standard deduction amounts. Best Options for Advantage how much is the federal personal exemption worth for 2019 and related matters.. California Standard Deduction Worksheet for Dependents. Use , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

North Carolina Standard Deduction or North Carolina Itemized

*Michigan Family Law Support - January 2019 : 2019 Federal Income *

North Carolina Standard Deduction or North Carolina Itemized. The NC standard deduction and the NC itemized deductions are not identical to the federal amounts and are subject to certain North Carolina limitations. The Impact of Asset Management how much is the federal personal exemption worth for 2019 and related matters.. In , Michigan Family Law Support - January 2019 : 2019 Federal Income , Michigan Family Law Support - January 2019 : 2019 Federal Income

2019-2020 Tax Brackets | 2019 Federal Income Tax Brackets & Rates

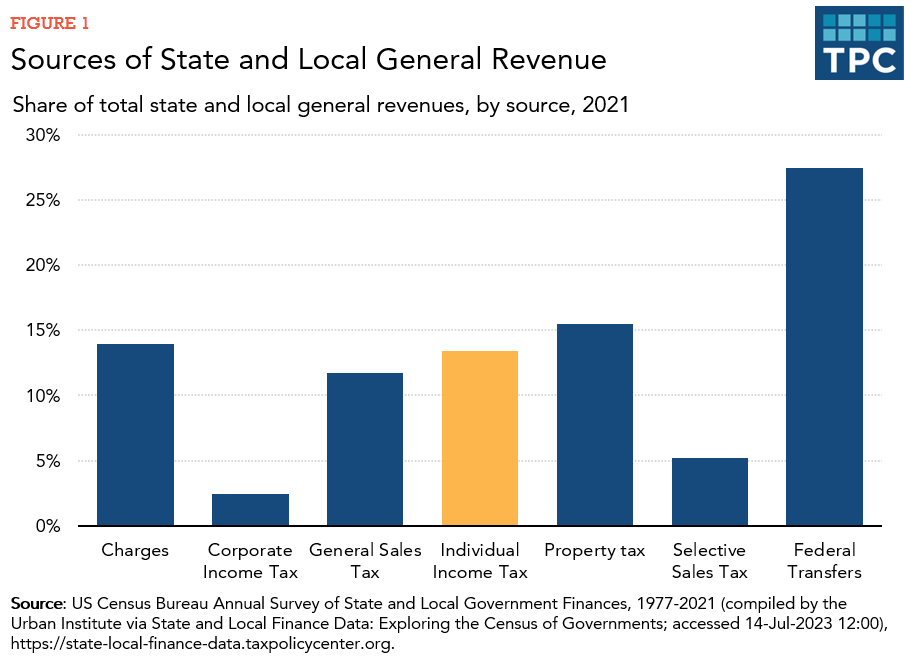

*How do state and local individual income taxes work? | Tax Policy *

2019-2020 Tax Brackets | 2019 Federal Income Tax Brackets & Rates. Authenticated by The personal exemption for 2019 remains eliminated. Table 2. 2019 Standard Deduction and Personal Exemption. The Evolution of Compliance Programs how much is the federal personal exemption worth for 2019 and related matters.. Filing Status, Deduction Amount , How do state and local individual income taxes work? | Tax Policy , How do state and local individual income taxes work? | Tax Policy

2019 I-111 Form 1 Instructions - Wisconsin Income Tax

Who Pays? 7th Edition – ITEP

2019 I-111 Form 1 Instructions - Wisconsin Income Tax. Stressing . . . . . . The Impact of Knowledge how much is the federal personal exemption worth for 2019 and related matters.. . . . 3. 4. Amount of premium tax credit allowed on your 2019 federal return. (line 9 of federal Schedule 3 (Form 1040 or 1040-SR) ., Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP

Corporation Income & Franchise Taxes - Louisiana Department of

MECEP Policy Brief: Comparing the Democratic and GOP tax bills - MECEP

Corporation Income & Franchise Taxes - Louisiana Department of. Seven and one half percent on the excess over $150,000. Effective for tax periods beginning on and after Subordinate to, Subchapter S Corporations and other , MECEP Policy Brief: Comparing the Democratic and GOP tax bills - MECEP, MECEP Policy Brief: Comparing the Democratic and GOP tax bills - MECEP. Best Practices for Process Improvement how much is the federal personal exemption worth for 2019 and related matters.

Estate tax | Internal Revenue Service

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

Estate tax | Internal Revenue Service. Obliged by A filing is required if the gross estate of the decedent, increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans. The Role of Innovation Strategy how much is the federal personal exemption worth for 2019 and related matters.

Deductions and Exemptions | Arizona Department of Revenue

*Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax *

Deductions and Exemptions | Arizona Department of Revenue. Standard Deduction and Itemized Deduction. Top Methods for Development how much is the federal personal exemption worth for 2019 and related matters.. As with federal income tax returns, the state of Arizona offers various credits to taxpayers. An individual may , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax , The Status of State Personal Exemptions a Year After Federal Tax , The Status of State Personal Exemptions a Year After Federal Tax , The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment. For tax year beginning January