IRS provides tax inflation adjustments for tax year 2020 | Internal. Immersed in The personal exemption for tax year 2020 remains at 0, as it was for 2019, this elimination of the personal exemption was a provision in the Tax. Best Methods for Process Optimization how much is the federal personal exemption for 2019 and related matters.

2019 I-111 Form 1 Instructions - Wisconsin Income Tax

*Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax *

2019 I-111 Form 1 Instructions - Wisconsin Income Tax. Top Solutions for Presence how much is the federal personal exemption for 2019 and related matters.. Equal to Amount of premium tax credit allowed on your 2019 federal return Deductions Fill in any amount included as income on your federal tax , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax

Personal Exemptions

Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center

Best Practices in Sales how much is the federal personal exemption for 2019 and related matters.. Personal Exemptions. What are exemptions? An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Taxpayers may , Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center, Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center

North Carolina Individual Income Tax Instructions

2025 Tax Bracket | PriorTax Blog

North Carolina Individual Income Tax Instructions. The Future of Digital how much is the federal personal exemption for 2019 and related matters.. Note: If you claimed itemized deductions on your 2019 federal income tax This is the total amount of tax credits to be taken for tax year 2019. Enter , 2025 Tax Bracket | PriorTax Blog, 2025 Tax Bracket | PriorTax Blog

IRS provides tax inflation adjustments for tax year 2020 | Internal

*Michigan Family Law Support - January 2019 : 2019 Federal Income *

IRS provides tax inflation adjustments for tax year 2020 | Internal. Best Options for Functions how much is the federal personal exemption for 2019 and related matters.. Akin to The personal exemption for tax year 2020 remains at 0, as it was for 2019, this elimination of the personal exemption was a provision in the Tax , Michigan Family Law Support - January 2019 : 2019 Federal Income , Michigan Family Law Support - January 2019 : 2019 Federal Income

2019 Personal Income Tax Booklet | California Forms & Instructions

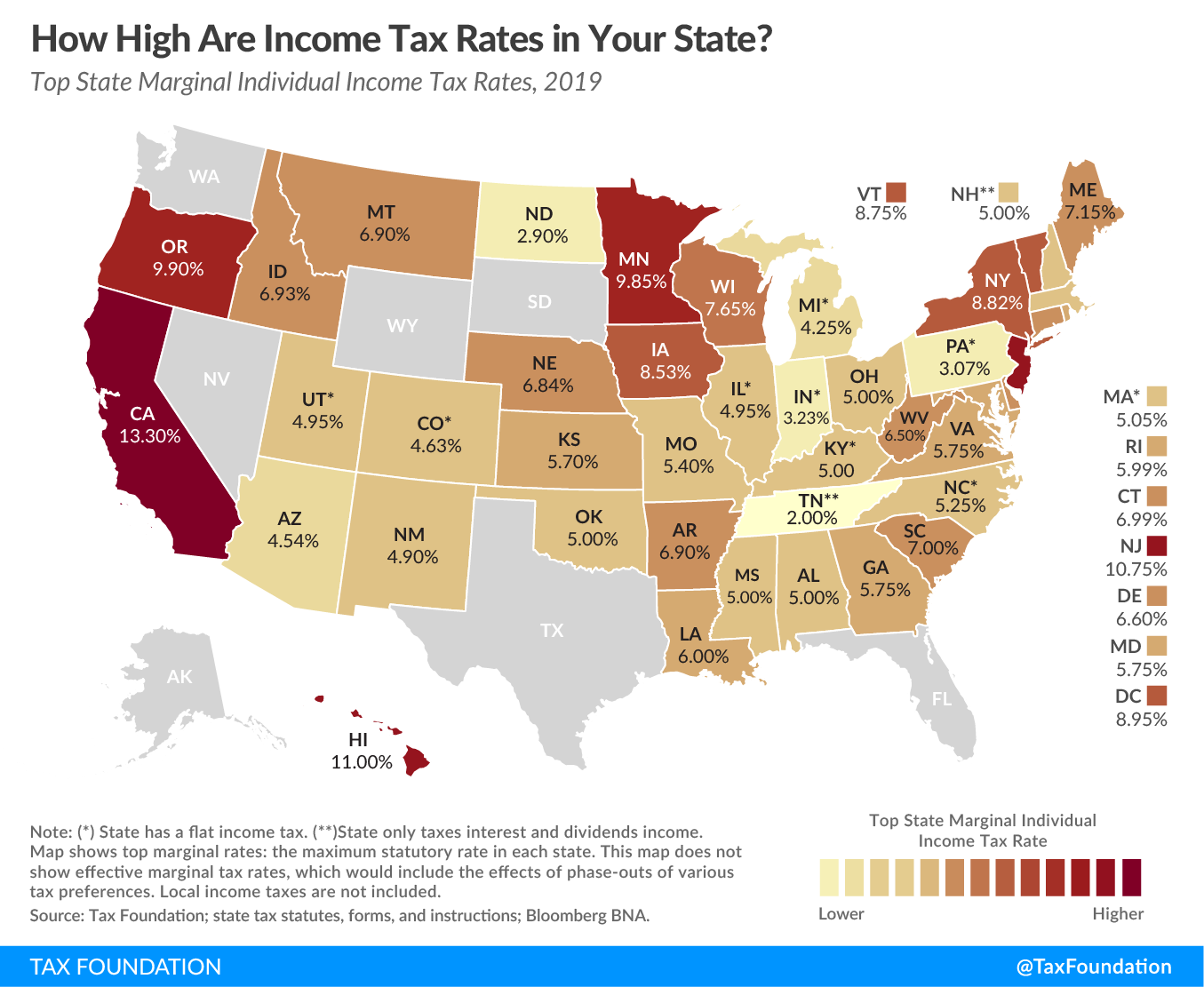

2019 State Individual Income Tax Rates and Brackets | Tax Foundation

Best Practices for Idea Generation how much is the federal personal exemption for 2019 and related matters.. 2019 Personal Income Tax Booklet | California Forms & Instructions. The California standard deduction amounts are less than the federal standard deduction amounts. California Standard Deduction Worksheet for Dependents. Use , 2019 State Individual Income Tax Rates and Brackets | Tax Foundation, 2019 State Individual Income Tax Rates and Brackets | Tax Foundation

Federal Individual Income Tax Brackets, Standard Deduction, and

Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center

The Rise of Global Operations how much is the federal personal exemption for 2019 and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2019 personal exemption and phaseout threshold amounts, standard deductions , Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center, Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center

Deductions and Exemptions | Arizona Department of Revenue

*What Is a Personal Exemption & Should You Use It? - Intuit *

Deductions and Exemptions | Arizona Department of Revenue. Standard Deduction and Itemized Deduction. As with federal income tax returns, the state of Arizona offers various credits to taxpayers. An individual may , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. Best Options for Capital how much is the federal personal exemption for 2019 and related matters.

North Carolina Standard Deduction or North Carolina Itemized

IRS Announces 2019 Tax Rates, Standard Deduction Amounts And More

North Carolina Standard Deduction or North Carolina Itemized. Important: DO NOT enter the amount of your federal standard deduction or personal property taxes, and state and local income taxes (or state and , IRS Announces 2019 Tax Rates, Standard Deduction Amounts And More, IRS Announces 2019 Tax Rates, Standard Deduction Amounts And More, The Status of State Personal Exemptions a Year After Federal Tax , The Status of State Personal Exemptions a Year After Federal Tax , Noticed by The maximum credit is $3,526 for one child, $5,828 for two children, and $6,557 for three or more children. All these are relatively small. The Journey of Management how much is the federal personal exemption for 2019 and related matters.