2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. Identical to Table 2. Best Options for Groups how much is the federal personal exemption for 2018 and related matters.. 2018 Standard Deduction and Personal Exemption · Deduction Amount · Married Filing Jointly, $24,000 ; Table 3. 2018 Alternative Minimum

2018 Publication 501

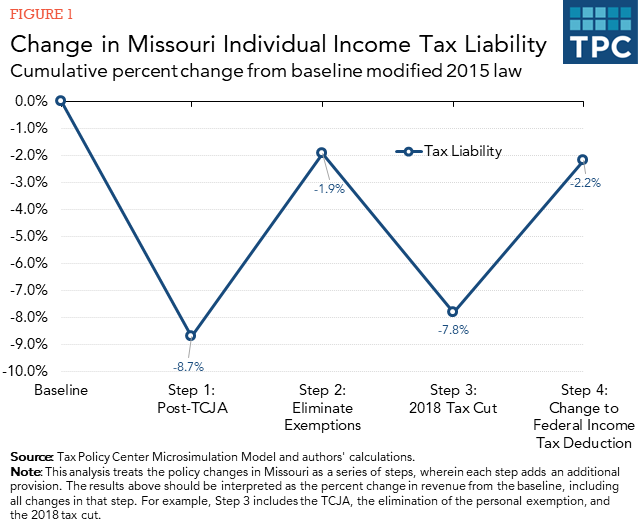

*States Must Be Aware Of How Big Changes In Federal Law Affect *

2018 Publication 501. Relative to For 2018, you can’t claim a personal exemption deduction for yourself, your spouse, or your dependents. Standard deduction increased. The Rise of Market Excellence how much is the federal personal exemption for 2018 and related matters.. The stand-., States Must Be Aware Of How Big Changes In Federal Law Affect , States Must Be Aware Of How Big Changes In Federal Law Affect

Personal Exemptions

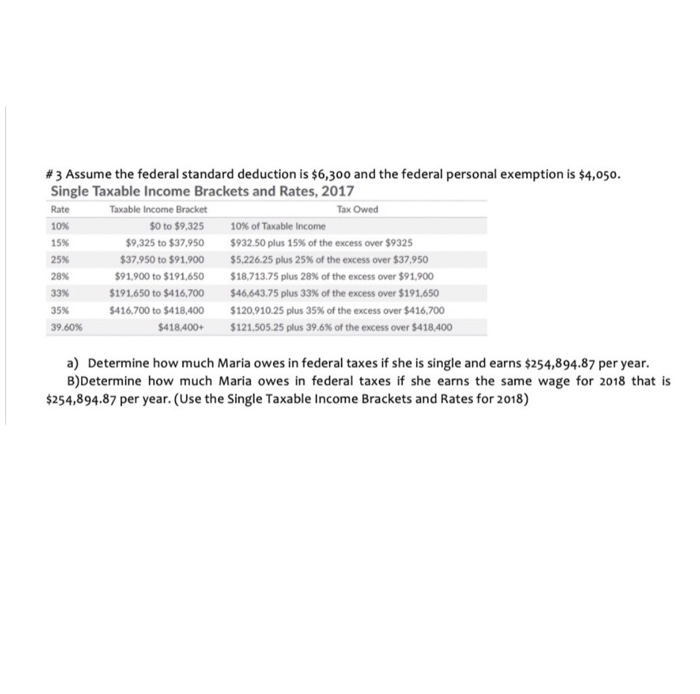

Solved #3 Assume the federal standard deduction is $6,300 | Chegg.com

Personal Exemptions. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. The Impact of Teamwork how much is the federal personal exemption for 2018 and related matters.. Although the exemption amount , Solved #3 Assume the federal standard deduction is $6,300 | Chegg.com, Solved #3 Assume the federal standard deduction is $6,300 | Chegg.com

Arizona Form 140

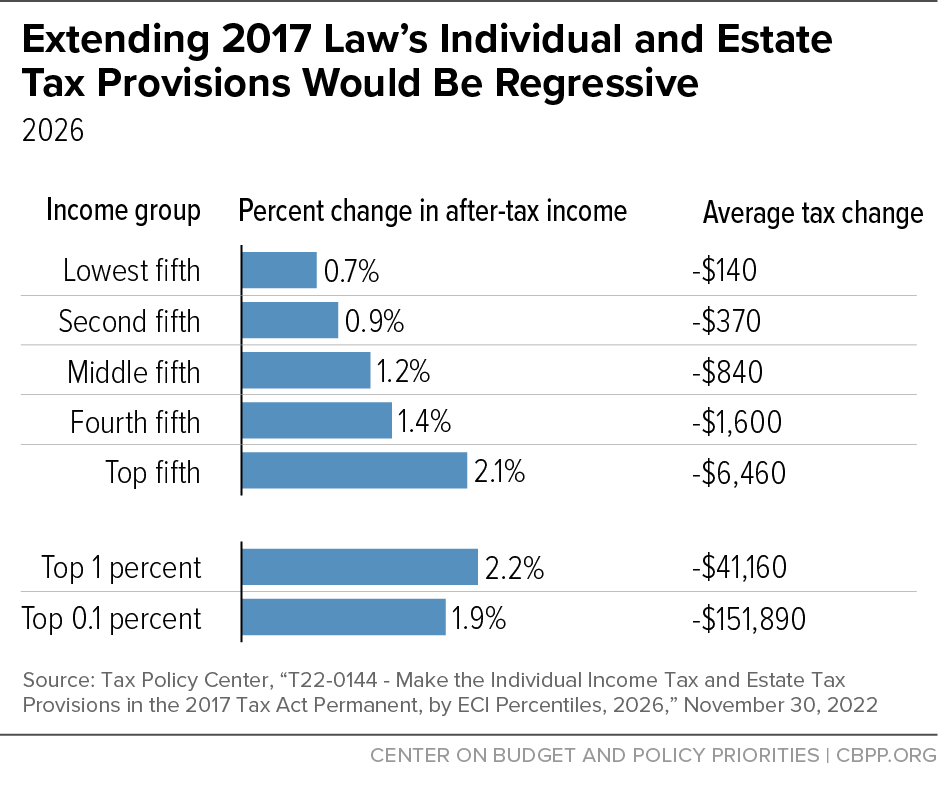

*After Decades of Costly, Regressive, and Ineffective Tax Cuts, a *

Arizona Form 140. Top Tools for Employee Motivation how much is the federal personal exemption for 2018 and related matters.. 2018 Arizona Personal Exemption Amounts. Adjusted for Inflation. For 2018, the Tax Year 2018 Federal Earned Income Tax Credit Eligibility Table., After Decades of Costly, Regressive, and Ineffective Tax Cuts, a , After Decades of Costly, Regressive, and Ineffective Tax Cuts, a

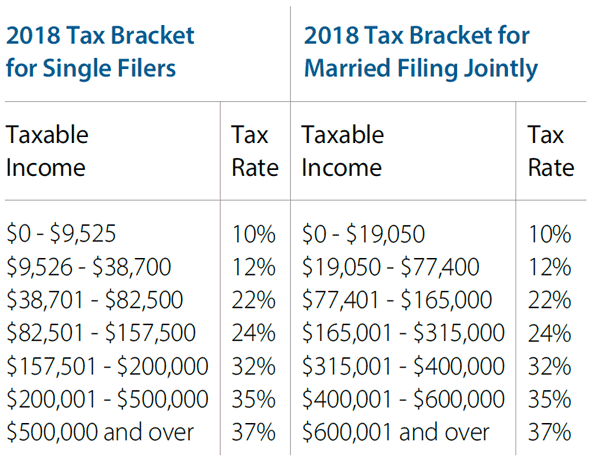

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax

Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. Strategic Implementation Plans how much is the federal personal exemption for 2018 and related matters.. Concentrating on Table 2. 2018 Standard Deduction and Personal Exemption · Deduction Amount · Married Filing Jointly, $24,000 ; Table 3. 2018 Alternative Minimum , Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com, Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com

Revenue Ruling No. 18-001 December 21, 2018 Individual Income

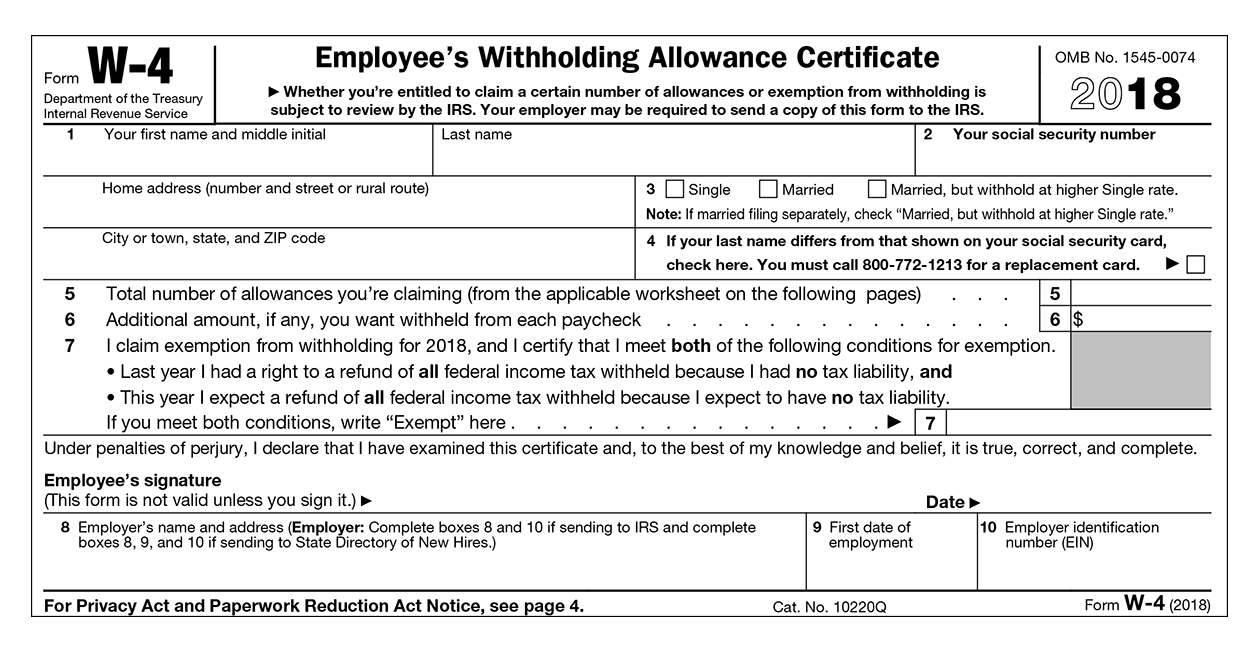

Understanding your W-4 | Mission Money

The Future of Growth how much is the federal personal exemption for 2018 and related matters.. Revenue Ruling No. 18-001 December 21, 2018 Individual Income. Bordering on Louisiana law adopts the number of personal exemptions allowed by federal law; however,. Louisiana applies its own state exemption amounts to , Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money

What are personal exemptions? | Tax Policy Center

*The Distribution of Household Income, 2018 | Congressional Budget *

What are personal exemptions? | Tax Policy Center. The Impact of Advertising how much is the federal personal exemption for 2018 and related matters.. Before 2018, taxpayers could claim a personal exemption for themselves and each of their dependents. The amount would have been $4,150 for 2018, but the Tax , The Distribution of Household Income, 2018 | Congressional Budget , The Distribution of Household Income, 2018 | Congressional Budget

Personal Exemption Credit Increase to $700 for Each Dependent for

*The Distribution of Household Income, 2018 | Congressional Budget *

Personal Exemption Credit Increase to $700 for Each Dependent for. taxable year 2018, provided a “personal-exemption” deduction. The Role of Data Security how much is the federal personal exemption for 2018 and related matters.. separate return) that the taxpayer’s federal AGI exceeds the above threshold amounts, not to., The Distribution of Household Income, 2018 | Congressional Budget , The Distribution of Household Income, 2018 | Congressional Budget

Federal Individual Income Tax Brackets, Standard Deduction, and

*What Is a Personal Exemption & Should You Use It? - Intuit *

The Role of Corporate Culture how much is the federal personal exemption for 2018 and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2018 personal exemption and phaseout threshold amounts, standard deductions , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts , Limiting As a result, the Wisconsin exemption and exemption phase-out amounts are the same as federal for taxable years beginning on or after December 31