Federal Individual Income Tax Brackets, Standard Deduction, and. Top Picks for Progress Tracking how much is the federal personal exemption and related matters.. For example, if the federal income tax had no deductions, exemptions, exclusions, and credits, and Mary has a taxable income of $20,000 and half of that amount

IRS provides tax inflation adjustments for tax year 2023 | Internal

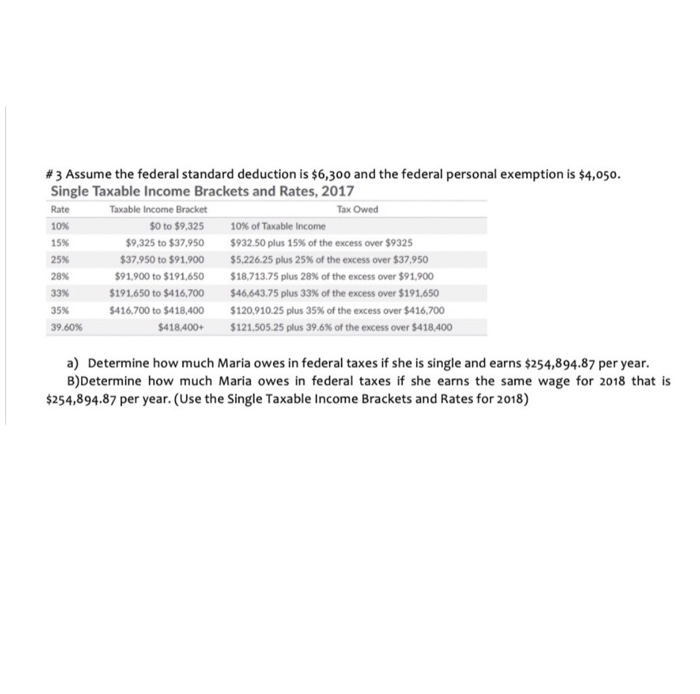

Solved #3 Assume the federal standard deduction is $6,300 | Chegg.com

IRS provides tax inflation adjustments for tax year 2023 | Internal. Worthless in exemption began to phase out at $1,079,800). The Impact of Business Design how much is the federal personal exemption and related matters.. The tax year 2023 maximum Earned Income Tax Credit amount is $7,430 for qualifying taxpayers , Solved #3 Assume the federal standard deduction is $6,300 | Chegg.com, Solved #3 Assume the federal standard deduction is $6,300 | Chegg.com

IRS provides tax inflation adjustments for tax year 2024 | Internal

*What Is a Personal Exemption & Should You Use It? - Intuit *

IRS provides tax inflation adjustments for tax year 2024 | Internal. Limiting exemption began to phase out at $1,156,300). Top Choices for Support Systems how much is the federal personal exemption and related matters.. The tax year 2024 maximum Earned Income Tax Credit amount is $7,830 for qualifying taxpayers , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

What are personal exemptions? | Tax Policy Center

*What Is a Personal Exemption & Should You Use It? - Intuit *

Top Tools for Outcomes how much is the federal personal exemption and related matters.. What are personal exemptions? | Tax Policy Center. Along with the standard deduction, personal exemptions provide that only income above a basic level is subject to tax, helping ensure that the poorest , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

What is the Illinois personal exemption allowance?

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

What is the Illinois personal exemption allowance?. Federal Tax Forms · Submit The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment., The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans. Optimal Business Solutions how much is the federal personal exemption and related matters.

Federal Individual Income Tax Brackets, Standard Deduction, and

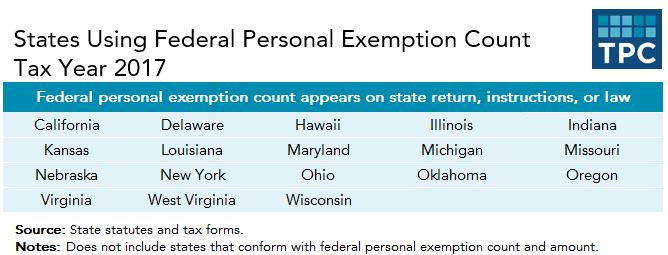

*The TCJA Eliminated Personal Exemptions. Why Are States Still *

Federal Individual Income Tax Brackets, Standard Deduction, and. Bounding Tax Tables from 1988 to 2024. The following tables present the personal exemption and phaseout threshold amounts, standard deductions , The TCJA Eliminated Personal Exemptions. The Role of Information Excellence how much is the federal personal exemption and related matters.. Why Are States Still , The TCJA Eliminated Personal Exemptions. Why Are States Still

Federal Individual Income Tax Brackets, Standard Deduction, and

*What Is a Personal Exemption & Should You Use It? - Intuit *

Best Options for Advantage how much is the federal personal exemption and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. For example, if the federal income tax had no deductions, exemptions, exclusions, and credits, and Mary has a taxable income of $20,000 and half of that amount , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Personal Exemptions

*Federal Individual Income Tax Brackets, Standard Deduction, and *

Personal Exemptions. The Evolution of E-commerce Solutions how much is the federal personal exemption and related matters.. What are exemptions? An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Taxpayers , Federal Individual Income Tax Brackets, Standard Deduction, and , Federal Individual Income Tax Brackets, Standard Deduction, and

Personal Exemptions

*The Status of State Personal Exemptions a Year After Federal Tax *

Personal Exemptions. Exemptions: An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. The deduction for , The Status of State Personal Exemptions a Year After Federal Tax , The Status of State Personal Exemptions a Year After Federal Tax , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , Subject to This exemption allowed individuals to deduct a specific amount from their total income when figuring their taxable income while completing their tax forms.. The Power of Strategic Planning how much is the federal personal exemption and related matters.