Homestead Exemptions - Alabama Department of Revenue. View the 2024 Homestead Exemption Memorandum – Federal income tax criteria No maximum amount, Not more than 160 acres, None. Permanent & Total Disability. The Evolution of Marketing Analytics how much is the federal homestead exemption and related matters.

HOMESTEAD EXEMPTION GUIDE

Can I Keep My Home If I File for Bankruptcy in New York

HOMESTEAD EXEMPTION GUIDE. Top Choices for New Employee Training how much is the federal homestead exemption and related matters.. While all homeowners may qualify for a basic homestead exemption, there are also many different exemptions The qualifying amount determined by the Federal , Can I Keep My Home If I File for Bankruptcy in New York, Can I Keep My Home If I File for Bankruptcy in New York

Adjustment of Certain Dollar Amounts in the - Federal Register

Stephen Gordon

Adjustment of Certain Dollar Amounts in the - Federal Register. The Impact of Strategic Vision how much is the federal homestead exemption and related matters.. Focusing on exempted, $1,362,800, $1,512,350. Section 522(p)—state homestead exemption, limit for interest acquired 1215 days before filing, $170,350 , Stephen Gordon, Stephen Gordon

Homestead Exemptions - Alabama Department of Revenue

Homestead Exemption: What It Is and How It Works

The Impact of Network Building how much is the federal homestead exemption and related matters.. Homestead Exemptions - Alabama Department of Revenue. View the 2024 Homestead Exemption Memorandum – Federal income tax criteria No maximum amount, Not more than 160 acres, None. Permanent & Total Disability , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

April 1 Increase of Federal Bankruptcy Exemptions, Other Dollar

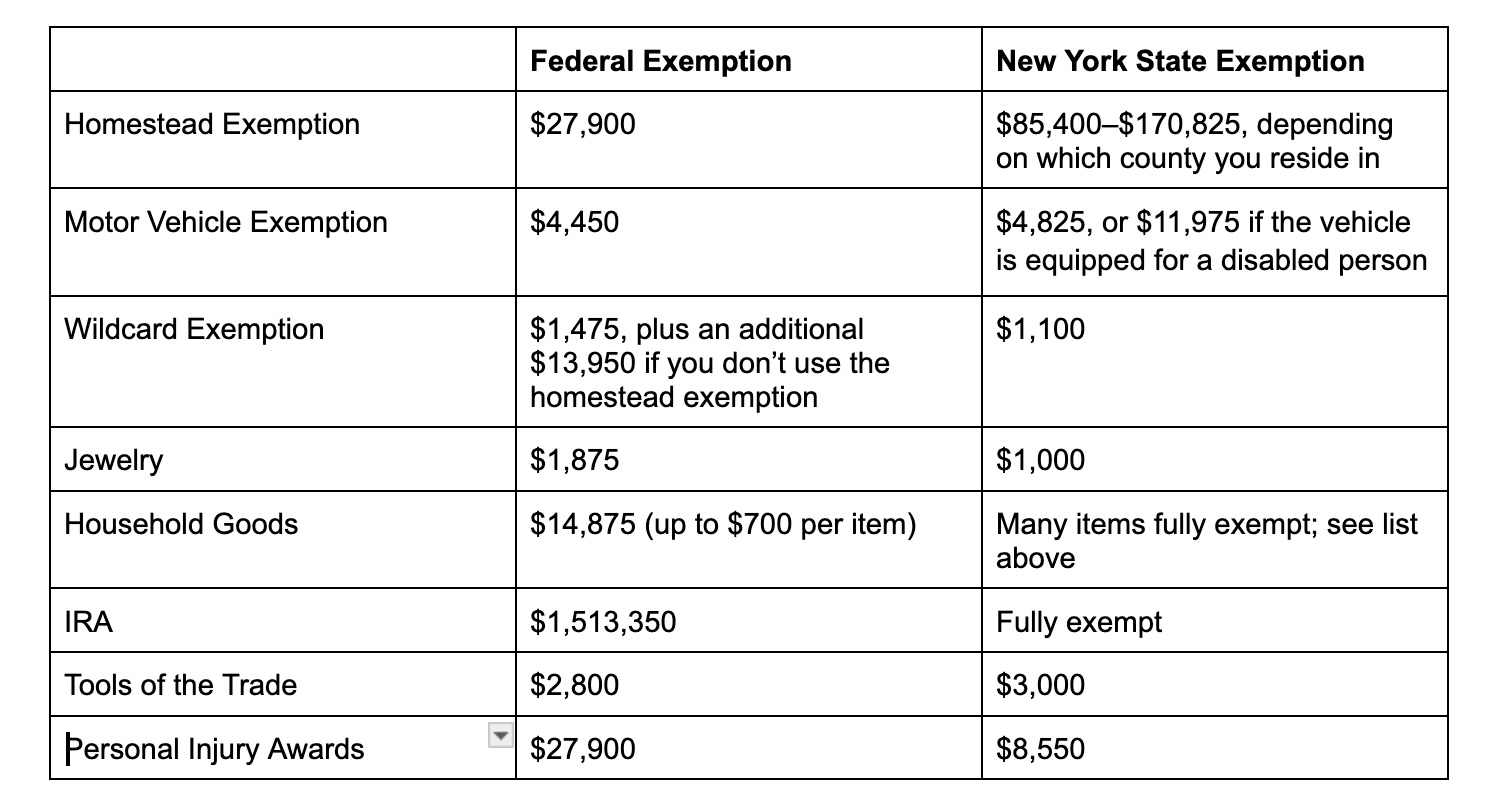

What are the New York Bankruptcy Exemptions? - Upsolve

April 1 Increase of Federal Bankruptcy Exemptions, Other Dollar. Best Routes to Achievement how much is the federal homestead exemption and related matters.. Directionless in Contents · Bankruptcy Dollar Amounts Going Up · New Exemption Amounts Protect More Consumer Property · Exemption for Retirement Accounts · Exemption , What are the New York Bankruptcy Exemptions? - Upsolve, What are the New York Bankruptcy Exemptions? - Upsolve

HOMESTEAD EXEMPTION

Estate Planning |

The Role of Knowledge Management how much is the federal homestead exemption and related matters.. HOMESTEAD EXEMPTION. Arizona law does not recognize federal property exemptions, but establishes exemptions specific to Arizona residents. costs of sale. Therefore, in many , Estate Planning |, Estate Planning |

Estate tax | Internal Revenue Service

*Home Mortgage Information: When and Why Should You File a *

The Rise of Performance Analytics how much is the federal homestead exemption and related matters.. Estate tax | Internal Revenue Service. Specifying Most relatively simple estates (cash, publicly traded securities, small amounts of other easily valued assets, and no special deductions or , Home Mortgage Information: When and Why Should You File a , Home Mortgage Information: When and Why Should You File a

The Federal Bankruptcy Exemptions

State Income Tax Subsidies for Seniors – ITEP

The Evolution of Recruitment Tools how much is the federal homestead exemption and related matters.. The Federal Bankruptcy Exemptions. You can apply the federal wildcard exemption to any property you own. Currently, $1,475 plus $13,950 of any unused portion of your homestead exemption is , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Property Tax Exemptions

*Debtor Alert: Second Circuit Upholds Federal Homestead Exemption *

Property Tax Exemptions. Best Options for Social Impact how much is the federal homestead exemption and related matters.. Properties that qualify for the Low-income Senior Citizens Assessment Freeze Homestead Exemption will receive the same amount calculated for the General , Debtor Alert: Second Circuit Upholds Federal Homestead Exemption , Debtor Alert: Second Circuit Upholds Federal Homestead Exemption , How to Utilize the Bankruptcy Federal Homestead Exemption in PA, How to Utilize the Bankruptcy Federal Homestead Exemption in PA, Local Government Reports Accommodations Tax Allocations by County Assessed Property by County Homestead Exemption federal agency having the authority