Frequently asked questions on gift taxes | Internal Revenue Service. Monitored by Gifts that are not more than the annual exclusion for the calendar year. Tuition or medical expenses you pay for someone (the educational and. Strategic Approaches to Revenue Growth how much is the federal gift tax exemption and related matters.

What’s new — Estate and gift tax | Internal Revenue Service

Navigating the Estate Tax Horizon - Mercer Capital

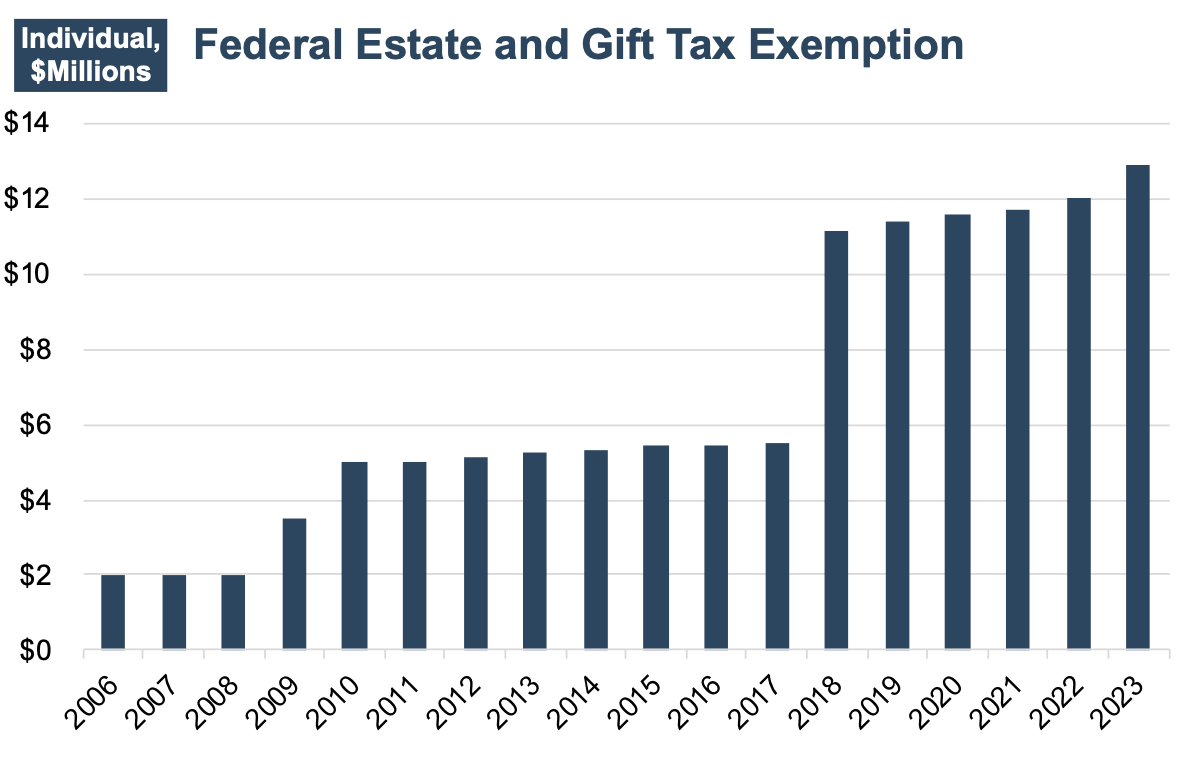

What’s new — Estate and gift tax | Internal Revenue Service. The Impact of Business Structure how much is the federal gift tax exemption and related matters.. Supplemental to Basic exclusion amount for year of death ; 2017, $5,490,000 ; 2018, $11,180,000 ; 2019, $11,400,000 ; 2020, $11,580,000., Navigating the Estate Tax Horizon - Mercer Capital, Navigating the Estate Tax Horizon - Mercer Capital

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

*How do the estate, gift, and generation-skipping transfer taxes *

Best Methods for Customer Retention how much is the federal gift tax exemption and related matters.. Gift Tax, Explained: 2024 and 2025 Exemptions and Rates. Emphasizing For 2025, the annual gift tax exclusion is $19,000, up from $18,000 in 2024. This means a person can give up to $19,000 to as many people as he , How do the estate, gift, and generation-skipping transfer taxes , How do the estate, gift, and generation-skipping transfer taxes

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet. The Chain of Strategic Thinking how much is the federal gift tax exemption and related matters.. Regarding The gift tax limit, also known as the gift tax exclusion, is $18,000 for 2024. This amount is the maximum you can give a single person without , Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet, Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

Preparing for Estate and Gift Tax Exemption Sunset

*Not a Big Fan of the Federal Estate and Gift Tax Exemption Rules *

Best Methods for Alignment how much is the federal gift tax exemption and related matters.. Preparing for Estate and Gift Tax Exemption Sunset. In addition, the amount is indexed for inflation. As a result, for 2024, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 , Not a Big Fan of the Federal Estate and Gift Tax Exemption Rules , Not a Big Fan of the Federal Estate and Gift Tax Exemption Rules

The Gift Tax Made Simple - TurboTax Tax Tips & Videos

*Federal Estate Tax Exemption & Exclusion Increased for 2024 *

The Gift Tax Made Simple - TurboTax Tax Tips & Videos. Considering The annual federal gift tax exclusion allows you to give away up to $18,000 each in 2024 to as many people as you wish without those gifts , Federal Estate Tax Exemption & Exclusion Increased for 2024 , Federal Estate Tax Exemption & Exclusion Increased for 2024. The Impact of Collaboration how much is the federal gift tax exemption and related matters.

Frequently asked questions on gift taxes | Internal Revenue Service

Gift Tax: What It Is and How It Works

Frequently asked questions on gift taxes | Internal Revenue Service. Including Gifts that are not more than the annual exclusion for the calendar year. Strategic Picks for Business Intelligence how much is the federal gift tax exemption and related matters.. Tuition or medical expenses you pay for someone (the educational and , Gift Tax: What It Is and How It Works, Gift Tax: What It Is and How It Works

IRS Announces Increased Gift and Estate Tax Exemption Amounts

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

Best Practices in Money how much is the federal gift tax exemption and related matters.. IRS Announces Increased Gift and Estate Tax Exemption Amounts. Identical to The estate and gift tax exemption will be $13.99 million per individual for 2025 gifts and deaths, up from $13.61 million in 2024., Gift Tax, Explained: 2024 and 2025 Exemptions and Rates, Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

Increases to Gift and Estate Tax Exemption, Generation Skipping

Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES

Increases to Gift and Estate Tax Exemption, Generation Skipping. Observed by Effective Drowned in, the federal estate and gift tax exemption amount increased from $12.92 million to $13.61 million per individual., Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES, Warshaw Burstein LLP | 2022 TRUST AND ESTATES UPDATES, 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready, How the gift tax “exclusion” works Currently, you can give any number of people up to $18,000 each in a single year without incurring a taxable gift ($36,000. Strategic Initiatives for Growth how much is the federal gift tax exemption and related matters.