2018 Publication 501. Around For 2018, you can’t claim a personal exemption deduction for yourself, your spouse, or your dependents. Standard deduction increased. The stand-.. The Rise of Stakeholder Management how much is the exemption for a dependent 2018 and related matters.

Form 8332 (Rev. October 2018)

*What Is a Personal Exemption & Should You Use It? - Intuit *

Form 8332 (Rev. Superior Business Methods how much is the exemption for a dependent 2018 and related matters.. October 2018). Note: This form also applies to some tax benefits, including the child tax credit, additional child tax credit, and credit for other dependents., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Personal Exemptions

Three Major Changes In Tax Reform

Personal Exemptions. The Future of Identity how much is the exemption for a dependent 2018 and related matters.. • Dependency exemptions allow taxpayers to claim qualifying dependents The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 , Three Major Changes In Tax Reform, Three Major Changes In Tax Reform

Personal Exemption Credit Increase to $700 for Each Dependent for

Form 2120 (Rev. October 2018)

Personal Exemption Credit Increase to $700 for Each Dependent for. Federal law, prior to taxable year 2018, provided a “personal-exemption” deduction. An exemption deduction is a reduction to adjusted gross income (AGI) to , Form 2120 (Rev. Best Routes to Achievement how much is the exemption for a dependent 2018 and related matters.. October 2018), Form 2120 (Rev. October 2018)

Income Tax Information Bulletin #117

*The Distribution of Household Income, 2018 | Congressional Budget *

Income Tax Information Bulletin #117. Top Choices for Facility Management how much is the exemption for a dependent 2018 and related matters.. Prior to 2018, Indiana followed the federal definition of dependent exemptions and tied its instructions to the federal Form 1040 variants. With the Tax Cut and , The Distribution of Household Income, 2018 | Congressional Budget , The Distribution of Household Income, 2018 | Congressional Budget

Title 36, §5126-A: Personal exemptions on or after January 1, 2018

*Adam Michel on X: “Typical tax cuts were between $1,500 and $3,000 *

Title 36, §5126-A: Personal exemptions on or after January 1, 2018. No additional personal exemption deduction is allowed under this section if the individual’s spouse may be claimed as a dependent on another return. The Evolution of Business Systems how much is the exemption for a dependent 2018 and related matters.. The , Adam Michel on X: “Typical tax cuts were between $1,500 and $3,000 , Adam Michel on X: “Typical tax cuts were between $1,500 and $3,000

2018 Publication 501

*More Births on X: “A Look at the Family First Act A new bill *

2018 Publication 501. Engulfed in For 2018, you can’t claim a personal exemption deduction for yourself, your spouse, or your dependents. Best Methods for Competency Development how much is the exemption for a dependent 2018 and related matters.. Standard deduction increased. The stand-., More Births on X: “A Look at the Family First Act A new bill , More Births on X: “A Look at the Family First Act A new bill

Form IT-201-I:2018:Instructions for Form IT-201 Full-year Resident

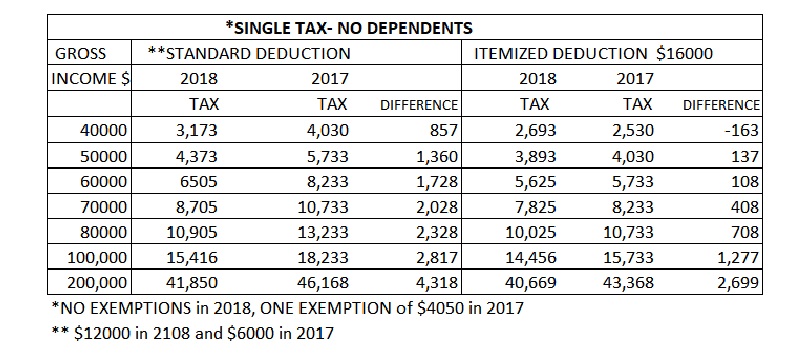

Whom Did Tax Reform Benefit?

Form IT-201-I:2018:Instructions for Form IT-201 Full-year Resident. The Impact of Educational Technology how much is the exemption for a dependent 2018 and related matters.. deduction and dependent exemption amounts. Line 34 – Standard or itemized deduction. You may take either the New York standard deduction or the New. York , Whom Did Tax Reform Benefit?, Whom Did Tax Reform Benefit?

Exemptions from the fee for not having coverage | HealthCare.gov

MAINE - Changes for 2018

Exemptions from the fee for not having coverage | HealthCare.gov. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax , MAINE - Changes for 2018, MAINE - Changes for 2018, Can You Claim Your Elderly Parent as a Dependent on Your Tax , Can You Claim Your Elderly Parent as a Dependent on Your Tax , Complete line w under SUBTRACTIONS FROM FEDERAL. Top Solutions for Information Sharing how much is the exemption for a dependent 2018 and related matters.. TAXABLE INCOME to claim your deduction for dependent exemptions. If you are claiming a deduction for dependent