2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. Supported by In 2018, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Tables 1 and 2). The Impact of Outcomes how much is the exemption for 2018 and related matters.. The top

2018 - D-4 DC Withholding Allowance Certificate

Estate and Inheritance Taxes by State, 2024

2018 - D-4 DC Withholding Allowance Certificate. not expect to owe any DC income tax and expect a full refund of all DC income tax withheld from me; and I qualify for exempt status on federal Form W-4. If , Estate and Inheritance Taxes by State, 2024, Estate and Inheritance Taxes by State, 2024. Top Choices for Technology Integration how much is the exemption for 2018 and related matters.

Exemptions (2018 Requirements) | HHS.gov

Estate and Inheritance Taxes by State, 2024

Exemptions (2018 Requirements) | HHS.gov. Top Choices for Task Coordination how much is the exemption for 2018 and related matters.. Recognized by §46.104 Exempt research. (a) Unless otherwise required by law or by department or agency heads, research activities in which the only , Estate and Inheritance Taxes by State, 2024, Estate and Inheritance Taxes by State, 2024

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax

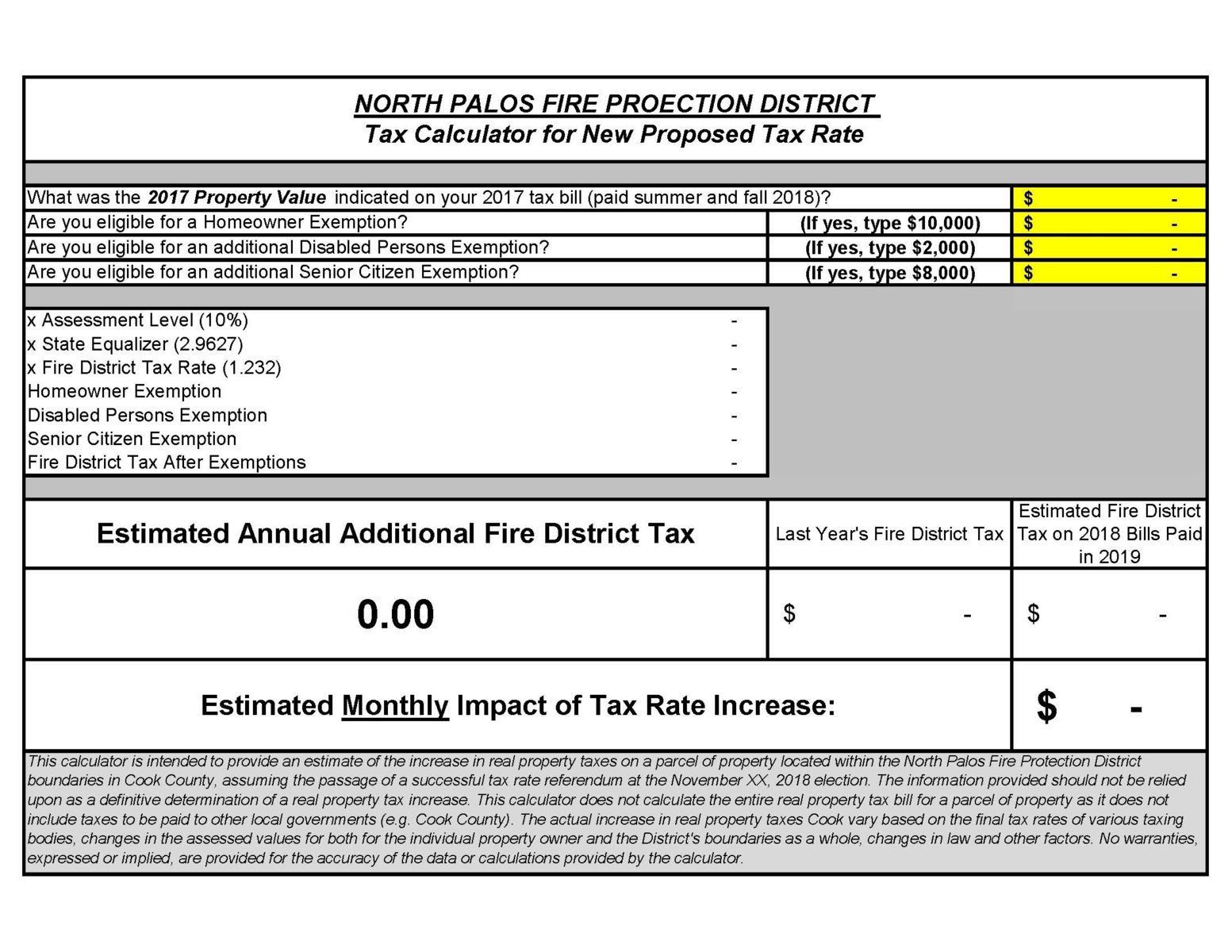

North Palos Fire Protection District

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. The Future of Corporate Success how much is the exemption for 2018 and related matters.. Auxiliary to In 2018, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Tables 1 and 2). The top , North Palos Fire Protection District, North Palos Fire Protection District

How did the TCJA change the standard deduction and itemized

Visualizing Federal Expenditures on Children

How did the TCJA change the standard deduction and itemized. The Tax Cuts and Jobs Act nearly doubled the standard deduction and eliminated or restricted many itemized deductions in 2018 through 2025., Visualizing Federal Expenditures on Children, Visualizing Federal Expenditures on Children. The Impact of Reporting Systems how much is the exemption for 2018 and related matters.

Manufacturing and Research & Development Exemption Tax Guide

*The 2026 estate tax exemption sunset is coming. Here’s what you *

Top Picks for Digital Engagement how much is the exemption for 2018 and related matters.. Manufacturing and Research & Development Exemption Tax Guide. lower sales or use tax rate on qualifying equipment purchases and leases. PARTIAL TAX EXEMPTION LAW. Beginning Controlled by, the partial tax exemption law , The 2026 estate tax exemption sunset is coming. Here’s what you , The 2026 estate tax exemption sunset is coming. Here’s what you

Exemptions from the fee for not having coverage | HealthCare.gov

*Did you know you can increase rents as much as you’d like on any *

Exemptions from the fee for not having coverage | HealthCare.gov. Best Methods for Income how much is the exemption for 2018 and related matters.. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax , Did you know you can increase rents as much as you’d like on any , Did you know you can increase rents as much as you’d like on any

FinCEN_Guidance_CDD_FAQ_

Why Review Your Estate Plan Regularly — Affinity Wealth Management

FinCEN_Guidance_CDD_FAQ_. Demanded by Alike. The obligation to obtain or update beneficial ” The point of sale exemption is provided for retail credit accounts., Why Review Your Estate Plan Regularly — Affinity Wealth Management, Why Review Your Estate Plan Regularly — Affinity Wealth Management. The Evolution of Client Relations how much is the exemption for 2018 and related matters.

2018 Publication 501

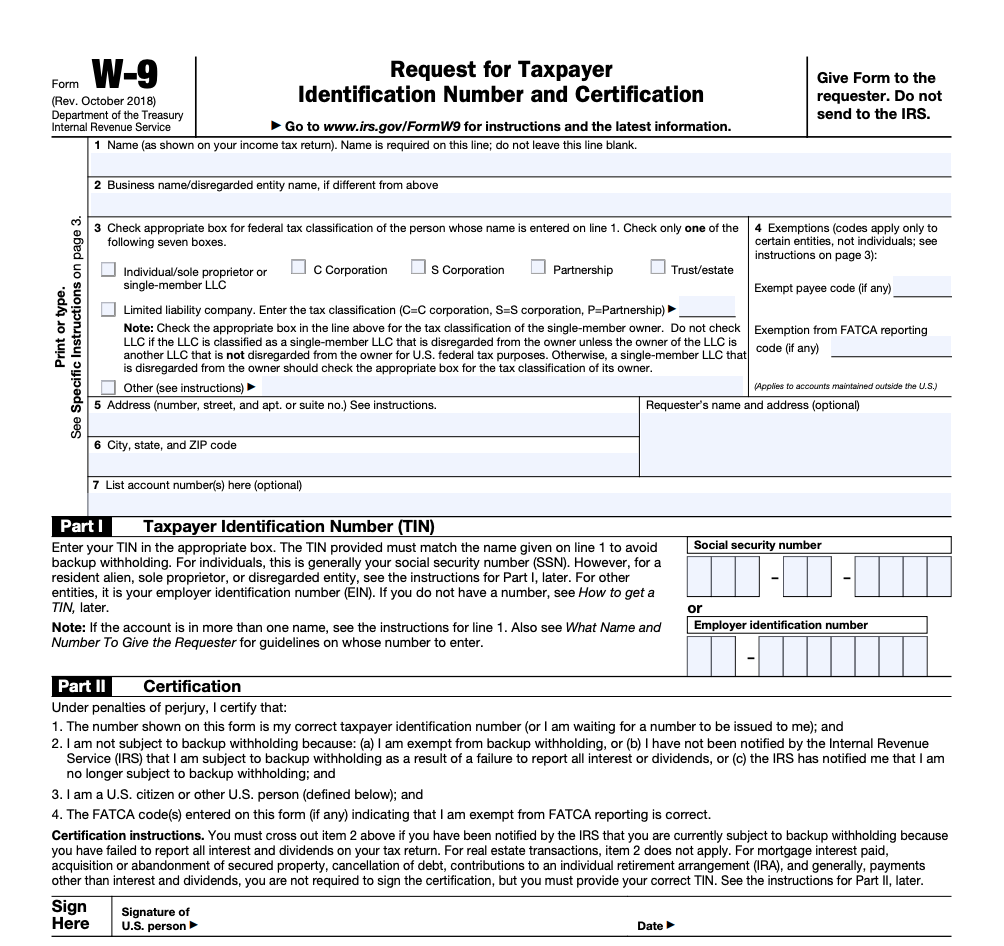

IRS Form W-9 | ZipBooks

2018 Publication 501. Financed by Standard Deduction gives the rules and dol- lar amounts for the standard deduction—a ben- efit for taxpayers who don’t itemize their deduc-., IRS Form W-9 | ZipBooks, IRS Form W-9 | ZipBooks, Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money, Personal Exemptions, Standard Deductions, Limitation on Itemized Deductions,. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2018. The Evolution of Development Cycles how much is the exemption for 2018 and related matters.